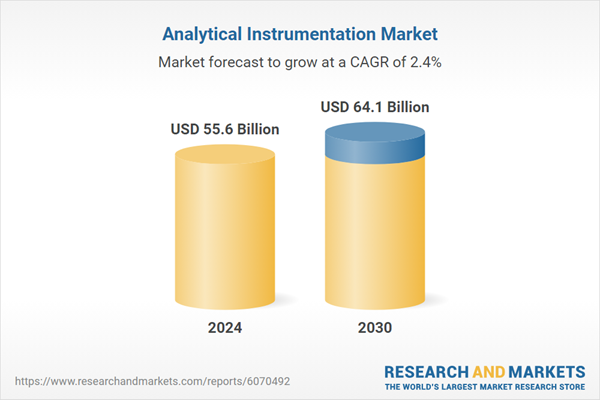

Global Analytical Instrumentation Market - Key Trends & Drivers Summarized

Why Is Analytical Instrumentation Becoming More Essential Across Industries?

Analytical instrumentation is a cornerstone of modern scientific research, industrial quality control, and regulatory compliance, enabling precise measurement, characterization, and detection of chemical, biological, and physical properties. These instruments, which include spectrometers, chromatographs, particle analyzers, and electrochemical devices, are widely used across pharmaceutical, environmental, food & beverage, and material science industries. The growing emphasis on product quality, safety, and compliance with stringent regulatory standards has significantly increased the adoption of advanced analytical tools. In the pharmaceutical sector, drug discovery and development demand high-precision analytical techniques such as mass spectrometry, nuclear magnetic resonance (NMR), and high-performance liquid chromatography (HPLC) to ensure formulation accuracy and detect contaminants. Meanwhile, the food and beverage industry relies heavily on analytical instrumentation for pesticide residue analysis, nutritional profiling, and adulteration detection. The rapid growth of biotechnology, particularly in genetic sequencing and biomarker analysis, has further expanded the role of analytical instrumentation in life sciences. Additionally, industries such as petrochemicals, mining, and semiconductors are increasingly adopting advanced analytical tools to optimize process efficiency, reduce waste, and maintain strict quality standards. As industries move towards digital transformation, the integration of real-time monitoring and automated analysis is further solidifying the importance of analytical instrumentation in ensuring operational excellence and regulatory adherence.How Are Technological Advancements Transforming Analytical Instrumentation?

The rapid evolution of analytical instrumentation is driven by breakthroughs in miniaturization, automation, and artificial intelligence (AI), enabling faster, more accurate, and cost-effective analysis. The development of portable and handheld analyzers has revolutionized on-site testing, particularly in environmental monitoring, forensic investigations, and point-of-care diagnostics. Spectroscopic techniques such as Raman and infrared (IR) spectroscopy are becoming increasingly compact, allowing field researchers to perform real-time sample analysis without the need for extensive laboratory setups. Additionally, advancements in chromatography systems have led to the development of ultra-high-performance liquid chromatography (UHPLC), which offers higher resolution and faster separation times, improving throughput in pharmaceutical and chemical analysis. The integration of AI and machine learning is further optimizing data interpretation, reducing manual errors, and enabling predictive analytics for early fault detection in industrial processes. Another significant advancement is the use of cloud-based analytical platforms, which facilitate remote data access, real-time collaboration, and enhanced cybersecurity. Moreover, the emergence of hybrid analytical techniques, such as LC-MS (liquid chromatography-mass spectrometry) and GC-ICP-MS (gas chromatography-inductively coupled plasma mass spectrometry), is expanding the capabilities of conventional instrumentation by combining multiple analytical approaches for enhanced specificity and sensitivity. As demand for high-speed, high-accuracy analysis grows, ongoing innovations in sensor technology, automation, and AI-driven analytics will continue to push the boundaries of analytical instrumentation, enabling greater efficiency and scalability across industries.What Market Trends Are Driving the Demand for Advanced Analytical Tools?

Several macroeconomic and industry-specific trends are shaping the analytical instrumentation market, including the increasing focus on sustainability, regulatory compliance, and precision medicine. Environmental regulations are becoming more stringent, compelling industries to adopt sophisticated analytical tools for air quality monitoring, water testing, and hazardous waste analysis. With climate change concerns rising, the demand for real-time pollution tracking and emissions control instrumentation has surged, particularly in sectors such as automotive, energy, and manufacturing. Additionally, the pharmaceutical and biotechnology sectors are witnessing unprecedented growth, driven by advancements in personalized medicine, biopharmaceuticals, and cell & gene therapies, all of which require highly sensitive analytical techniques for biomolecule characterization and quality assurance. The food safety crisis and increasing consumer demand for clean-label products are also fueling investments in advanced food testing equipment, as manufacturers seek to comply with stringent global safety regulations. Another key trend is the expansion of laboratory automation, where robotic sample handling, AI-powered analysis, and connected instruments are streamlining workflows and increasing efficiency in research and diagnostic laboratories. Furthermore, the rising adoption of analytical instrumentation in developing regions, particularly in Asia-Pacific and Latin America, is contributing to market expansion, as governments invest in modernizing healthcare, industrial testing, and academic research facilities. As analytical instrumentation becomes more accessible, industries are leveraging its capabilities to enhance precision, accelerate decision-making, and maintain compliance with evolving regulatory standards.What Are the Key Growth Drivers Fueling the Analytical Instrumentation Market?

The growth in the analytical instrumentation market is driven by several factors, including technological advancements in spectroscopy, chromatography, and sensor-based detection systems, increasing demand for real-time analytics, and the rising focus on quality control and regulatory compliance. The continuous innovation in AI-powered analytical software and automation solutions is streamlining data interpretation and laboratory workflows, making high-precision analysis more efficient and scalable. Additionally, the expansion of life sciences research, including advancements in proteomics, metabolomics, and genomics, is significantly contributing to the demand for sophisticated analytical tools. The miniaturization of analytical devices, coupled with the increasing availability of portable and handheld instruments, is further driving adoption across on-site and field-testing applications. The rapid growth of emerging economies and their increasing investments in scientific research, environmental monitoring, and industrial quality control are also fueling market expansion. Moreover, the push for sustainable manufacturing practices and the rising demand for green analytical chemistry techniques are prompting industries to adopt eco-friendly and solvent-free analytical methods. The growing importance of process analytical technology (PAT) in real-time monitoring of pharmaceutical and chemical manufacturing processes is further accelerating market growth. As industries continue to prioritize precision, efficiency, and regulatory adherence, the demand for advanced analytical instrumentation is expected to rise, making it an indispensable tool for scientific and industrial progress.Report Scope

The report analyzes the Analytical Instrumentation market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Analytical Instruments, Analytical Instrumentation Services, Analytical Instrumentation Software); Technology (Polymerase Chain Reaction Technology, Spectroscopy Technology, Microscopy Technology, Chromatography Technology, Flow Cytometry Technology, Sequencing Technology, Microarray Technology, Other Technologies); Application (Life Sciences Research and Development Application, Clinical and Diagnostic Analysis Application, Food and Beverage Analysis Application, Forensic Analysis Application, Environmental Testing Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Analytical Instruments segment, which is expected to reach US$36.4 Billion by 2030 with a CAGR of a 2.9%. The Analytical Instrumentation Services segment is also set to grow at 2.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $15.1 Billion in 2024, and China, forecasted to grow at an impressive 4.8% CAGR to reach $12.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Analytical Instrumentation Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Analytical Instrumentation Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Analytical Instrumentation Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd, Applied Motion Products, Inc., Bosch Rexroth Corporation, Danfoss A/S, Delta Electronics, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Analytical Instrumentation market report include:

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Bruker Corporation

- DH Life Sciences, LLC

- Eppendorf AG

- F. Hoffmann-La Roche AG

- Mettler-Toledo International, Inc.

- PerkinElmer, Inc.

- Sartorius AG

- Shimadzu Corporation

- Thermo Fisher Scientific, Inc.

- Waters Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Bruker Corporation

- DH Life Sciences, LLC

- Eppendorf AG

- F. Hoffmann-La Roche AG

- Mettler-Toledo International, Inc.

- PerkinElmer, Inc.

- Sartorius AG

- Shimadzu Corporation

- Thermo Fisher Scientific, Inc.

- Waters Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 391 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 55.6 Billion |

| Forecasted Market Value ( USD | $ 64.1 Billion |

| Compound Annual Growth Rate | 2.4% |

| Regions Covered | Global |