Global High Electron Mobility Transistor Market - Key Trends & Drivers Summarized

What Makes High Electron Mobility Transistors (HEMTs) Stand Out in Modern Electronics?

High Electron Mobility Transistors (HEMTs) have revolutionized the semiconductor industry by enabling high-speed, high-frequency, and low-noise performance across various applications. Unlike conventional MOSFETs, HEMTs leverage the heterojunction between two semiconductor materials, such as gallium nitride (GaN) and aluminum gallium nitride (AlGaN), to achieve exceptional electron mobility. This unique structure minimizes carrier scattering and enhances signal amplification, making HEMTs indispensable in radio frequency (RF) and microwave applications. With increasing demand for ultra-fast electronic components, HEMTs are gaining traction in satellite communication, radar systems, and even 5G infrastructure. Another distinguishing feature of HEMTs is their superior thermal stability and ability to operate at high voltages, making them ideal for power electronics, including electric vehicle (EV) inverters and renewable energy systems. The performance advantage of HEMTs is also evident in their ability to reduce energy losses, which is crucial in aerospace and defense applications where efficiency and reliability are paramount. Moreover, advancements in material science, particularly in wide-bandgap semiconductors such as gallium nitride (GaN) and silicon carbide (SiC), have further elevated the performance benchmarks of HEMTs. As the world moves towards higher-frequency operations and power-efficient technologies, the role of HEMTs is expanding, making them a critical component in the semiconductor market. The increasing adoption of 6G wireless communication and millimeter-wave (mmWave) technologies further underscores the significance of HEMTs in the next-generation electronics landscape.How Are Industry Advancements Pushing HEMTs to the Forefront of Innovation?

HEMTs have become a focal point of semiconductor innovation due to their unparalleled speed and efficiency, with research and development (R&D) efforts accelerating across multiple domains. One of the most notable advancements in recent years is the transition from GaAs-based HEMTs to GaN-based variants, which offer significantly higher breakdown voltage and power density. GaN HEMTs are increasingly preferred in military and commercial radar systems due to their ability to operate efficiently at high temperatures while maintaining signal integrity. Another major breakthrough is the development of enhancement-mode (E-mode) HEMTs, which eliminate the need for a negative gate voltage, simplifying circuit design and improving reliability. In power electronics, HEMTs are being integrated into high-efficiency power conversion systems, where their low switching losses contribute to substantial energy savings. Moreover, researchers are exploring hybrid HEMT architectures that combine the advantages of GaN and SiC to further enhance performance metrics. The rise of monolithic microwave integrated circuits (MMICs) has also driven demand for HEMTs, as these transistors serve as the backbone for compact, high-performance RF amplifiers. With increasing interest in terahertz (THz) technology for ultra-fast data transmission, HEMTs are being optimized for frequencies beyond 100 GHz, unlocking new possibilities in wireless communications and imaging applications. Additionally, efforts to improve HEMT reliability and longevity are leading to innovations in device passivation techniques and thermal management solutions. As HEMTs continue to evolve, their application scope is broadening, paving the way for enhanced semiconductor performance across multiple industries.Where Are HEMTs Making the Biggest Impact Across Industries?

The influence of HEMTs extends beyond traditional semiconductor applications, finding new opportunities in various high-growth industries. One of the most significant sectors benefiting from HEMTs is the telecommunications industry, where they enable ultra-high-frequency signal transmission for 5G base stations, satellite links, and fiber-optic networks. In automotive electronics, HEMTs are playing a critical role in the electrification movement, where they enhance the efficiency of EV powertrains and enable fast-charging technologies. The aerospace and defense sector remains a major consumer of HEMTs, leveraging their capabilities for electronic warfare, missile guidance systems, and next-generation radar technologies. Medical imaging and diagnostics are also witnessing the advantages of HEMTs, particularly in positron emission tomography (PET) scanners and advanced ultrasound systems, where high-frequency signal processing is essential for precision imaging. Additionally, HEMTs are gaining traction in quantum computing, where their high-speed switching characteristics support advanced computing architectures. The expansion of smart grid technologies and renewable energy solutions has further accelerated the adoption of HEMTs in high-voltage power conversion applications. In consumer electronics, these transistors are being integrated into high-performance audio amplifiers and RF front-end modules for smartphones, ensuring superior signal clarity and efficiency. Furthermore, emerging applications such as unmanned aerial vehicles (UAVs) and high-speed rail systems are leveraging HEMT-based power solutions to enhance operational efficiency and reliability. The ongoing miniaturization trend in electronics has also spurred the development of compact HEMT modules, making them more accessible for integration into next-generation devices. As industry requirements continue to evolve, the versatility and adaptability of HEMTs are proving to be instrumental in shaping the future of electronic innovation.What’ s Driving the Rapid Growth of the HEMT Market?

The growth in the global HEMT market is driven by several factors, including the rising demand for high-frequency and high-power electronics across multiple industries. The expansion of 5G and upcoming 6G networks is a primary driver, as HEMTs are essential for enabling efficient signal transmission and amplification at millimeter-wave frequencies. The increasing adoption of electric vehicles and advancements in fast-charging infrastructure are also fueling demand for HEMTs in power conversion applications. Additionally, the rapid development of space and satellite communication systems, driven by increasing government and private investments, is further propelling market growth. Military and defense applications remain a crucial sector, with heightened investments in radar, surveillance, and electronic warfare technologies where HEMTs offer unmatched performance. The push for energy-efficient power electronics in industrial automation and smart grids is another critical growth driver, as industries strive to minimize energy losses and improve system efficiency. The growing emphasis on high-performance computing and data centers, where HEMTs are used for ultra-fast switching applications, is further contributing to market expansion. Additionally, the rise of artificial intelligence (AI) and machine learning (ML) workloads is driving the need for advanced semiconductor components, including HEMTs, to meet the processing demands of next-generation computing platforms. The medical sector is also experiencing increased adoption of HEMTs in high-precision imaging technologies, further diversifying their application scope. Increasing R&D investments and collaborations between semiconductor manufacturers, research institutions, and government agencies are fostering continuous innovation in HEMT technology, ensuring steady market growth. With ongoing advancements in material science, particularly in GaN and SiC-based HEMTs, the market is poised for sustained expansion, catering to the growing demands of high-frequency, high-power, and energy-efficient electronic applications.Report Scope

The report analyzes the High Electron Mobility Transistor market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Gallium Nitride Type, Silicon Carbide Type, Gallium Arsenide Type, Other Types); End-Use (Consumer Electronics End-Use, Automotive End-Use, Industrial End-Use, Aerospace & Defense End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Gallium Nitride segment, which is expected to reach US$4.4 Billion by 2030 with a CAGR of a 8.5%. The Silicon Carbide segment is also set to grow at 4.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.7 Billion in 2024, and China, forecasted to grow at an impressive 11.2% CAGR to reach $2.0 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global High Electron Mobility Transistor Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global High Electron Mobility Transistor Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global High Electron Mobility Transistor Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Arauco, Dieffenbacher GmbH, Duratex S.A., Egger Group, Finsa and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this High Electron Mobility Transistor market report include:

- Analog Devices, Inc.

- Coherent Corp.

- Infineon Technologies AG

- Intel Corporation

- IQE plc

- MACOM Technology Solutions Holdings, Inc.

- Microsemi Corporation

- Mitsubishi Electric Corporation

- NXP Semiconductors N.V.

- ON Semiconductor Corporation

- Qorvo, Inc.

- Raytheon Technologies Corporation

- Renesas Electronics Corporation

- ROHM Co., Ltd.

- STMicroelectronics N.V.

- Sumitomo Electric Industries, Ltd.

- Taiwan Semiconductor Manufacturing Company (TSMC)

- Texas Instruments Incorporated

- Toshiba Corporation

- Wolfspeed, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Analog Devices, Inc.

- Coherent Corp.

- Infineon Technologies AG

- Intel Corporation

- IQE plc

- MACOM Technology Solutions Holdings, Inc.

- Microsemi Corporation

- Mitsubishi Electric Corporation

- NXP Semiconductors N.V.

- ON Semiconductor Corporation

- Qorvo, Inc.

- Raytheon Technologies Corporation

- Renesas Electronics Corporation

- ROHM Co., Ltd.

- STMicroelectronics N.V.

- Sumitomo Electric Industries, Ltd.

- Taiwan Semiconductor Manufacturing Company (TSMC)

- Texas Instruments Incorporated

- Toshiba Corporation

- Wolfspeed, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 282 |

| Published | February 2026 |

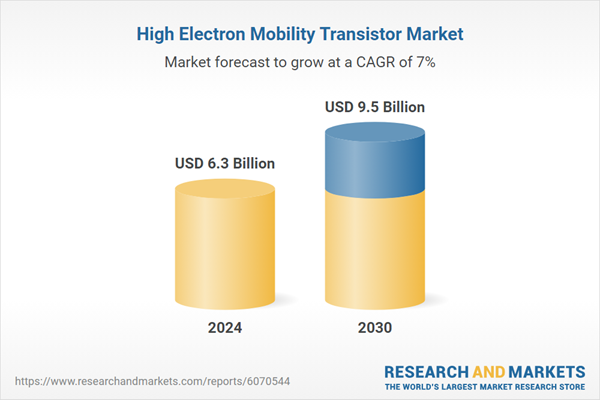

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6.3 Billion |

| Forecasted Market Value ( USD | $ 9.5 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |