Global Preclinical CRO Market - Key Trends & Drivers Summarized

How Are Preclinical CROs Accelerating Drug Development and Innovation?

Preclinical contract research organizations (CROs) play a crucial role in pharmaceutical and biotechnology research, providing specialized services for drug discovery, safety assessment, and regulatory compliance before clinical trials begin. As drug development becomes more complex and costly, pharmaceutical companies are increasingly outsourcing preclinical research to CROs to reduce operational expenses and streamline timelines. These organizations offer expertise in pharmacokinetics, toxicology, bioanalysis, and animal studies, ensuring that investigational drugs meet regulatory requirements before progressing to human trials. The expansion of biopharmaceutical research, particularly in gene therapy, oncology, and rare diseases, has driven demand for advanced preclinical testing capabilities. Additionally, the integration of artificial intelligence (AI), machine learning, and in-silico modeling is enhancing preclinical research efficiency, improving drug candidate selection, and reducing reliance on animal testing. As the pharmaceutical industry seeks to accelerate innovation while maintaining regulatory compliance, preclinical CROs are emerging as key partners in drug development, facilitating faster and more cost-effective transitions from discovery to clinical trials.What Challenges Are Impacting the Growth of the Preclinical CRO Industry?

Despite their growing importance, preclinical CROs face several challenges that affect market expansion and operational efficiency. One of the primary concerns is the high cost of preclinical research, particularly for small and mid-sized biopharma companies with limited budgets. The stringent regulatory landscape also poses challenges, as CROs must ensure compliance with evolving safety and efficacy guidelines across different markets, including the FDA, EMA, and CFDA. Additionally, ethical concerns surrounding animal testing are leading to increased pressure to adopt alternative testing methods, such as organ-on-a-chip technology and AI-driven simulations. The complexity of managing diverse preclinical studies, ranging from toxicology to drug metabolism, requires highly specialized expertise, making talent acquisition and retention a key challenge for CROs. Moreover, the growing trend of mergers and acquisitions within the CRO industry has created competitive pressures, forcing smaller CROs to differentiate through niche services or strategic partnerships. Addressing these challenges will require continued investment in cutting-edge technologies, enhanced regulatory collaboration, and expanded service offerings to meet the evolving needs of pharmaceutical clients.How Are Technological Advancements Enhancing Preclinical Research?

The integration of advanced technologies is transforming preclinical research, making drug development more efficient, accurate, and ethical. AI and machine learning are revolutionizing data analysis, enabling CROs to identify potential drug candidates faster by analyzing vast datasets and predicting drug efficacy with greater precision. The rise of in-silico modeling and computational drug discovery is reducing dependency on animal testing, allowing researchers to simulate drug interactions and toxicity using virtual models. High-throughput screening (HTS) and automated laboratory workflows are also streamlining preclinical experiments, accelerating lead optimization and biomarker identification. Additionally, CRISPR-based gene editing is being leveraged in preclinical studies to create more precise disease models, enhancing translational research for personalized medicine. The adoption of cloud-based platforms for data sharing and remote monitoring is further improving collaboration between CROs and pharmaceutical clients, enabling real-time decision-making and study adjustments. As technology continues to evolve, preclinical CROs are set to become even more integral to drug development, offering innovative solutions that enhance research efficiency and compliance.What Is Driving the Growth of the Preclinical CRO Market?

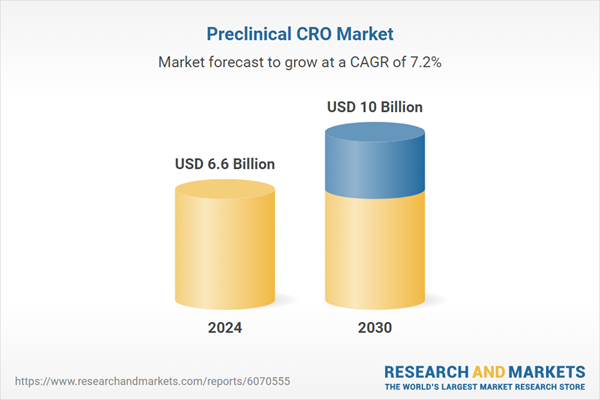

The growth in the preclinical CRO market is driven by several factors, including the increasing complexity of drug development, rising biopharmaceutical investments, and the growing need for outsourcing research to specialized service providers. The surge in demand for oncology, neurology, and rare disease therapeutics is fueling the need for sophisticated preclinical testing services. Pharmaceutical companies are prioritizing cost reduction and operational flexibility, leading to higher reliance on external CROs for early-stage research. The expansion of precision medicine and biologics is also contributing to market growth, as CROs offer expertise in specialized preclinical studies for gene therapies and antibody-based treatments. Additionally, regulatory agencies are encouraging the use of alternative preclinical testing models, accelerating the adoption of AI-driven drug discovery and 3D tissue models. The globalization of drug development, with emerging markets investing in pharmaceutical R&D, is further expanding the role of preclinical CROs. As these trends continue, the preclinical CRO market is expected to witness sustained growth, driving innovation in early-stage drug discovery and safety assessment.Report Scope

The report analyzes the Preclinical CRO market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Service Type (Toxicology Testing, Bioanalysis & DMPK Studies, Compound Management, Computation Chemistry, Safety Pharmacology, Other Service Types); Model Type (Patient Derived Organoid Model, Patient Derived Xenograft Model); End-Use (Biopharmaceutical Companies End-Use, Government & Academic Institutes End-Use, Medical Device Companies End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Some of the 42 companies featured in this Preclinical CRO market report include -

- Altasciences Company Inc.

- Charles River Laboratories

- Covance Inc.

- Crown Bioscience International

- Envigo

- Eurofins Scientific

- ICON plc

- Intertek Group plc

- IQVIA

- Labcorp Drug Development

- Medpace Holdings, Inc.

- NorthEast BioAnalytical Laboratories LLC

- PAREXEL International Corporation

- Pharmaceutical Product Development (PPD)

- PharmaLegacy Laboratories

- SGS SA

- Syneos Health

- TFS HealthScience CRO

- Thermo Fisher Scientific Inc.

- WuXi AppTec

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Toxicology Testing Service segment, which is expected to reach US$2.7 Billion by 2030 with a CAGR of a 9.5%. The Bioanalysis & DMPK Studies segment is also set to grow at 5.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.8 Billion in 2024, and China, forecasted to grow at an impressive 11.7% CAGR to reach $2.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Preclinical CRO Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Preclinical CRO Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Preclinical CRO Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AGCO Corporation, Bourgault Industries Ltd., Buhler Industries Inc., Case IH (a brand of CNH Industrial), Claas KGaA mbH and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Select Competitors (Total 42 Featured):

- Altasciences Company Inc.

- Charles River Laboratories

- Covance Inc.

- Crown Bioscience International

- Envigo

- Eurofins Scientific

- ICON plc

- Intertek Group plc

- IQVIA

- Labcorp Drug Development

- Medpace Holdings, Inc.

- NorthEast BioAnalytical Laboratories LLC

- PAREXEL International Corporation

- Pharmaceutical Product Development (PPD)

- PharmaLegacy Laboratories

- SGS SA

- Syneos Health

- TFS HealthScience CRO

- Thermo Fisher Scientific Inc.

- WuXi AppTec

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Altasciences Company Inc.

- Charles River Laboratories

- Covance Inc.

- Crown Bioscience International

- Envigo

- Eurofins Scientific

- ICON plc

- Intertek Group plc

- IQVIA

- Labcorp Drug Development

- Medpace Holdings, Inc.

- NorthEast BioAnalytical Laboratories LLC

- PAREXEL International Corporation

- Pharmaceutical Product Development (PPD)

- PharmaLegacy Laboratories

- SGS SA

- Syneos Health

- TFS HealthScience CRO

- Thermo Fisher Scientific Inc.

- WuXi AppTec

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 381 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6.6 Billion |

| Forecasted Market Value ( USD | $ 10 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |