Luxury Fabric: What’ s Behind the Global Surge in Demand for High-End Textiles?

Global Luxury Fabric Market - Key Trends & Drivers Summarized

The global luxury fabric market is undergoing a significant renaissance, fueled by the rising demand for premium quality materials across fashion, interior design, and automotive sectors. Luxury fabrics - encompassing silk, cashmere, fine wool, velvet, linen, and innovative blends - are increasingly sought after not only for their tactile excellence and visual elegance but also for the stories they convey about craftsmanship, heritage, and exclusivity. Brands across haute couture, home dé cor, and even automotive interiors are leveraging luxury textiles to differentiate their offerings and elevate customer experiences. The trend is being reinforced by a consumer shift toward authentic, long-lasting products that marry artistry with functionality. Notably, the resurgence of slow fashion and sustainability consciousness is driving preference for artisanal, traceable, and eco-friendly fabrics over mass-produced synthetics.Fashion continues to be a primary end-use sector for luxury fabrics, with top-tier designers and labels prioritizing rare and bespoke textiles to maintain competitive edge. Seasonality and runway trends significantly influence the demand for specific textures, patterns, and fabric compositions. At the same time, home and hospitality sectors are emerging as growth hotspots, particularly in the demand for high-end upholstery, drapery, and bedding fabrics. In luxury interiors, materials like mohair, alpaca, silk-blended jacquards, and handwoven linens are increasingly used to project understated opulence. High-net-worth individuals and boutique developers are willing to invest in luxury fabrics that embody comfort, heritage, and individuality, helping drive market momentum beyond traditional fashion applications.

How Are Innovation and Sustainability Reshaping Luxury Textile Design?

Technological advancements and sustainability imperatives are revolutionizing the way luxury fabrics are designed, produced, and consumed. In terms of innovation, textile mills and luxury brands are incorporating cutting-edge processes such as nanofinishing, digital weaving, and 3D knitting to enhance performance without compromising on tactile appeal. Functional luxury fabrics with properties like water resistance, stain repellence, UV protection, and antimicrobial finishes are gaining traction, especially in high-performance fashion and travelwear segments. These value-added features are appealing to modern luxury consumers who demand aesthetics without sacrificing practicality.Sustainability has become central to the evolution of the luxury textile narrative. Ethical sourcing, eco-friendly dyeing methods, and closed-loop production systems are being prioritized by leading manufacturers. Organic silk, traceable cashmere, recycled cotton, and plant-based dyes are increasingly incorporated into collections to meet both regulatory standards and consumer expectations. Blockchain and QR code technologies are now used to authenticate fabric origin and production processes, enhancing transparency and brand trust. Additionally, luxury brands are investing in regenerative agriculture initiatives and local artisanal networks to ensure environmental stewardship and socio-economic impact, aligning their material sourcing strategies with global ESG trends. The convergence of innovation and ethics is not only enhancing product value but also positioning luxury fabrics as symbols of conscious affluence.

What Are the Regional Trends and Consumer Shifts Powering Growth?

Regionally, Europe remains the heartland of luxury fabric production, with Italy, France, and the UK being home to some of the oldest and most prestigious textile houses in the world. These countries continue to set quality benchmarks through traditional craftsmanship, innovation, and strong ties to fashion houses. Italian mills, for instance, are renowned for their high-end wool, silk, and linen blends, supplying global luxury brands with exclusive, made-to-order materials. France, meanwhile, excels in haute couture fabrics with intricate embroidery, lace, and jacquards. However, the Asia-Pacific region is rapidly emerging as both a manufacturing and consumption hub, particularly in China, India, and Japan. Rising disposable incomes, increasing fashion consciousness, and a growing appetite for luxury living are fueling demand for both imported and locally sourced premium fabrics.In China, domestic luxury fashion brands are investing heavily in heritage-inspired textiles and modern adaptations of traditional materials such as silk brocade and handloomed cotton. India is witnessing a parallel renaissance in luxury textiles, driven by both global demand for artisanal craftsmanship - such as handwoven silks, pashmina, and khadi - and the rise of luxury homegrown brands catering to a discerning urban elite. Meanwhile, demand in North America and the Middle East is being driven by the interior dé cor and hospitality segments, with luxury fabrics used extensively in high-end homes, yachts, and hotels. Across these regions, affluent consumers are increasingly prioritizing the provenance, sustainability, and exclusivity of the materials they purchase, signaling a deeper, values-based relationship with luxury.

The Growth in the Luxury Fabric Market Is Driven by Several Factors…

The growth in the luxury fabric market is driven by several factors tied to technological advancements, evolving end-use sectors, and shifting consumer preferences. A major growth driver is the rising demand for high-quality, natural, and ethically sourced materials across both fashion and interior design industries. As consumers increasingly seek sustainable luxury, there is strong momentum behind fabrics made from organic fibers, low-impact dyes, and traceable raw materials. Technological innovations - such as performance-enhancing nanofinishes, smart textile integration, and precision digital weaving - are further elevating fabric utility while preserving their artisanal essence, opening new possibilities in luxury fashion, sportswear, and upholstery.End-use diversification is another significant catalyst, as luxury fabrics are now being embraced in hospitality, automotive, and bespoke furniture design. Automakers in the premium segment are replacing synthetic interiors with wool blends, suede, and sustainable leathers, elevating both comfort and brand prestige. Similarly, luxury hotels and upscale residential projects are driving demand for custom-made textiles that enhance sensory experience and design harmony. The growing culture of personalized luxury is also pushing designers and consumers alike toward limited-edition, handcrafted fabrics with unique textures and heritage value. Additionally, increased global exposure to luxury fashion and lifestyle trends - amplified through digital media and influencer marketing - is fueling aspirational consumption in emerging economies. Combined, these drivers are ensuring that the luxury fabric market remains not just relevant, but increasingly vital to the future of premium design and sustainable innovation.

Report Scope

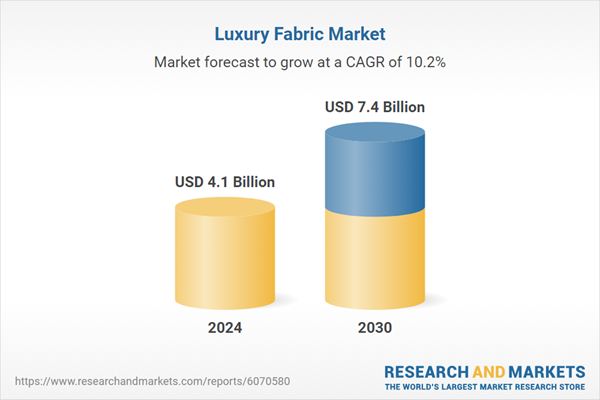

The report analyzes the Luxury Fabric market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Interior Luxury Fabric, Exterior Luxury Fabric); Raw Material (Silk Raw Material, Cashmere Raw Material, Cotton Raw Material, Velvet Raw Material, Linen Raw Material, Jacquard Raw Material, Other Raw Materials); Distribution Channel (Online Distribution Channel, Offline Distribution Channel).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Interior Fabric segment, which is expected to reach US$4.5 Billion by 2030 with a CAGR of a 8.7%. The Exterior Fabric segment is also set to grow at 12.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.1 Billion in 2024, and China, forecasted to grow at an impressive 13.7% CAGR to reach $1.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Luxury Fabric Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Luxury Fabric Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Luxury Fabric Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Burberry Group plc, Bvlgari (LVMH Group), Cartier (Richemont Group), Chanel S.A., De Rigo Vision S.p.A. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Luxury Fabric market report include:

- Brunschwig & Fils

- Designers Guild

- Dormeuil

- Ermenegildo Zegna

- Holland & Sherry

- Johnstons of Elgin

- Kravet Inc.

- Lanificio F.lli Cerruti

- Loro Piana

- Nina Campbell

- Osborne & Little

- Piacenza Cashmere

- Rubelli

- Sahco

- Sanderson

- Scabal

- Scalamandré

- Tessitura Luigi Bevilacqua

- Vitale Barberis Canonico

- Zimmer + Rohde

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Brunschwig & Fils

- Designers Guild

- Dormeuil

- Ermenegildo Zegna

- Holland & Sherry

- Johnstons of Elgin

- Kravet Inc.

- Lanificio F.lli Cerruti

- Loro Piana

- Nina Campbell

- Osborne & Little

- Piacenza Cashmere

- Rubelli

- Sahco

- Sanderson

- Scabal

- Scalamandré

- Tessitura Luigi Bevilacqua

- Vitale Barberis Canonico

- Zimmer + Rohde

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 380 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.1 Billion |

| Forecasted Market Value ( USD | $ 7.4 Billion |

| Compound Annual Growth Rate | 10.2% |

| Regions Covered | Global |