Global POS Security Market - Key Trends & Drivers Summarized

Why Is POS Security Becoming a Critical Concern for Businesses?

The increasing reliance on Point-of-Sale (POS) systems for financial transactions has made POS security a top priority for businesses across various industries, including retail, hospitality, healthcare, and e-commerce. POS systems are essential for processing credit card payments, customer transactions, and inventory management, but they are also a prime target for cybercriminals. As hackers, fraudsters, and cybercriminals develop more sophisticated techniques, businesses must implement robust security measures to prevent data breaches, financial fraud, and regulatory non-compliance.Cyberattacks targeting POS systems often involve malware infiltration, skimming devices, insider threats, and network vulnerabilities. Without proper security protocols, businesses risk exposing sensitive payment information, personal customer data, and financial records, leading to severe reputational and financial damages. The increasing adoption of contactless payments, cloud-based POS systems, and mobile payment solutions has further expanded attack surfaces, making end-to-end encryption, tokenization, and multi-factor authentication (MFA) essential components of modern POS security.

How Are Technological Advancements Strengthening POS Security?

Advancements in cybersecurity, encryption algorithms, and real-time threat detection have significantly improved POS security by reducing vulnerabilities and preventing fraudulent activities. One of the most notable innovations is the adoption of End-to-End Encryption (E2EE) and Tokenization, which ensure that credit card and payment data are encrypted throughout the transaction process. By replacing sensitive cardholder data with encrypted tokens, businesses can minimize the risk of data breaches and unauthorized access.Another major technological advancement is the integration of AI-driven fraud detection and behavioral analytics. Modern POS security solutions leverage machine learning algorithms to analyze transaction patterns, user behaviors, and anomaly detection in real time. If suspicious activity is detected - such as unusual transaction locations, duplicate payment requests, or unauthorized device access - the system can automatically flag or block the transaction, preventing fraud before it occurs.

The rise of cloud-based POS security solutions has also enhanced remote monitoring, automatic software updates, and compliance with industry regulations. Cloud-based security systems provide real-time threat intelligence, ensuring that businesses can identify and mitigate security risks across multiple store locations. Additionally, biometric authentication, secure login mechanisms, and multi-factor authentication (MFA) are being implemented to protect POS access points from unauthorized personnel. As businesses increasingly transition to mobile POS (mPOS) and self-checkout systems, security solutions are evolving to protect both hardware and digital payment infrastructures.

What Market Trends Are Influencing the Adoption of POS Security Solutions?

One of the most influential trends shaping the POS security market is the increasing frequency of cyberattacks on retail and hospitality businesses. High-profile data breaches involving stolen credit card information, phishing attacks, and malware infections have pushed businesses to prioritize investment in secure POS solutions. Regulatory bodies, including PCI DSS (Payment Card Industry Data Security Standard) and GDPR (General Data Protection Regulation), have introduced stricter security compliance requirements, forcing businesses to adopt advanced encryption, secure payment processing, and continuous vulnerability monitoring.The rise of contactless and digital payment methods is another key factor driving POS security innovation. As more consumers adopt NFC-based transactions, QR code payments, and mobile wallets (Apple Pay, Google Pay, and Samsung Pay), businesses must secure wireless payment channels from potential cyber threats. Hackers often exploit unsecured Wi-Fi networks, Bluetooth connections, and weak authentication protocols to gain access to POS terminals, making endpoint security and secure wireless communication essential.

Another major market trend is the adoption of blockchain technology in POS security. Blockchain-based decentralized transaction verification systems reduce the risk of data tampering, unauthorized chargebacks, and transaction fraud. Additionally, blockchain ensures transparency in financial transactions, providing an immutable record of payments that enhances consumer trust and fraud prevention. Businesses are increasingly exploring blockchain-based POS security frameworks to enhance payment authentication and compliance.

What Factors Are Driving the Growth of the POS Security Market?

The growth in the POS security market is driven by several factors, including the expansion of digital payments, the rise of cloud-based POS solutions, and increasing cybersecurity threats targeting financial transactions. One of the primary drivers is the global shift toward cashless transactions, with businesses adopting digital and mobile payment platforms to enhance customer convenience and operational efficiency. However, this shift has also led to an increase in payment fraud, data breaches, and identity theft, necessitating the adoption of multi-layered security solutions to protect transactional data and financial assets.Another major growth factor is the rise of small and medium-sized enterprises (SMEs) adopting cloud-based POS systems. Cloud POS solutions offer cost-effective, scalable, and real-time security features, enabling businesses to automate software updates, monitor threats remotely, and implement AI-powered fraud detection. With the increasing affordability of cloud security services, SMEs can now access enterprise-grade POS security features, reducing their exposure to cyber threats and payment fraud.

The adoption of biometric authentication and AI-powered facial recognition in POS security is also fueling market growth. Businesses are implementing fingerprint scanners, facial recognition payment authentication, and voice recognition technology to prevent unauthorized transactions and insider fraud. These advanced security features are particularly useful in self-checkout kiosks, unattended retail stores, and high-value transaction environments, where enhanced identity verification is crucial.

Additionally, government regulations and industry compliance standards are pushing businesses to upgrade legacy POS security infrastructures. The enforcement of PCI DSS compliance, EMV (Europay, Mastercard, and Visa) chip technology, and 3D Secure authentication protocols is driving investment in advanced POS security solutions. Businesses that fail to comply with security mandates face financial penalties, legal liabilities, and reputational damage, making POS security a critical investment for long-term business sustainability.

As cyber threats continue to evolve and target financial transactions, the POS security market is expected to expand rapidly, with businesses investing in next-generation encryption, AI-driven fraud prevention, and blockchain-based transaction security. With continued advancements in secure payment technology and digital identity verification, POS security solutions will play an increasingly important role in protecting financial ecosystems and consumer trust worldwide.

Report Scope

The report analyzes the POS Security market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Offering Type (POS Security Services, POS Security Solutions); Organization Size (Large Enterprises, SMEs); End-Use (Retail End-Use, Hospitality End-Use, Restaurants End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the POS Security Services segment, which is expected to reach US$4 Billion by 2030 with a CAGR of a 5.3%. The POS Security Solutions segment is also set to grow at 8.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.2 Billion in 2024, and China, forecasted to grow at an impressive 9.7% CAGR to reach $1.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global POS Security Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global POS Security Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global POS Security Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Accuray Incorporated, Aribex (acquired by KaVo Kerr), Canon Medical Systems, Carestream Health, CurveBeam LLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this POS Security market report include:

- Auto-Star Compusystems Inc.

- Block, Inc. (Square)

- Check Point Software Technologies Ltd.

- Clover Network, Inc.

- Epos Now

- Fortinet, Inc.

- Ingenico Group

- Microsoft Corporation

- NEC Corporation

- New POS Technology Limited

- Oracle Corporation

- PAX Technology

- PayPal Holdings, Inc.

- Shopify Inc.

- Sophos Group plc

- Symantec Corporation

- Trellix

- Trend Micro Inc.

- VeriFone Systems Inc.

- WatchGuard Technologies, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Auto-Star Compusystems Inc.

- Block, Inc. (Square)

- Check Point Software Technologies Ltd.

- Clover Network, Inc.

- Epos Now

- Fortinet, Inc.

- Ingenico Group

- Microsoft Corporation

- NEC Corporation

- New POS Technology Limited

- Oracle Corporation

- PAX Technology

- PayPal Holdings, Inc.

- Shopify Inc.

- Sophos Group plc

- Symantec Corporation

- Trellix

- Trend Micro Inc.

- VeriFone Systems Inc.

- WatchGuard Technologies, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 373 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

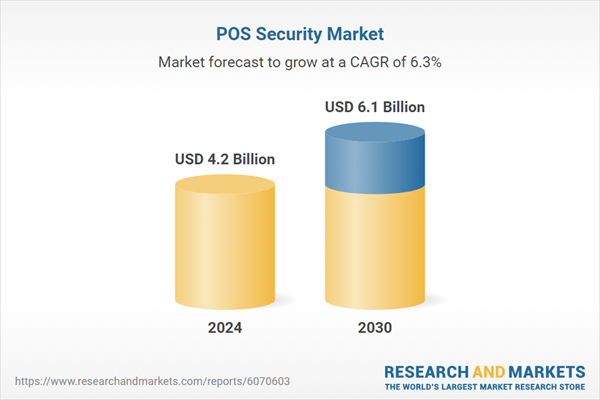

| Estimated Market Value ( USD | $ 4.2 Billion |

| Forecasted Market Value ( USD | $ 6.1 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |