Global Metal Coil Lamination Market - Key Trends & Drivers Summarized

What Is Metal Coil Lamination and How Does It Work?

Metal coil lamination is a process in which thin layers of material, typically plastic films or metal foils, are bonded to metal coils, typically made of aluminum, steel, or copper. This lamination process is designed to improve the properties of the base metal, such as corrosion resistance, strength, appearance, and insulation. The laminated coils are then used in a variety of applications, including manufacturing electrical components, building materials, automotive parts, and home appliances. The metal coil lamination process typically involves applying heat, pressure, or adhesives to adhere the lamination material to the metal surface, creating a durable and functional composite material.The lamination process serves several purposes: it enhances the aesthetic appeal of the metal, protects it from external environmental factors, and adds specific properties like thermal insulation, electrical conductivity, or resistance to wear and tear. For example, in the automotive industry, metal coil lamination is used to produce body panels that are resistant to corrosion and UV degradation, while in electronics, laminated metal coils are used to manufacture components like transformers, capacitors, and motors. The versatility of this technology makes it integral to industries requiring high-performance materials with enhanced functional properties.

What Are the Key Trends in the Metal Coil Lamination Market?

A significant trend in the metal coil lamination market is the growing demand for lightweight and high-performance materials in the automotive and aerospace industries. With the increasing focus on energy efficiency and reducing carbon emissions, industries are increasingly adopting lightweight materials that also offer durability and strength. Metal coil lamination, particularly using aluminum or composite materials, is ideal for these applications as it provides an efficient way to enhance the mechanical properties of metals while keeping the overall weight low. Additionally, the automotive sector is also focusing on improving fuel efficiency, which further drives the demand for metal coil lamination solutions that can reduce weight without compromising safety or performance.Another key trend is the increasing use of advanced coatings and laminate materials that offer enhanced functionality. For example, antimicrobial coatings, fire-resistant materials, and UV-resistant films are being incorporated into metal lamination to provide additional benefits. These innovations are particularly important in sectors such as construction, electronics, and food packaging, where durability, hygiene, and aesthetics are paramount. In the construction industry, for instance, metal coil lamination is being used in the production of roofing, cladding, and other building components that need to withstand environmental stresses like moisture, UV exposure, and temperature fluctuations. The rise in demand for specialized coatings that offer more than just aesthetic enhancement is encouraging further development of advanced lamination technologies.

Why Is the Demand for Metal Coil Lamination Growing?

The demand for metal coil lamination is growing primarily due to the increasing need for corrosion-resistant, lightweight, and durable materials across a variety of industries. The ability to improve the properties of base metals, particularly steel and aluminum, makes metal coil lamination an attractive solution for manufacturers looking to enhance product performance and longevity. For instance, in industries such as automotive manufacturing, where durability, safety, and aesthetics are key factors, laminated metals can improve the overall quality of the products. The automotive industry's shift toward electric vehicles (EVs) has also driven the demand for specialized laminated materials that improve energy efficiency and reduce the weight of battery components, further boosting market demand.In addition, there is a growing focus on sustainable manufacturing processes and materials. Lamination technology allows manufacturers to reduce material waste, as it enables the use of thinner metal coils without compromising on strength or functionality. Furthermore, the use of eco-friendly lamination materials, such as biodegradable films or recyclable coatings, is gaining traction as industries seek to meet sustainability goals. As businesses in sectors like construction, automotive, and consumer electronics become more environmentally conscious, they are increasingly turning to metal coil lamination solutions that provide both functional and ecological benefits.

The versatility of metal coil lamination is another reason for its increasing demand. Laminated metal coils can be used across a wide range of industries, from construction and automotive to electronics and packaging. The broad applicability of laminated metal makes it an attractive option for manufacturers looking for adaptable solutions that can serve multiple functions, including protection, insulation, decoration, and functionality improvement. As global industries continue to innovate and demand higher-performing, cost-effective materials, the metal coil lamination market is seeing sustained growth.

What Are the Key Growth Drivers in the Metal Coil Lamination Market?

The growth in the metal coil lamination market is driven by several factors, starting with the increasing demand for lightweight materials in the automotive and aerospace sectors. As the automotive industry continues to push for lighter, more fuel-efficient vehicles, metal coil lamination offers an effective way to enhance the strength and durability of metals without adding significant weight. This is particularly important as the industry shifts toward electric vehicles, which require lightweight materials to extend battery life and improve energy efficiency. Lamination technology allows manufacturers to combine the benefits of metals, like strength, with the performance characteristics of other materials, such as composites and polymers, resulting in high-performance components that meet the evolving demands of the industry.Another significant growth driver is the increased focus on product durability and performance across industries such as construction, electronics, and consumer goods. In the construction sector, for example, laminated metals are used in roofing, facades, and insulation materials due to their ability to withstand harsh environmental conditions, including moisture, UV exposure, and extreme temperatures. As urbanization continues to rise and the demand for sustainable buildings grows, the market for metal coil lamination is expanding. Similarly, in the electronics industry, laminated metals are critical for producing efficient, high-performance components such as transformers, capacitors, and motors, where thermal management and electrical conductivity are vital.

Additionally, technological advancements in coating materials and lamination processes are fueling market growth. New innovations, such as the development of smart coatings, have made metal coil lamination an even more attractive option. These coatings not only provide traditional benefits like corrosion resistance and UV protection but also offer advanced capabilities like self-healing properties or the ability to change color based on temperature. As industries demand more specialized, functional materials, the evolution of lamination technologies ensures that metal coil laminating processes can meet these needs while offering cost-effective and efficient solutions.

Finally, growing environmental concerns and sustainability initiatives are driving the adoption of metal coil lamination as an eco-friendly solution. Lamination technologies allow manufacturers to use thinner layers of metal while maintaining product strength, thereby reducing material waste and improving resource efficiency. The use of recyclable and biodegradable films in metal lamination is also on the rise, contributing to the development of more sustainable materials that meet the environmental standards set by regulatory bodies and consumers alike. As industries strive to reduce their carbon footprints and adopt circular economy practices, the demand for eco-conscious lamination solutions continues to grow.

With these factors contributing to the expansion of the market, metal coil lamination is poised to play a crucial role in meeting the demands of industries seeking high-performance, sustainable, and versatile materials. The continued development of advanced lamination technologies, alongside broader trends in lightweighting, sustainability, and product durability, will likely drive further market growth in the coming years.

Report Scope

The report analyzes the Metal Coil Lamination market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Polymer Type (PP, PET, PVC, PVF, Others).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the PP segment, which is expected to reach US$2.3 Billion by 2030 with a CAGR of a 5.3%. The PET segment is also set to grow at 6.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.2 Billion in 2024, and China, forecasted to grow at an impressive 8.2% CAGR to reach $1.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Metal Coil Lamination Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Metal Coil Lamination Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Metal Coil Lamination Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

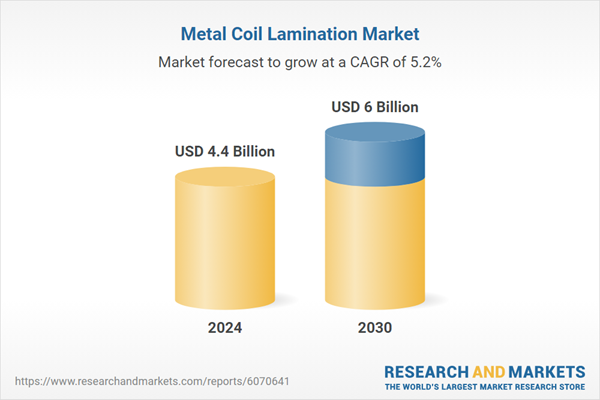

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aquatech International LLC, Avista Technologies, Inc., ChemREADY, ClearBlu Environmental, Ecologix Environmental Systems and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Metal Coil Lamination market report include:

- American Nickeloid Company

- Andritz AG

- ArcelorMittal

- Berlin Metals

- Danieli & C. Officine Meccaniche S.p.A.

- Diehl Metall

- Formosa Plastics Corporation

- Henkel AG & Co. KGaA

- JFE Steel Corporation

- Jindal Poly Films Ltd.

- Klöckner & Co SE

- Lienchy Laminated Metal Co., Ltd.

- Material Sciences Corporation

- METAL TRADE COMAX

- Mitsubishi Chemical Corporation

- Nippon Steel Corporation

- Orion Profiles Ltd.

- Polytech America LLC

- POSCO

- Severstal

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- American Nickeloid Company

- Andritz AG

- ArcelorMittal

- Berlin Metals

- Danieli & C. Officine Meccaniche S.p.A.

- Diehl Metall

- Formosa Plastics Corporation

- Henkel AG & Co. KGaA

- JFE Steel Corporation

- Jindal Poly Films Ltd.

- Klöckner & Co SE

- Lienchy Laminated Metal Co., Ltd.

- Material Sciences Corporation

- METAL TRADE COMAX

- Mitsubishi Chemical Corporation

- Nippon Steel Corporation

- Orion Profiles Ltd.

- Polytech America LLC

- POSCO

- Severstal

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.4 Billion |

| Forecasted Market Value ( USD | $ 6 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |