Global Industrial Maintenance Coatings Market - Key Trends & Drivers Summarized

Industrial Maintenance Coatings: Ensuring Durability, Corrosion Resistance, and Longevity in Industrial Infrastructure

Industrial maintenance coatings play a critical role in protecting industrial infrastructure, machinery, and structural components from corrosion, wear, chemical exposure, and environmental degradation. These coatings are essential in oil & gas, manufacturing, marine, construction, aerospace, and power generation sectors, where equipment and surfaces must withstand harsh conditions, extreme temperatures, and mechanical stress. Available in epoxy, polyurethane, alkyd, fluoropolymer, and zinc-rich formulations, industrial maintenance coatings ensure long-term durability, improved safety, and cost-effective maintenance of industrial assets.One of the most significant trends in the industrial maintenance coatings market is the shift toward eco-friendly, low-VOC (volatile organic compound), and waterborne coatings. With stricter environmental regulations and the demand for sustainable manufacturing processes, industries are replacing solvent-based coatings with high-solids and waterborne alternatives that offer reduced emissions, improved worker safety, and lower environmental impact. Additionally, advancements in nanotechnology, self-healing coatings, and high-performance polymer formulations are improving resistance to corrosion, heat, and UV exposure, extending the lifespan of industrial structures and machinery.

Why Are Industrial Maintenance Coatings Essential for Asset Protection?

Industrial maintenance coatings are indispensable for industries requiring long-term equipment reliability and protection against corrosion, moisture, and chemical exposure. In the oil & gas sector, these coatings protect storage tanks, pipelines, and offshore platforms from saltwater corrosion, abrasive materials, and extreme temperature fluctuations, ensuring compliance with safety standards. Similarly, in manufacturing and heavy machinery, coatings are used to prevent oxidation, reduce friction, and enhance wear resistance in high-impact mechanical systems.In the aerospace and automotive industries, industrial coatings improve fuel efficiency, aerodynamic performance, and surface durability in aircraft, vehicle components, and structural frames. Anti-fouling and anti-microbial coatings are also widely applied in marine, pharmaceutical, and food processing industries to prevent contamination, microbial growth, and biofouling on surfaces. With growing demand for smart coatings with embedded sensors for wear detection, industries are increasingly adopting next-generation coatings that provide real-time performance insights and predictive maintenance capabilities.

How Is Technology Transforming Industrial Maintenance Coatings?

Technological innovations in advanced polymer chemistry, AI-driven coatings application, and self-healing nanocoatings are significantly enhancing the durability, efficiency, and sustainability of industrial coatings. The introduction of graphene-enhanced coatings has resulted in superior hardness, UV resistance, and electrical conductivity, making them ideal for marine, aerospace, and high-temperature applications. Additionally, plasma coatings and thermal spray technologies are being adopted to improve surface adhesion, abrasion resistance, and temperature tolerance in high-performance machinery and industrial turbines.The rise of AI and IoT-enabled coatings monitoring systems is further revolutionizing industrial asset management. Smart coatings with embedded sensors can now detect coating degradation, corrosion initiation, and thermal stress in real time, enabling industries to implement predictive maintenance strategies and optimize reapplication schedules. Additionally, automated robotic spray applications and electrostatic liquid coating techniques are improving precision, reducing material waste, and minimizing labor-intensive processes in large-scale industrial painting operations.

What’ s Driving the Growth of the Industrial Maintenance Coatings Market?

The growth in the industrial maintenance coatings market is driven by increasing industrial expansion, rising investments in infrastructure development, and the demand for sustainable and long-lasting protective solutions. The shift toward corrosion-resistant coatings in offshore energy projects, chemical processing plants, and heavy manufacturing facilities is fueling demand for high-performance polymer coatings with extended service life. Additionally, government regulations mandating the use of low-VOC and non-toxic coatings are pushing manufacturers to develop waterborne, bio-based, and hybrid coatings that meet environmental compliance standards.Another significant growth factor is the increasing use of maintenance coatings in renewable energy infrastructure, including solar farms, wind turbines, and hydroelectric power plants, where coatings protect metal frames, energy storage systems, and exposed surfaces from weathering and corrosion. The rise of AI-driven coating quality control and automation in coating application is also enhancing efficiency, cost-effectiveness, and precision in industrial maintenance coatings, ensuring long-term durability and reduced operational downtime.

Report Scope

The report analyzes the Industrial Maintenance Coatings market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Acrylic Coatings Type, Alkyd Coatings Type, Epoxy Coatings Type, Polyurethane Coatings Type, Other Types); Technology (Solvent-Borne Coatings Technology, Waterborne Coatings Technology, Powder Coatings Technology, Ultra Violet -Cured Coatings Technology); End-Use (Energy & Power End-Use, Metal Processing End-Use, Transportation End-Use, Chemical Processing End-Use, Construction End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Acrylic Coatings segment, which is expected to reach US$1.8 Billion by 2030 with a CAGR of a 2.5%. The Alkyd Coatings segment is also set to grow at 1.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.3 Billion in 2024, and China, forecasted to grow at an impressive 4.6% CAGR to reach $1.0 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Industrial Maintenance Coatings Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Industrial Maintenance Coatings Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Industrial Maintenance Coatings Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as A123 Systems LLC, BYD Company Limited, CALB (China Aviation Lithium Battery), Contemporary Amperex Technology Co., Limited (CATL), Envision AESC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Industrial Maintenance Coatings market report include:

- AkzoNobel

- Asian Paints Limited

- Axalta Coating Systems

- BASF Coatings

- Behr Process Corporation

- Benjamin Moore & Co.

- Berger Paints India Limited

- DuluxGroup

- Hempel Group

- Jotun A/S

- Kansai Paint Co., Ltd.

- National Paints Factories Co. Ltd.

- Nippon Paint Holdings Co., Ltd.

- PPG Industries

- RPM International Inc.

- Rust-Oleum

- Sherwin-Williams Company

- Sika AG

- Tikkurila Oyj

- Valspar Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AkzoNobel

- Asian Paints Limited

- Axalta Coating Systems

- BASF Coatings

- Behr Process Corporation

- Benjamin Moore & Co.

- Berger Paints India Limited

- DuluxGroup

- Hempel Group

- Jotun A/S

- Kansai Paint Co., Ltd.

- National Paints Factories Co. Ltd.

- Nippon Paint Holdings Co., Ltd.

- PPG Industries

- RPM International Inc.

- Rust-Oleum

- Sherwin-Williams Company

- Sika AG

- Tikkurila Oyj

- Valspar Corporation

Table Information

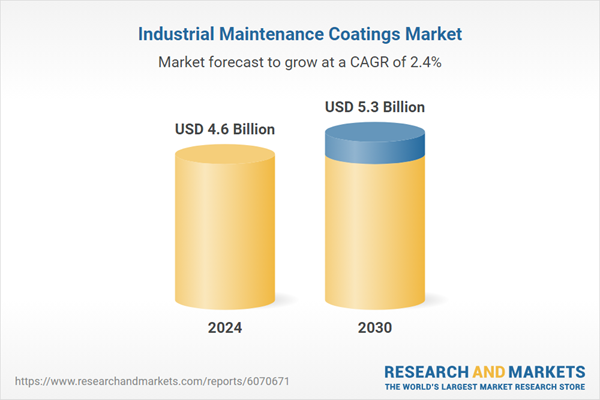

| Report Attribute | Details |

|---|---|

| No. of Pages | 392 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.6 Billion |

| Forecasted Market Value ( USD | $ 5.3 Billion |

| Compound Annual Growth Rate | 2.4% |

| Regions Covered | Global |