Global Female Infertility Diagnosis Market - Key Trends & Drivers Summarized

Why Is Female Infertility Diagnosis Gaining Unprecedented Attention in Modern Healthcare?

The rising global prevalence of infertility is placing female infertility diagnosis at the forefront of reproductive healthcare innovation. With an estimated 8- 12% of reproductive-aged couples affected by infertility worldwide, women increasingly undergo diagnostic evaluations to uncover underlying causes such as ovulatory disorders, endometriosis, uterine abnormalities, or diminished ovarian reserve. Changing societal norms - including delayed childbearing, urbanization, and increased awareness - have further contributed to higher diagnosis rates. As women now often attempt pregnancy at older ages, age-related infertility and hormonal imbalances have become more prominent, necessitating comprehensive diagnostic strategies. Clinical workflows now typically begin with basic evaluations such as hormone level testing and transvaginal ultrasounds, progressing to advanced techniques like hysterosalpingography (HSG), laparoscopy, genetic screening, and ovarian reserve assessments. This demand is bolstered by a growing number of specialized fertility clinics, particularly in urban centers, offering rapid diagnostic services under one roof. In developing countries, rising healthcare literacy and government-backed reproductive health programs are helping dismantle social stigmas and encouraging more women to seek timely diagnostic support, adding further momentum to the market’ s expansion.How Is Diagnostic Technology Shaping the Future of Female Fertility Assessments?

The landscape of female infertility diagnosis is being rapidly transformed by technological advancements that enable earlier, more accurate, and minimally invasive evaluations. Artificial intelligence (AI) and machine learning are being applied to ultrasound imaging and hormone analytics, enhancing diagnostic precision and pattern recognition. Innovations like 3D and 4D ultrasound imaging are providing superior anatomical insights into uterine and ovarian structures, while advanced laparoscopy tools are offering real-time, high-definition visualization of pelvic anomalies. Moreover, the development of hormone assay kits with higher sensitivity and specificity has made it easier to detect irregularities in estrogen, FSH, LH, AMH, and prolactin levels. Genetic testing is also becoming increasingly relevant, particularly in identifying chromosomal or hereditary conditions linked to recurrent miscarriages or premature ovarian failure. The proliferation of at-home fertility test kits for AMH levels or ovulation tracking is enhancing accessibility, particularly among tech-savvy and privacy-conscious consumers. Alongside these innovations, integrated digital platforms and telehealth consultations are streamlining the diagnostic journey by consolidating test results, facilitating remote consultations with specialists, and enabling personalized diagnostic pathways based on a woman’ s reproductive profile.What Social and Cultural Dynamics Are Shaping Diagnostic Demand Worldwide?

Social attitudes toward fertility and motherhood are playing a critical role in determining how, when, and where women seek infertility diagnoses. In many developed nations, the normalization of assisted reproductive technologies (ART) has prompted women to pursue earlier diagnostic testing as a proactive step toward future family planning. Delayed marriages and shifting priorities - such as education, career development, and financial stability - are influencing women to seek fertility assessments in their late twenties and thirties, often before symptoms arise. In contrast, in traditional societies, infertility remains highly stigmatized, and women may face immense societal pressure to conceive, pushing them to seek diagnosis quickly - often in secrecy or without adequate information. This cultural pressure is increasingly being countered by educational campaigns, fertility awareness weeks, and NGO-led outreach programs that emphasize the medical, not moral, nature of infertility. Additionally, access disparities - based on geography, income, and healthcare infrastructure - continue to influence market penetration. In low- and middle-income countries, urban-rural divides often determine access to quality diagnostics, though mobile clinics and subsidized testing initiatives are beginning to bridge these gaps. Fertility advocacy, celebrity openness, and media campaigns are also making the topic more mainstream, breaking taboos and fueling diagnostic demand across diverse demographics.Which Core Factors Are Propelling Market Growth Across Regions and Demographics?

The growth in the Female Infertility Diagnosis market is driven by several factors tied to medical technology evolution, shifting patient demographics, and healthcare system priorities. One of the most significant drivers is the increasing maternal age at first childbirth, which inherently raises the likelihood of fertility complications and prompts earlier and more frequent diagnostic evaluations. The widespread availability of fertility-focused health insurance and reimbursement policies in developed markets is also making high-cost diagnostics more accessible to a larger population. Advances in diagnostic accuracy, including the use of AMH testing to assess ovarian reserve and genetic panels for reproductive disorders, are making diagnostics indispensable in early fertility planning. The proliferation of fertility centers offering bundled diagnostic and treatment services under one umbrella is enhancing convenience and uptake, particularly among urban and career-oriented women. Another critical factor is the surge in ART cycles globally, where precise diagnosis is essential for selecting optimal treatment protocols. Governments and private players are also investing in expanding fertility infrastructure, with initiatives in countries like India, China, and parts of the Middle East targeting early screening and awareness.The report analyzes the Female Infertility Diagnosis market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.

- Segments: Test (Ovarian Reserve Testing, Hysterosalpingography Test, Hormone Testing, Other Tests).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Ovarian Reserve Testing segment, which is expected to reach US$2.6 Billion by 2030 with a CAGR of a 5.4%. The Hysterosalpingography Test segment is also set to grow at 8.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.3 Billion in 2024, and China, forecasted to grow at an impressive 10.3% CAGR to reach $1.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Female Infertility Diagnosis Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Female Infertility Diagnosis Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Female Infertility Diagnosis Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Female Infertility Diagnosis market report include:

- Bayer AG

- Carrot Fertility

- CCRM Fertility

- Dallas Fort Worth Fertility Associates

- Extend Fertility

- Ferring Pharmaceuticals

- Hertility Health

- Institute for Human Reproduction

- Las Vegas Fertility

- Main Line Fertility

- Mankind Pharma

- Merck KGaA

- Novartis International AG

- Overlake Reproductive Health

- Pacific Fertility Center Los Angeles (PFCLA)

- Pfizer Inc.

- Proov

- San Diego Fertility Center

- Selectivity

- Wisconsin Fertility Institute

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Bayer AG

- Carrot Fertility

- CCRM Fertility

- Dallas Fort Worth Fertility Associates

- Extend Fertility

- Ferring Pharmaceuticals

- Hertility Health

- Institute for Human Reproduction

- Las Vegas Fertility

- Main Line Fertility

- Mankind Pharma

- Merck KGaA

- Novartis International AG

- Overlake Reproductive Health

- Pacific Fertility Center Los Angeles (PFCLA)

- Pfizer Inc.

- Proov

- San Diego Fertility Center

- Selectivity

- Wisconsin Fertility Institute

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 176 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

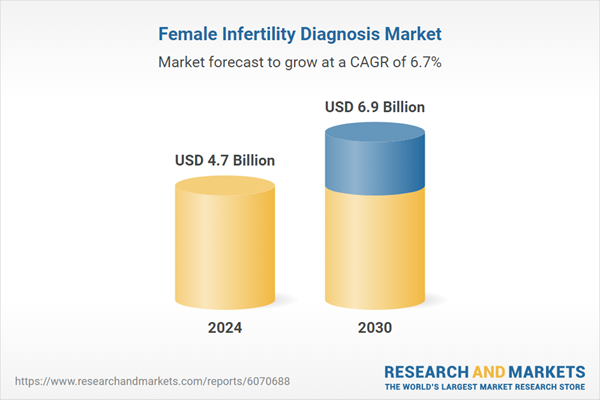

| Estimated Market Value ( USD | $ 4.7 Billion |

| Forecasted Market Value ( USD | $ 6.9 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |