Global Bio-based Polyurethane Market - Key Trends & Drivers Summarized

Why Is Bio-based Polyurethane Gaining Traction in Industrial Applications?

The growing shift toward sustainable materials and eco-friendly alternatives is propelling the demand for bio-based polyurethane across various industries. Traditionally, polyurethane has been widely used in applications such as construction, automotive, and furniture due to its excellent flexibility, durability, and insulation properties. However, conventional polyurethane is derived from petroleum-based feedstocks, which contribute significantly to carbon emissions and environmental degradation. The emergence of bio-based polyurethane, produced from renewable sources such as vegetable oils, biomass, and algae, offers a promising solution to these challenges. Manufacturers are increasingly incorporating bio-based polyols into their formulations to reduce dependence on fossil fuels and meet stringent environmental regulations. Additionally, advancements in green chemistry have enabled the production of high-performance bio-based polyurethane with enhanced mechanical and thermal stability, making it suitable for use in high-end industrial applications. As industries aim to achieve carbon neutrality and implement sustainable practices, the adoption of bio-based polyurethane is expected to accelerate, positioning it as a vital material in the future of industrial manufacturing.How Are Technological Advancements Enhancing the Performance of Bio-based Polyurethane?

Significant technological advancements in polymer science and material engineering are enhancing the performance attributes of bio-based polyurethane, making it a viable alternative to its petroleum-based counterpart. Researchers are developing innovative catalyst systems that improve the efficiency of bio-polyol production, leading to enhanced reactivity and superior end-product quality. The integration of nanotechnology in polyurethane formulations is further improving characteristics such as tensile strength, thermal resistance, and biodegradability. Additionally, breakthroughs in enzyme-based polymerization processes are facilitating the production of high-purity bio-based polyurethane with minimal environmental impact. Another critical development is the enhancement of foam and coating applications through the incorporation of bio-based isocyanates, which provide better adhesion, flexibility, and chemical resistance. These technological innovations are expanding the application scope of bio-based polyurethane beyond conventional markets, enabling its use in medical devices, footwear, and high-performance coatings. As research and development in sustainable polymers continue to progress, bio-based polyurethane is poised to become a cornerstone of the next-generation materials landscape.What Market Trends Are Driving the Adoption of Bio-based Polyurethane?

Several key trends are shaping the rapid adoption of bio-based polyurethane across industries. The push for circular economy practices and stricter environmental regulations are compelling manufacturers to transition toward bio-based materials, reducing reliance on petrochemical-derived products. The automotive industry, for example, is increasingly utilizing bio-based polyurethane in interior components, seat cushions, and lightweight panels to enhance fuel efficiency and sustainability. Similarly, the construction sector is leveraging bio-based polyurethane for green building applications, including energy-efficient insulation materials and low-VOC adhesives. Another significant trend is the increasing consumer preference for sustainable and biodegradable products in furniture and footwear manufacturing, driving demand for eco-friendly polyurethane-based materials. Additionally, government incentives and subsidies supporting the production and commercialization of biopolymers are encouraging further market penetration. The growing interest in low-carbon footprint products is further driving investments in bio-refinery infrastructure, enhancing the scalability and affordability of bio-based polyurethane. As companies align their strategies with sustainability goals, bio-based polyurethane is expected to witness widespread integration across diverse industrial and consumer applications.What Are the Key Factors Fueling the Growth of the Bio-based Polyurethane Market?

The growth in the bio-based polyurethane market is driven by several factors, including increasing regulatory support for sustainable materials, advancements in bio-polymerization techniques, and the rising adoption of bio-based alternatives in high-performance industries. The automotive sector's demand for lightweight, high-strength materials to improve fuel efficiency and reduce emissions is a significant driver, leading to the increased use of bio-based polyurethane in vehicle manufacturing. Additionally, the furniture and bedding industry is adopting bio-based polyurethane for eco-friendly cushioning and upholstery, catering to the demand for sustainable home furnishings. The medical sector is also contributing to market expansion, with bio-based polyurethane being used in prosthetics, wound care, and biomedical coatings due to its biocompatibility and durability. Moreover, technological improvements in polyurethane foam production are enhancing the material's recyclability, further solidifying its position in the circular economy framework. As industries and consumers prioritize environmentally responsible materials, bio-based polyurethane is expected to play a pivotal role in reducing carbon emissions and promoting sustainable product development.Report Scope

The report analyzes the Bio-based Polyurethane market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Rigid Foams, Flexible Foams, Coatings, Adhesives and Sealants, Other Product Types); End-Use (Building and Construction End-Use, Automotive End-Use, Consumer Goods End-Use, Electrical and Electronics End-Use, Packaging End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Rigid Foams segment, which is expected to reach US$23.9 Million by 2030 with a CAGR of a 9.8%. The Flexible Foams segment is also set to grow at 8.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $11.3 Million in 2024, and China, forecasted to grow at an impressive 8.3% CAGR to reach $11.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Bio-based Polyurethane Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Bio-based Polyurethane Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Bio-based Polyurethane Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

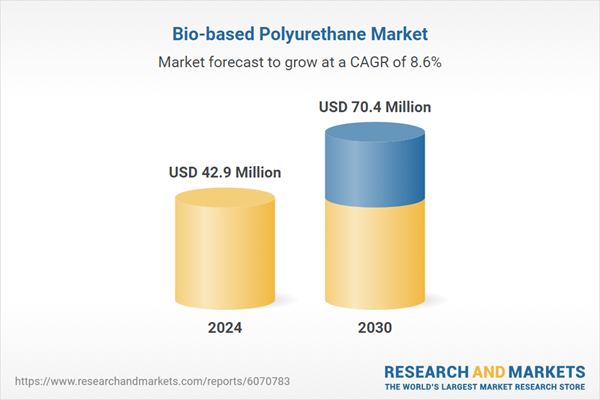

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Avient Corp., BASF SE, Borealis AG, Braskem SA, Danimer Scientific and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Bio-based Polyurethane market report include:

- Arkema Group

- BASF SE

- Cargill, Inc.

- Covestro AG

- Huntsman Corporation

- MCPU Polymer Engineering LLC

- Miracll Chemicals Co. Ltd

- Mitsui Chemicals, Inc.

- RAMPF Holding GmbH & Co., KG

- Stahl Holdings BV

- Teijin Ltd.

- The Lubrizol Corporation

- Toray Industries, Inc.

- WeylChem International GmbH

- Woodbridge

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Arkema Group

- BASF SE

- Cargill, Inc.

- Covestro AG

- Huntsman Corporation

- MCPU Polymer Engineering LLC

- Miracll Chemicals Co. Ltd

- Mitsui Chemicals, Inc.

- RAMPF Holding GmbH & Co., KG

- Stahl Holdings BV

- Teijin Ltd.

- The Lubrizol Corporation

- Toray Industries, Inc.

- WeylChem International GmbH

- Woodbridge

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 142 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 42.9 Million |

| Forecasted Market Value ( USD | $ 70.4 Million |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | Global |