Global Fuel Cards Market - Key Trends & Drivers Summarized

Why Are Fuel Cards Becoming an Essential Tool for Businesses and Individuals?

The fuel cards market has experienced rapid expansion due to the increasing need for efficient fuel expense management among businesses and individuals. Fuel cards have evolved from being mere payment instruments to becoming comprehensive financial tools that help organizations streamline fuel purchases, control expenses, and optimize fleet operations. As fuel costs continue to be one of the largest expenditures for logistics, transportation, and corporate travel, businesses are turning to fuel cards for better financial oversight. These cards offer benefits such as automated expense reporting, fraud prevention, and real-time tracking, making them indispensable for companies managing large fleets. Additionally, businesses can negotiate discounts and rebates with fuel providers, leading to substantial cost savings. Individual consumers are also adopting fuel cards to benefit from cashback offers, reward programs, and budget-friendly fuel purchasing options, further driving market penetration.The shift toward digital transactions has further accelerated the adoption of fuel cards, particularly as governments and regulatory bodies push for cashless economies. Fleet operators are increasingly recognizing the advantages of using fuel cards to reduce administrative burdens and gain visibility into fuel expenditures. Furthermore, the rise of ride-hailing services and last-mile delivery businesses has significantly increased the demand for fuel management solutions, positioning fuel cards as a crucial component of modern mobility. With a growing focus on corporate sustainability initiatives, fuel cards are also being leveraged to track carbon footprints and encourage eco-friendly fuel consumption patterns. As fuel prices fluctuate due to geopolitical tensions and supply chain disruptions, the role of fuel cards in cost optimization is becoming more pronounced, making them a vital tool for both businesses and everyday consumers.

How is Technology Transforming the Functionality and Security of Fuel Cards?

Technological advancements have played a pivotal role in enhancing the functionality and security of fuel cards, making them more efficient and fraud-resistant. One of the most significant developments in the market is the integration of smart chips, PIN authentication, and RFID technology, which helps in preventing unauthorized transactions and reducing fuel theft. AI-driven analytics have further improved fuel card security by identifying unusual spending patterns, alerting fleet managers about potential fraud, and enabling automated transaction approvals. Additionally, blockchain technology is being explored as a way to create a secure, decentralized system for tracking fuel purchases, ensuring transparency in transactions, and reducing the risk of tampering or manipulation. The use of digital wallets and virtual fuel cards is also on the rise, providing users with enhanced flexibility and reducing dependency on physical cards, which can be lost or stolen.Another major technological transformation is the integration of fuel cards with IoT-enabled fuel stations and telematics systems.

Which Industries and Market Segments Are Driving the Demand for Fuel Cards?

The transportation and logistics industry remains the largest consumer of fuel cards, as fleet operators seek more efficient ways to manage fuel expenses and streamline operational costs. Trucking companies, courier services, and last-mile delivery providers are among the most active adopters of fuel card solutions, using them to monitor driver spending, improve fuel efficiency, and reduce unauthorized purchases. The aviation and maritime sectors are also beginning to explore fuel card solutions, particularly for refueling operations in commercial air travel and cargo shipping. The construction and mining industries, where heavy-duty vehicles consume large amounts of fuel, are also showing increased interest in fuel cards as a way to manage large-scale fuel procurement and prevent misuse. Additionally, corporate travel programs are leveraging fuel cards to facilitate business-related travel expenses while ensuring compliance with company spending policies.Beyond traditional industries, fuel cards are making inroads into new market segments such as electric vehicle (EV) charging infrastructure and smart mobility solutions. As more businesses transition to hybrid and electric fleets, fuel card providers are integrating their services with EV charging networks, allowing users to manage both fuel and electric charging expenses through a single platform. The retail and hospitality industries are also contributing to the growth of the market, with fuel card loyalty programs driving customer engagement and enhancing brand loyalty. The food delivery and gig economy sectors have further propelled demand, as independent contractors and delivery personnel seek cost-effective fuel management solutions. Additionally, fuel card providers are partnering with smart city initiatives to facilitate digital payments at multi-service stations, expanding the scope of fuel card applications beyond traditional fuel purchases.

What Key Factors Are Driving Market Growth?

The growth in the fuel cards market is driven by several factors, including increasing demand for expense management solutions, advancements in digital payment technology, and the expansion of fuel retail networks. The rise in fleet digitization has fueled the need for automated, real-time expense tracking, prompting businesses to invest in fuel card solutions. The growing adoption of contactless and mobile payment technologies has further simplified fuel card transactions, making them more secure and efficient. Additionally, regulatory measures promoting the reduction of cash-based transactions in fuel purchases have encouraged businesses and individual users to transition to fuel card-based payment models. The integration of telematics and AI-driven analytics into fuel card platforms is also a significant driver, allowing businesses to gain better insights into fuel consumption patterns and optimize fleet efficiency.Another key growth factor is the rising demand for flexible payment solutions, with fuel card providers offering customized plans tailored to the needs of businesses and individual consumers. The increasing prevalence of fuel price volatility has prompted organizations to seek better control over fuel expenses, leading to a surge in fuel card adoption. Additionally, the expansion of multi-service fuel stations - offering fueling, maintenance, car washes, and toll payments - has boosted the utility of fuel cards beyond traditional fuel purchases. The introduction of green fuel and EV charging compatibility in fuel card networks is another emerging trend, catering to the sustainability goals of businesses transitioning toward cleaner energy sources. Moreover, the rapid expansion of e-commerce and food delivery services has created a new segment of fuel card users, further diversifying the market landscape. As fuel cards continue to integrate with emerging mobility trends, including ride-sharing and autonomous vehicle fleets, their market potential is expected to grow exponentially in the coming years.

Report Scope

The report analyzes the Fuel Cards market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Memory Type, MPU Microprocessor Type); Interface (Contact Interface, Contactless Interface, Dual Interface); Functionality (Transaction Functionality, Communication Functionality, Security & Access Control Functionality); Application (BFSI Application, Telecommunication Application, Government & Healthcare Application, Retail & E-Commerce Application, Transportation Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Memory Cards segment, which is expected to reach US$736.7 Billion by 2030 with a CAGR of a 6%. The MPU Microprocessor Cards segment is also set to grow at 10.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $220.0 Billion in 2024, and China, forecasted to grow at an impressive 11.6% CAGR to reach $261.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Fuel Cards Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Fuel Cards Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Fuel Cards Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Austria Juice, Babolat Industrial Group, Döhler, Firmenich, Flavorman and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Fuel Cards market report include:

- Allstar Business Solutions

- AtoB

- BP

- Caltex StarCard

- Cepsa

- Chevron

- Coast

- Comdata

- Corpay (formerly FleetCor Technologies)

- DKV Euro Service

- Edenred

- ExxonMobil

- FleetCards USA

- Fuelman

- Galp Energia

- PetroChina

- Pumacard

- Repsol

- Shell

- Sinopec

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Allstar Business Solutions

- AtoB

- BP

- Caltex StarCard

- Cepsa

- Chevron

- Coast

- Comdata

- Corpay (formerly FleetCor Technologies)

- DKV Euro Service

- Edenred

- ExxonMobil

- FleetCards USA

- Fuelman

- Galp Energia

- PetroChina

- Pumacard

- Repsol

- Shell

- Sinopec

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 469 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

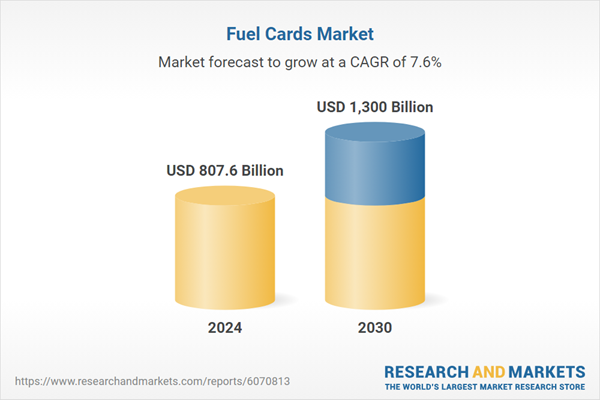

| Estimated Market Value ( USD | $ 807.6 Billion |

| Forecasted Market Value ( USD | $ 1300 Billion |

| Compound Annual Growth Rate | 7.6% |

| Regions Covered | Global |