Global Sustainable Pharmaceutical Packaging Market - Key Trends & Drivers Summarized

Why Is Pharma's Packaging Paradigm Under Growing Environmental Scrutiny?

The pharmaceutical industry, traditionally focused on sterility, safety, and regulatory compliance, is now facing growing pressure to address its environmental footprint - particularly when it comes to packaging. With global drug production and healthcare consumption on the rise, the scale of pharmaceutical packaging waste has become difficult to ignore. Single-use plastics, aluminum foils, multi-material blister packs, and non-recyclable laminates have long been the standard for preserving drug efficacy, but they are also among the most challenging materials to recycle. Mounting consumer concern, institutional ESG commitments, and environmental regulations are converging to push pharmaceutical manufacturers toward sustainable alternatives. These changes are particularly evident in over-the-counter (OTC) medications, nutraceuticals, and direct-to-consumer pharma brands, where packaging plays a central role in brand perception. Hospitals and healthcare providers are also revisiting procurement policies to favor eco-conscious packaging solutions. As stakeholders grow more climate-conscious, sustainability is becoming a key differentiator - not just for reputation, but for market access and compliance. Pharma's traditional trade-off between product integrity and environmental responsibility is being rewritten, and the packaging industry must now deliver both.Can Innovation Balance Sustainability with Stringent Pharma Compliance Standards?

Balancing sustainability with the rigorous standards of pharmaceutical packaging - such as sterility, barrier protection, moisture sensitivity, and tamper evidence - has historically been a formidable challenge. However, material science innovations and design thinking are unlocking new opportunities. Biodegradable polymers, recyclable mono-materials, and bio-based resins are being engineered to meet regulatory and performance requirements. Developments in polyethylene and polypropylene structures are allowing the creation of recyclable blister packs and primary packaging components without compromising protective qualities. Meanwhile, fiber-based packaging formats for secondary and tertiary uses are gaining ground, especially as alternatives to plastic inserts, cartons, and shrink wraps. Labeling technologies are also evolving - solvent-free adhesives, water-based inks, and laser marking are becoming more common, aligning with broader sustainability standards. Smart packaging solutions incorporating digital traceability and anti-counterfeiting features are also reducing the need for excessive labeling and redundant packaging. Importantly, sustainability is being built into packaging design from the start, with increased focus on lightweighting, modularity, and recyclability. By designing packaging systems that meet pharma-grade sterility and safety while minimizing environmental impact, the industry is beginning to prove that performance and sustainability can, in fact, coexist.How Are Policies and Patient Expectations Reshaping Pharma Packaging Decisions?

Regulatory frameworks and evolving patient expectations are now reshaping pharmaceutical packaging decisions at every level. In the European Union, legislation tied to the EU Green Deal and Circular Economy Action Plan is pushing pharmaceutical companies to consider packaging recyclability, materials disclosure, and lifecycle assessments in their product stewardship. In the United States, the FDA and EPA are expanding dialogue around sustainable healthcare practices, while states like California are tightening extended producer responsibility (EPR) laws that include pharmaceutical packaging. Meanwhile, global voluntary standards such as ISO 14001 and guidelines from the United Nations Sustainable Development Goals (SDGs) are being used to benchmark packaging sustainability. On the patient side, growing awareness of plastic waste and healthcare's carbon footprint is shifting preferences. Individuals increasingly expect recyclable, easy-to-dispose-of packaging - especially for at-home treatments, personal medical devices, and OTC drugs. Pharmaceutical brands are now incorporating QR codes and transparency features to educate users about disposal and recyclability, which also supports patient trust and loyalty. Hospitals and healthcare institutions are similarly adopting sustainable procurement criteria, prompting pharmaceutical companies to rethink the full lifecycle of their packaging. Sustainability is no longer an optional add-on - it is a growing expectation in both B2B and B2C pharma ecosystems.What's Driving the Accelerated Growth of the Sustainable Pharmaceutical Packaging Market?

The growth in the sustainable pharmaceutical packaging market is driven by several interconnected factors related to technology evolution, industry dynamics, end-user influence, and global policy momentum. Technological advances in recyclable barrier films, compostable biopolymers, and low-carbon materials are enabling packaging to meet pharmaceutical performance standards while reducing environmental impact. The rising demand for personalized medicine, home healthcare, and e-pharmacies is accelerating the need for modular, lightweight, and sustainable packaging that is user-friendly and compliant. In parallel, pharmaceutical companies are aligning sustainability goals with product development pipelines and packaging operations, often driven by ESG frameworks and pressure from institutional investors. Green building certifications for manufacturing facilities, Scope 3 emissions tracking, and circular supply chain initiatives are pushing packaging sustainability from the factory floor to the consumer's hands. Healthcare providers and pharmacies are increasingly selecting suppliers based on sustainable packaging credentials, often supported by lifecycle assessments and material certifications. Meanwhile, regulatory tailwinds - from EPR schemes and labeling mandates to carbon disclosure requirements - are reinforcing adoption across global markets. Finally, the integration of sustainability metrics into procurement, compliance, and brand strategy is solidifying the business case for greener packaging, making it a critical growth lever in the evolving pharmaceutical landscape.Report Scope

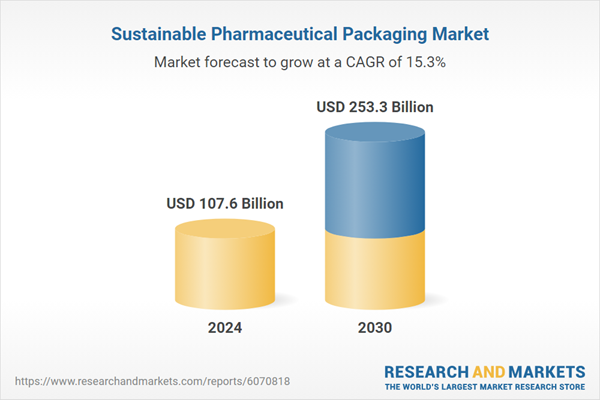

The report analyzes the Sustainable Pharmaceutical Packaging market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Material (Plastics, Paper & Paperboard, Glass, Metal); Process (Recyclable, Reusable, Biodegradable).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Plastics Material segment, which is expected to reach US$127.3 Billion by 2030 with a CAGR of a 17.4%. The Paper & Paperboard Material segment is also set to grow at 11.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $28.3 Billion in 2024, and China, forecasted to grow at an impressive 14.3% CAGR to reach $39 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Sustainable Pharmaceutical Packaging Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Sustainable Pharmaceutical Packaging Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Sustainable Pharmaceutical Packaging Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AptarGroup, Inc., ArcelorMittal, Brambles Limited, Braskem, Coca-Cola Consolidated and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Sustainable Pharmaceutical Packaging market report include:

- Amcor plc

- Ascend Packaging Systems

- Berry Global Inc.

- Bormioli Pharma S.p.A.

- CCL Healthcare

- Corning Incorporated

- Crown Holdings, Inc.

- Drug Plastics

- DS Smith

- Gerresheimer AG

- International Paper Company

- MM Board & Paper

- Mondi Group

- PGP Glass

- SGD Pharma

- Sharp Services

- Smurfit Kappa

- Sonoco Products Company

- Syntegon Technology GmbH

- Tetra Pak

- West Pharmaceutical Services, Inc.

- WestRock Company

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amcor plc

- Ascend Packaging Systems

- Berry Global Inc.

- Bormioli Pharma S.p.A.

- CCL Healthcare

- Corning Incorporated

- Crown Holdings, Inc.

- Drug Plastics

- DS Smith

- Gerresheimer AG

- International Paper Company

- MM Board & Paper

- Mondi Group

- PGP Glass

- SGD Pharma

- Sharp Services

- Smurfit Kappa

- Sonoco Products Company

- Syntegon Technology GmbH

- Tetra Pak

- West Pharmaceutical Services, Inc.

- WestRock Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 179 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 107.6 Billion |

| Forecasted Market Value ( USD | $ 253.3 Billion |

| Compound Annual Growth Rate | 15.3% |

| Regions Covered | Global |