Global Underwater Warfare Market - Key Trends & Drivers Summarized

Is the Subsea Domain Becoming the New Battleground for Global Naval Superiority?

As geopolitical tensions rise and maritime security takes center stage, underwater warfare is emerging as one of the most strategically important arenas in modern defense. The underwater warfare domain encompasses a range of capabilities including submarine combat, anti-submarine warfare (ASW), undersea surveillance, naval mine countermeasures, and unmanned underwater operations. Nations are increasingly recognizing the critical role that control of the subsea environment plays in achieving maritime dominance, securing trade routes, and protecting underwater infrastructure. Submarines, both nuclear and diesel-electric, remain the backbone of undersea combat, with navies across the globe investing heavily in next-generation stealth, propulsion, and weapons systems. Meanwhile, layered underwater defense systems - integrating sonar networks, acoustic sensors, and autonomous platforms - are being deployed to enhance situational awareness and force projection in contested waters. With growing threats to strategic assets such as undersea fiber optic cables and offshore energy platforms, countries are shifting focus from surface-based dominance to deep-sea superiority. This renewed emphasis on underwater warfare is fueling multi-billion-dollar procurement and R&D programs, positioning the subsea domain as a critical frontier in 21st-century defense strategy.Why Are Unmanned Systems and Autonomous Technologies Reshaping Subsea Combat Operations?

The rapid evolution of unmanned and autonomous systems is redefining how underwater warfare is conducted, offering new tactical capabilities while reducing risk to human life. Unmanned underwater vehicles (UUVs), including both remotely operated and fully autonomous platforms, are being widely adopted for missions such as mine detection, ISR (intelligence, surveillance, and reconnaissance), and anti-submarine operations. These platforms can operate for extended periods, access difficult terrain, and relay real-time data back to command centers - providing an operational advantage in both peacetime surveillance and active conflict. Advances in autonomy, propulsion efficiency, battery life, and underwater communication technologies are enabling swarming behaviors, coordinated mission execution, and more agile deployment strategies. Integration of UUVs with manned platforms - such as submarines and surface vessels - is enabling multi-domain operational synergy. Additionally, the use of artificial intelligence and machine learning for target recognition, navigation, and threat analysis is expanding the role of autonomous systems from support tools to active combat participants. These trends are not only transforming the tactical and operational landscape of underwater warfare but are also opening up significant procurement and innovation opportunities for defense contractors and technology firms specializing in subsea combat systems.Could Advancements in Underwater Surveillance and Weapon Systems Shift the Strategic Balance?

Breakthroughs in underwater surveillance and strike technologies are rapidly advancing the capabilities of modern navies and reshaping strategic deterrence models. Sophisticated sonar systems, including towed arrays, variable depth sonars, and passive acoustic sensors, are improving detection capabilities across deep and shallow waters. Coupled with AI-enhanced data processing, these systems can now identify, classify, and track stealthy submarines and UUVs with unprecedented accuracy. Simultaneously, next-generation torpedoes are being developed with advanced homing systems, longer ranges, and multi-target engagement capabilities. Naval mines are also being redesigned with intelligent sensors and programmable deployment features, enabling them to act as strategic deterrents and area denial tools. On the defensive side, decoys, acoustic countermeasures, and anti-torpedo systems are evolving to enhance survivability in hostile underwater environments. The increasing vulnerability of critical subsea infrastructure - such as communication cables and energy pipelines - is also driving investments in surveillance networks and rapid response systems. Many navies are building integrated undersea warfare networks that combine manned platforms, unmanned systems, and stationary sensors into a unified maritime operations grid. These advancements are shifting the underwater domain from a stealth-based tactical space to a contested, high-tech battlespace with major implications for global security and naval power dynamics.What Are the Key Forces Driving Growth in the Underwater Warfare Market?

The growth in the underwater warfare market is driven by several powerful and interconnected forces related to defense modernization, technological innovation, and evolving threat landscapes. One of the primary drivers is the increased defense spending by maritime powers - especially in Asia-Pacific, North America, and Europe - as they seek to secure strategic waterways and deter adversarial activity. Rising territorial disputes in regions like the South China Sea and the Arctic are accelerating naval procurement and deployment of underwater combat systems. The proliferation of submarines, both manned and unmanned, across emerging and established naval forces is expanding the market for ASW technologies and surveillance networks. Technological advances in sonar, communication, propulsion, and underwater autonomy are enabling more agile, stealthy, and mission-flexible platforms, driving upgrades and fleet expansions. In addition, the growing risk to undersea critical infrastructure, such as data cables and offshore energy assets, is prompting governments to prioritize subsea situational awareness and rapid response capabilities. Multinational joint exercises, naval alliances, and intelligence-sharing initiatives are also fueling cross-border demand for interoperable underwater warfare systems. Lastly, increased public and private sector collaboration, coupled with defense-industry investment in next-gen undersea platforms, is sustaining long-term innovation and growth in the global underwater warfare market.Report Scope

The report analyzes the Underwater Warfare market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: System (Sonar Systems, Electronic Warfare Systems, Weapons Systems, Communications Systems, Unmanned Systems); Platform (Submarine Platform, Surface Ship Platform, Naval Helicopter Platform); Capability (Attack Capability, Protect Capability, Support Capability).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Sonar Systems segment, which is expected to reach US$3.3 Billion by 2030 with a CAGR of a 10.3%. The Electronic Warfare Systems segment is also set to grow at 10.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.1 Billion in 2024, and China, forecasted to grow at an impressive 8.7% CAGR to reach $1.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Underwater Warfare Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Underwater Warfare Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Underwater Warfare Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Advanced Navigation, Amron International, Ceebus Technologies, Channel Technologies Group, C-Tecnics and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Underwater Warfare market report include:

- Abeking & Rasmussen GmbH & Co. KG

- ASELSAN A.S.

- Atlas Elektronik GmbH

- BAE Systems plc

- Boeing Company

- Curtiss-Wright Corporation

- ECA Group

- Elbit Systems Ltd.

- General Atomics Aeronautical Systems Inc.

- General Dynamics Corporation

- Harris Corporation

- Huntington Ingalls Industries

- Hydroid, LLC

- Israel Aerospace Industries

- Kongsberg Gruppen

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Naval Group

- Northrop Grumman Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abeking & Rasmussen GmbH & Co. KG

- ASELSAN A.S.

- Atlas Elektronik GmbH

- BAE Systems plc

- Boeing Company

- Curtiss-Wright Corporation

- ECA Group

- Elbit Systems Ltd.

- General Atomics Aeronautical Systems Inc.

- General Dynamics Corporation

- Harris Corporation

- Huntington Ingalls Industries

- Hydroid, LLC

- Israel Aerospace Industries

- Kongsberg Gruppen

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Naval Group

- Northrop Grumman Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 223 |

| Published | February 2026 |

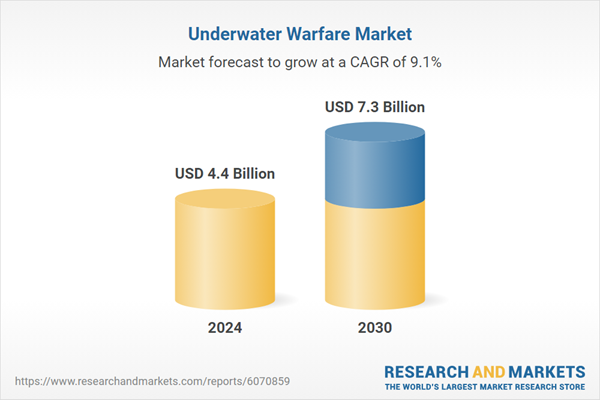

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.4 Billion |

| Forecasted Market Value ( USD | $ 7.3 Billion |

| Compound Annual Growth Rate | 9.1% |

| Regions Covered | Global |