Global Vehicles Intelligent Battery Sensor Market - Key Trends & Drivers Summarized

Why Are Intelligent Battery Sensors Becoming Essential in Modern Vehicles?

Intelligent Battery Sensors (IBS) have become a critical component in modern automotive systems, primarily due to the increasing demand for energy efficiency, predictive maintenance, and vehicle electrification. As vehicles become more electrified - whether fully electric, hybrid, or incorporating advanced driver assistance systems (ADAS) - the need for reliable and real-time battery monitoring has grown significantly. IBS devices continuously monitor key battery parameters such as voltage, current, temperature, and state of charge (SoC), allowing the vehicle's electronic control unit (ECU) to manage energy consumption more effectively. This is vital not only for ensuring smooth engine starts and consistent electrical supply but also for supporting stop-start systems, regenerative braking, and other energy-saving technologies. Moreover, consumers expect greater reliability and longer battery life, particularly in cold climates or high-demand urban driving conditions, which can be addressed through intelligent battery monitoring. Manufacturers are integrating IBS solutions as standard components to enhance overall vehicle performance, meet fuel efficiency regulations, and minimize warranty costs due to battery failures. These sensors also play a key role in enabling predictive diagnostics, which reduce the risk of vehicle downtime and improve customer satisfaction. As the vehicle's electrical load continues to increase, IBS is becoming indispensable in balancing power distribution and ensuring system reliability.How Is Technology Enhancing the Capabilities of Intelligent Battery Sensors?

Technological advancement is greatly expanding the functionality, precision, and integration capacity of intelligent battery sensors, making them more effective and versatile across a wide range of vehicle types. The latest IBS units combine high-precision shunt resistors with microcontrollers and CAN (Controller Area Network) or LIN (Local Interconnect Network) interfaces, allowing seamless communication with the vehicle's onboard computer systems. Enhanced sensor algorithms can now provide accurate real-time data on state of health (SoH), state of charge (SoC), and state of function (SoF), enabling smarter decision-making within energy management systems. Additionally, compact designs and improved thermal compensation allow these sensors to perform reliably in harsh automotive environments. The integration of machine learning and artificial intelligence (AI) is paving the way for adaptive diagnostics and early failure detection, enabling vehicles to predict battery degradation patterns and alert users before failure occurs. Advanced manufacturing techniques and sensor miniaturization are also reducing production costs, allowing OEMs to incorporate IBS into more mid-range and compact vehicle models. Moreover, developments in wireless IBS and cloud connectivity are enabling remote monitoring and fleet-wide battery health management - an essential feature for EV fleets, autonomous vehicles, and shared mobility services. This technological evolution is making IBS not only smarter but also more connected and proactive in contributing to overall vehicle intelligence.Why Are OEMs, Tier 1 Suppliers, and Fleet Operators Investing in IBS Technologies?

Automotive OEMs, Tier 1 suppliers, and fleet operators are increasingly investing in intelligent battery sensor technologies as part of their broader strategy to enhance vehicle efficiency, reduce emissions, and minimize unplanned downtime. For OEMs, integrating IBS into both internal combustion engine (ICE) vehicles and electrified platforms supports compliance with global fuel economy and emissions regulations, such as Euro 6/7 and CAFÉ standards. These sensors help optimize battery use in start-stop systems, hybrid powertrains, and 48V architectures, improving fuel savings and extending battery lifespan. Tier 1 suppliers are developing integrated IBS modules that combine sensing, control, and communication functions into a single, compact unit - simplifying system design and boosting compatibility across different platforms. For commercial fleet operators, intelligent battery sensors enable real-time battery diagnostics and predictive maintenance, which significantly reduces vehicle downtime, improves operational efficiency, and lowers total cost of ownership (TCO). In electric vehicles, where battery performance directly impacts driving range and safety, the role of IBS becomes even more critical. The ability to precisely monitor and manage battery health can also influence resale value, leasing models, and insurance assessments. As vehicle electrification becomes a dominant trend across global markets, IBS technologies are being prioritized as core enablers of smarter energy management and reliable mobility.What Factors Are Driving the Global Growth of the Vehicles Intelligent Battery Sensor Market?

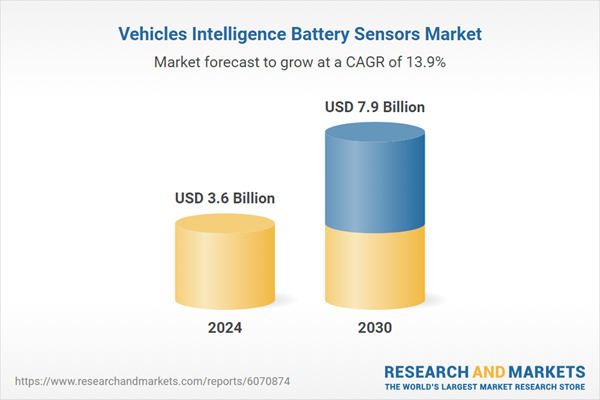

The growth in the vehicles intelligent battery sensor market is driven by several factors directly linked to automotive electrification, technological advancement, evolving vehicle architectures, and regulatory mandates. A major driver is the global shift toward hybrid and electric vehicles, where accurate battery monitoring is essential for performance, safety, and longevity. Increasing integration of start-stop and energy recovery systems in ICE and mild hybrid vehicles is also boosting demand for intelligent energy management tools like IBS. Stricter emissions and fuel economy regulations in regions such as Europe, North America, and Asia-Pacific are pushing automakers to adopt systems that optimize battery performance and reduce powertrain load. Advances in sensor technology, including more compact designs, multi-channel capabilities, and enhanced data processing, are enabling widespread adoption across vehicle segments - from economy to luxury. Additionally, rising consumer expectations for reliability, reduced maintenance, and digital diagnostics are encouraging manufacturers to include IBS as a standard feature. The rapid rise of fleet electrification and shared mobility services is further increasing demand for connected, cloud-based battery monitoring systems that ensure maximum uptime and efficiency. Growing collaboration between sensor manufacturers, OEMs, and software developers is leading to more integrated, scalable solutions. Collectively, these trends are propelling the intelligent battery sensor market into a high-growth trajectory as it becomes a foundational technology in the evolving landscape of intelligent and electrified mobility.Report Scope

The report analyzes the Vehicles Intelligence Battery Sensors market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Technology (Hall-Effect Sensor, MEMS Sensor, Optical Sensor); Application (Battery Management System, Start-Stop System, Regenerative Braking System, Others); End-Use (Passenger Cars, Commercial Vehicles).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Hall-Effect Sensor segment, which is expected to reach US$5.4 Billion by 2030 with a CAGR of a 15.3%. The MEMS Sensor segment is also set to grow at 10.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $947.6 Million in 2024, and China, forecasted to grow at an impressive 13% CAGR to reach $1.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Vehicles Intelligence Battery Sensors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Vehicles Intelligence Battery Sensors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Vehicles Intelligence Battery Sensors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AT&T Intellectual Property, Azuga, CalAmp Corporation, Cartrack, Continental AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 37 companies featured in this Vehicles Intelligence Battery Sensors market report include:

- Amphenol Corporation

- Ams-OSRAM AG

- Abertax Technologies Ltd.

- AVL List GmbH

- Continental AG

- Denso Corporation

- Furukawa Electric Co., Ltd.

- HELLA GmbH & Co. KGaA

- Hitachi Astemo, Ltd.

- Infineon Technologies AG

- inomatic GmbH

- Johnson Controls Inc.

- Microchip Technology Inc.

- MTA S.p.A

- NXP Semiconductors

- Robert Bosch GmbH

- STMicroelectronics

- TE Connectivity

- Texas Instruments Incorporated

- Vishay Intertechnology, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amphenol Corporation

- Ams-OSRAM AG

- Abertax Technologies Ltd.

- AVL List GmbH

- Continental AG

- Denso Corporation

- Furukawa Electric Co., Ltd.

- HELLA GmbH & Co. KGaA

- Hitachi Astemo, Ltd.

- Infineon Technologies AG

- inomatic GmbH

- Johnson Controls Inc.

- Microchip Technology Inc.

- MTA S.p.A

- NXP Semiconductors

- Robert Bosch GmbH

- STMicroelectronics

- TE Connectivity

- Texas Instruments Incorporated

- Vishay Intertechnology, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 169 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.6 Billion |

| Forecasted Market Value ( USD | $ 7.9 Billion |

| Compound Annual Growth Rate | 13.9% |

| Regions Covered | Global |