Global Commercial Flexible Electrical Conduits Market - Key Trends & Drivers Summarized

Why Are Flexible Electrical Conduits Becoming Essential in Commercial Wiring Systems?

Flexible electrical conduits are becoming an integral part of modern commercial wiring systems due to their ability to provide superior protection and adaptability in dynamic and high-movement environments. Unlike rigid conduits, flexible conduits allow for easy routing through tight spaces, making them ideal for commercial buildings, industrial plants, and smart infrastructure where complex electrical layouts are required. These conduits offer enhanced resistance to mechanical stress, vibrations, moisture, and chemical exposure, ensuring long-term reliability in challenging commercial applications. The demand for commercial flexible electrical conduits is rising as businesses prioritize space-saving electrical solutions that allow for quick modifications and expansion. With the growing adoption of automation, robotics, and smart electrical systems in commercial settings, flexible conduits are being used to protect high-frequency wiring and communication cables from interference and external damage. Additionally, the rise of prefabricated construction and modular commercial buildings is increasing the demand for flexible conduits, as they enable faster and more efficient electrical installations without extensive modifications to existing structures. Compliance with stringent fire safety and environmental regulations is also driving the adoption of halogen-free and low-smoke flexible conduits, particularly in industries such as healthcare, transportation, and data centers where fire-resistant wiring solutions are crucial.How Are Advancements in Material Technology and Smart Infrastructure Driving Market Growth?

The commercial flexible electrical conduit market is experiencing rapid technological advancements, with manufacturers focusing on developing high-performance materials that enhance flexibility, durability, and fire resistance. Innovations in polymer-based flexible conduits, such as thermoplastic elastomers (TPE) and polyamide-based conduits, are improving heat and chemical resistance while maintaining lightweight properties. The integration of smart conduit systems with embedded sensors is revolutionizing electrical infrastructure monitoring, enabling real-time detection of temperature fluctuations, mechanical stress, and potential failures. Additionally, the development of self-extinguishing and antimicrobial-coated flexible conduits is enhancing safety in medical facilities and food processing plants where hygiene and fire protection are critical concerns. The growing emphasis on sustainable construction is also driving the use of environmentally friendly, recyclable flexible conduit materials that comply with green building standards. As smart commercial buildings and Industry 4.0 applications continue to expand, the demand for intelligent, high-performance flexible conduits is expected to grow. Businesses are increasingly investing in flexible electrical conduit solutions that support the integration of renewable energy sources, energy-efficient lighting systems, and advanced automation technologies. With the continued evolution of commercial infrastructure and digital connectivity requirements, flexible electrical conduits are set to play a vital role in enabling safer, more efficient, and future-ready electrical installations.Report Scope

The report analyzes the Commercial Flexible Electrical Conduits market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Trade Size (½ to 1 Trade Size, 1 ¼ to 2 Trade Size, 2 ½ to 3 Trade Size, 3 to 4 Trade Size, 5 to 6 Trade Size, Other Trade Sizes); Configuration (Flexible Metallic Configuration, Liquid-Tight Flexible Metal Configuration, Flexible Metallic Tubing Configuration, Liquid-Tight Flexible Non-Metallic Configuration).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the ½ to 1 Trade Size Conduits segment, which is expected to reach US$248.5 Million by 2030 with a CAGR of a 8.1%. The 1 ¼ to 2 Trade Size Conduits segment is also set to grow at 6.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $173.4 Million in 2024, and China, forecasted to grow at an impressive 10.7% CAGR to reach $196.6 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Commercial Flexible Electrical Conduits Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Commercial Flexible Electrical Conduits Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Commercial Flexible Electrical Conduits Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as American Conduit, Anamet Electrical, Inc., Atkore International Group Inc., Calpipe Industries, Cantex Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Commercial Flexible Electrical Conduits market report include:

- American Conduit

- Anamet Electrical, Inc.

- Atkore International Group Inc.

- Calpipe Industries

- Cantex Inc.

- Champion Fiberglass

- Columbia-MBF

- Delikon

- Dura-Line Corporation

- Electri-Flex Company

- Heritage Plastics

- IPEX Inc.

- National Pipe & Plastics

- Nucor Tubular Products

- Prime Conduit, Inc.

- Republic Conduit

- Robroy Industries

- Southwire Company, LLC

- Thomas & Betts (ABB Installation Products Inc.)

- Wheatland Tube

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- American Conduit

- Anamet Electrical, Inc.

- Atkore International Group Inc.

- Calpipe Industries

- Cantex Inc.

- Champion Fiberglass

- Columbia-MBF

- Delikon

- Dura-Line Corporation

- Electri-Flex Company

- Heritage Plastics

- IPEX Inc.

- National Pipe & Plastics

- Nucor Tubular Products

- Prime Conduit, Inc.

- Republic Conduit

- Robroy Industries

- Southwire Company, LLC

- Thomas & Betts (ABB Installation Products Inc.)

- Wheatland Tube

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 297 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

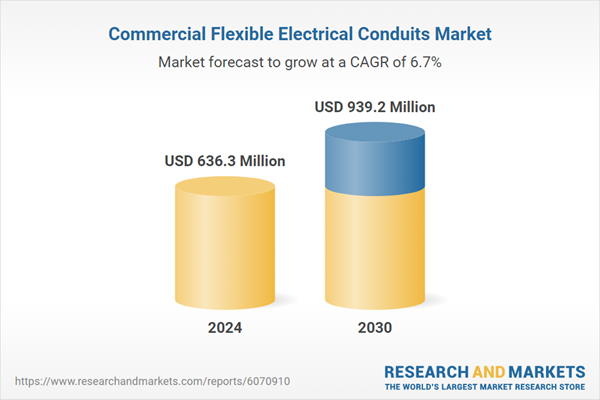

| Estimated Market Value ( USD | $ 636.3 Million |

| Forecasted Market Value ( USD | $ 939.2 Million |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |