Global Electric Vehicle Finance Market - Key Trends & Drivers Summarized

How Is Financing Evolving to Support the Growing Electric Vehicle Market?

The financing landscape for electric vehicles (EVs) is evolving rapidly as the global transition to electric mobility accelerates. As EVs are typically more expensive than traditional internal combustion engine (ICE) vehicles, innovative financing models are becoming critical to overcoming the affordability barrier for consumers and businesses. Traditional car loans and leases are being adapted to cater to the unique aspects of EV ownership, including longer vehicle lifecycles, battery warranties, and the availability of incentives. For consumers, government-backed subsidies and tax incentives are helping to offset the upfront cost of EVs, while private financial institutions are offering tailored loans and lease options with competitive interest rates. Additionally, the growing popularity of subscription models, where users pay a fixed monthly fee for vehicle access, is becoming increasingly common in urban areas. This model allows customers to avoid the large initial cost of purchasing an EV and provides the flexibility to upgrade to newer models as technology improves. On the commercial side, fleet operators are exploring tailored financing solutions for electric trucks, buses, and delivery vehicles, which include options for battery leasing, which separates the cost of the vehicle from the battery, providing a more affordable and flexible approach to fleet electrification.Are Government Incentives and Regulatory Policies Accelerating EV Financing?

Government policies and incentives are playing a pivotal role in shaping the electric vehicle finance market, creating an environment that supports the widespread adoption of EVs. Across the globe, governments are offering subsidies, rebates, and tax credits for the purchase of electric vehicles, which have significantly lowered the cost of ownership for consumers. In addition to direct financial incentives, many governments have implemented regulations that encourage or mandate the adoption of cleaner vehicles, such as emission reduction targets and low-emission zones in cities. These measures are driving demand for EVs and, consequently, spurring growth in financing options. In countries like Norway, China, and parts of the European Union, where EV adoption has reached significant levels, tax incentives and rebates have made EVs more affordable, resulting in strong market demand. For businesses, these regulations are creating opportunities to invest in EVs as part of sustainability initiatives or to comply with emissions targets, further enhancing the demand for financing solutions tailored to EV fleets. Additionally, governments are backing financial institutions with low-interest loans and credit guarantees to make EVs more accessible to a wider range of customers, particularly in regions where EV adoption is still emerging.How Are Financial Institutions Innovating in EV Financing Models?

Financial institutions are stepping up their innovation efforts to create financing products that meet the unique needs of electric vehicle buyers. Beyond traditional loans and leases, banks and specialized lenders are now offering new, flexible financing options that cater specifically to the EV market. One significant innovation is the concept of battery leasing, which allows consumers to lease the battery separately from the vehicle itself. This model helps reduce the upfront cost of the vehicle, as the battery is often one of the most expensive components. Additionally, financial institutions are adopting performance-based financing, where loans and leases are structured based on the EV’ s expected range, battery life, and long-term reliability, aligning payments with the vehicle’ s long-term value proposition. Digital platforms and fintech companies are also introducing peer-to-peer lending and crowdfunding opportunities, allowing individuals or small investors to directly fund EV purchases, further democratizing access to EVs. For businesses, financiers are designing tailored fleet financing solutions that include bundled maintenance, insurance, and charging infrastructure costs, providing a more comprehensive approach to managing the total cost of ownership. These innovative models are not only making EVs more accessible but also enhancing consumer confidence and fostering the growth of electric mobility.What Are the Key Drivers of Growth in the Electric Vehicle Finance Market?

The growth in the electric vehicle finance market is driven by several key factors, including technological advancements, shifting consumer behavior, and the global push toward sustainability. As EV technology continues to improve, with longer battery life, increased range, and reduced charging times, consumers are becoming more comfortable with the idea of owning an electric vehicle, which is in turn driving demand. Furthermore, as more affordable EV models enter the market, the potential customer base is widening, especially as middle-class consumers in emerging markets begin to consider EVs as a viable option. The expansion of charging infrastructure is another critical driver, addressing one of the main barriers to EV adoption - range anxiety. This growing network of charging stations further enhances the convenience and practicality of EV ownership. Financial institutions are responding to these changes by introducing more personalized and flexible financing solutions that meet the specific needs of a diverse customer base, including lower interest rates, more accessible terms, and greater availability of EV-specific financial products. Moreover, the ongoing efforts by governments to set stricter environmental regulations, such as carbon emissions reduction goals, are pushing businesses to invest in electric fleets, further driving demand for financing options tailored to fleet operators. Finally, growing consumer awareness and preference for environmentally responsible choices are influencing purchasing decisions, increasing the demand for EVs and supporting the growth of the electric vehicle finance market. These combined factors are creating a strong, sustainable market for EV financing that will continue to evolve as the electric vehicle industry matures.Report Scope

The report analyzes the Electric Vehicle Finance market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Financial Institution (Bank, Non-Banking Financial Company, Other Financial Institutions); Vehicle (Passenger Car, Commercial Vehicle, Two-Wheeler Vehicle, Three-Wheeler Vehicle).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Bank segment, which is expected to reach US$205.5 Billion by 2030 with a CAGR of a 34%. The Non-Banking Financial Company segment is also set to grow at 24.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $17.8 Billion in 2024, and China, forecasted to grow at an impressive 40.1% CAGR to reach $83.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Electric Vehicle Finance Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Electric Vehicle Finance Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Electric Vehicle Finance Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AISIN Corporation, Allison Transmission Holdings Inc., AVL List GmbH, BluE Nexus Corporation, BorgWarner Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Electric Vehicle Finance market report include:

- Ally Financial Inc.

- Bank of America Corporation

- BNP Paribas Personal Finance

- Capital One Auto Finance

- Citizens Financial Group, Inc.

- Crédit Agricole Consumer Finance

- Ford Credit

- Hitachi Capital Corporation

- Hyundai Capital Services Inc.

- JPMorgan Chase & Co.

- Nissan Motor Acceptance Corporation

- PNC Financial Services Group, Inc.

- RCI Banque (Mobilize Financial Services)

- Santander Consumer USA Holdings Inc.

- TD Auto Finance

- Tesla Finance

- Toyota Financial Services

- U.S. Bank

- Volkswagen Financial Services AG

- Wells Fargo & Company

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ally Financial Inc.

- Bank of America Corporation

- BNP Paribas Personal Finance

- Capital One Auto Finance

- Citizens Financial Group, Inc.

- Crédit Agricole Consumer Finance

- Ford Credit

- Hitachi Capital Corporation

- Hyundai Capital Services Inc.

- JPMorgan Chase & Co.

- Nissan Motor Acceptance Corporation

- PNC Financial Services Group, Inc.

- RCI Banque (Mobilize Financial Services)

- Santander Consumer USA Holdings Inc.

- TD Auto Finance

- Tesla Finance

- Toyota Financial Services

- U.S. Bank

- Volkswagen Financial Services AG

- Wells Fargo & Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 284 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

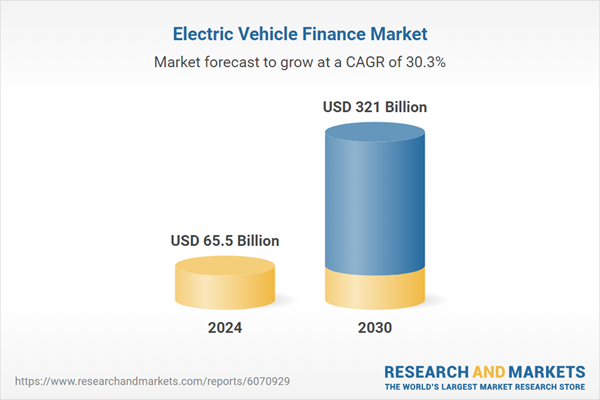

| Estimated Market Value ( USD | $ 65.5 Billion |

| Forecasted Market Value ( USD | $ 321 Billion |

| Compound Annual Growth Rate | 30.3% |

| Regions Covered | Global |