Global Protein-Fortified Food Products Market - Key Trends & Drivers Summarized

Why Are Consumers Increasingly Turning to Protein-Fortified Food Products?

The global demand for protein-fortified food products has surged dramatically, driven by changing dietary habits, increased health consciousness, and a growing emphasis on preventive nutrition. Consumers today are more aware of the role of protein in muscle growth, weight management, and overall well-being, leading to a rising preference for high-protein diets. This trend is especially prominent among fitness enthusiasts, athletes, and individuals following specialized diets such as keto, paleo, and plant-based nutrition. The food industry has responded by introducing a wide range of protein-enhanced products, including dairy-based beverages, plant-based protein bars, cereals, snacks, and meal replacements. The demand is not just limited to gym-goers; an increasing number of aging populations and individuals seeking better metabolic health are also incorporating protein-fortified foods into their daily diets. Functional foods infused with proteins derived from whey, soy, pea, and even emerging sources like insect proteins and algae are gaining momentum, offering consumers diverse options to meet their nutritional needs. The convenience factor also plays a crucial role, as protein-fortified products allow busy professionals and on-the-go consumers to meet their dietary requirements without compromising on taste or variety. As food manufacturers continue innovating with new formulations and protein blends, the landscape of fortified food products is expected to expand further, catering to a broader demographic.How Are Technological Advancements and Innovation Shaping the Market?

Technological advancements in food processing and ingredient formulation have significantly contributed to the growth of the protein-fortified food products market. The development of high-protein ingredients with enhanced solubility, taste, and texture has enabled food manufacturers to create more appealing and palatable fortified foods. Innovations in microencapsulation techniques have allowed better delivery of protein without altering the sensory experience of the final product, ensuring improved consumer acceptance. Additionally, plant-based protein sources have been optimized to mimic the taste and texture of traditional animal-based proteins, addressing concerns related to sustainability and ethical food production. The rise of clean-label trends and consumer preference for natural and minimally processed foods have also influenced manufacturers to explore novel protein sources such as chickpeas, lentils, fava beans, and hemp. Moreover, advancements in fermentation technologies have paved the way for precision fermentation-derived proteins, which are expected to be a game-changer in the fortified food space. As regulatory agencies impose stricter guidelines on labeling and health claims, companies are investing in scientific research to substantiate the benefits of protein fortification, ensuring compliance with international food safety standards. This trend is expected to drive further innovation in product development, making high-protein foods more accessible and diverse.How Are Changing Consumer Preferences Impacting Market Growth?

Consumer behavior has played a pivotal role in the evolution of the protein-fortified food products market. The shift toward personalized nutrition and the demand for functional foods that cater to specific health needs have created a competitive landscape where brands strive to offer unique value propositions. Millennials and Gen Z consumers, in particular, are prioritizing protein-enriched snacks and beverages that align with their active lifestyles and dietary preferences. Additionally, the rise of plant-based eating has fueled demand for alternative protein sources, leading to the proliferation of fortified plant-based dairy, meat substitutes, and bakery products. Consumers are also showing a preference for products that support gut health, cognitive function, and immune support, pushing manufacturers to explore multi-functional protein formulations that go beyond muscle-building benefits. Transparency and sustainability are also influencing purchasing decisions, with many consumers opting for brands that source their protein ingredients ethically and use eco-friendly packaging. The demand for clean, organic, and non-GMO protein sources has led to the growth of niche segments within the fortified food category. As e-commerce platforms continue to thrive, direct-to-consumer brands specializing in protein-fortified functional foods are gaining traction, leveraging digital marketing and influencer-driven campaigns to reach health-conscious consumers worldwide.What Are the Key Factors Driving the Global Protein-Fortified Food Products Market?

The growth in the global protein-fortified food products market is driven by several factors, including the increasing prevalence of protein deficiency, the growing demand for high-protein functional foods, and the rising adoption of plant-based nutrition. One of the most significant drivers is the expanding sports and fitness industry, where protein intake plays a crucial role in muscle recovery and athletic performance. Additionally, the aging population is contributing to market growth, as seniors seek protein-rich diets to maintain muscle mass and prevent age-related sarcopenia. The rapid urbanization and busy lifestyles of modern consumers have also led to a surge in demand for convenient, ready-to-eat protein-fortified snacks and beverages. Another critical factor is the expansion of the health and wellness industry, where dietary supplements and fortified foods are gaining widespread acceptance as preventive healthcare solutions. The increasing penetration of online retail channels has further accelerated market growth, allowing consumers to access a diverse range of protein-fortified products from different regions. The rise of personalized nutrition, enabled by advancements in nutrigenomics and AI-driven dietary recommendations, is also expected to shape the future of the market. Additionally, government initiatives promoting protein consumption as part of balanced diets, along with favorable regulatory frameworks supporting clean-label and high-protein claims, are driving innovation in the industry. The surge in investment in food-tech startups focusing on alternative protein sources, such as lab-grown proteins and mycoproteins, is also set to transform the protein-fortified food landscape. With increasing collaborations between food manufacturers, biotech firms, and research institutions, the market is poised for continuous growth, offering consumers a wider array of high-quality, sustainable, and nutritious protein-fortified options.Report Scope

The report analyzes the Protein-Fortified Food Products market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Nature (Organic, Conventional); Product (Bakery & Snacks Products, Protein Bars, RTD & RTM Beverages, Dairy & Dairy Alternatives, Meat & Meat Alternatives, Breakfast & Cereals Bars, Frozen & Refrigerated Foods, Baby Food & Infant Formula, Sports & Nutrition Supplements, Others); Distribution Channel (Supermarkets / Hypermarkets, Convenience Stores, Specialty Stores, Online, Others).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Some of the 42 companies featured in this Protein-Fortified Food Products market report include -

- Abbott Laboratories

- ADM (Archer Daniels Midland Company)

- Arla Foods Ingredients

- BASF SE

- Cargill Incorporated

- DuPont de Nemours, Inc.

- Essentia Protein Solutions

- General Mills, Inc.

- Glanbia PLC

- Herbalife Nutrition Ltd.

- Hexagon Nutrition

- Ingredion Incorporated

- Kerry Group

- Mondelez International Inc.

- Nestlé S.A.

- Novozymes

- PepsiCo Inc.

- Prinova Group LLC

- The Simply Good Foods Company

- WK Kellogg Co.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Organic Products segment, which is expected to reach US$57.1 Billion by 2030 with a CAGR of a 3.6%. The Conventional Products segment is also set to grow at 6.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $18.8 Billion in 2024, and China, forecasted to grow at an impressive 6.9% CAGR to reach $17.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Protein-Fortified Food Products Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Protein-Fortified Food Products Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Protein-Fortified Food Products Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abcam plc, Advanced Enzymes Technologies Ltd., Agilent Technologies Inc., Amano Enzyme Inc., Amicogen and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Select Competitors (Total 42 Featured):

- Abbott Laboratories

- ADM (Archer Daniels Midland Company)

- Arla Foods Ingredients

- BASF SE

- Cargill Incorporated

- DuPont de Nemours, Inc.

- Essentia Protein Solutions

- General Mills, Inc.

- Glanbia PLC

- Herbalife Nutrition Ltd.

- Hexagon Nutrition

- Ingredion Incorporated

- Kerry Group

- Mondelez International Inc.

- Nestlé S.A.

- Novozymes

- PepsiCo Inc.

- Prinova Group LLC

- The Simply Good Foods Company

- WK Kellogg Co.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories

- ADM (Archer Daniels Midland Company)

- Arla Foods Ingredients

- BASF SE

- Cargill Incorporated

- DuPont de Nemours, Inc.

- Essentia Protein Solutions

- General Mills, Inc.

- Glanbia PLC

- Herbalife Nutrition Ltd.

- Hexagon Nutrition

- Ingredion Incorporated

- Kerry Group

- Mondelez International Inc.

- Nestlé S.A.

- Novozymes

- PepsiCo Inc.

- Prinova Group LLC

- The Simply Good Foods Company

- WK Kellogg Co.

Table Information

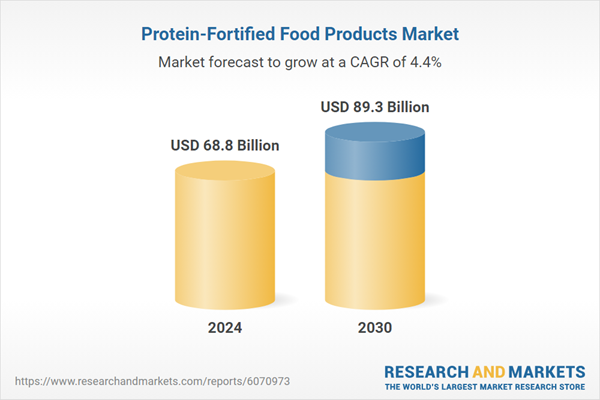

| Report Attribute | Details |

|---|---|

| No. of Pages | 399 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 68.8 Billion |

| Forecasted Market Value ( USD | $ 89.3 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |