Global Canned Alcoholic Beverages Market - Key Trends & Drivers Summarized

Why Are Consumers Cracking Open Cans Over Bottles? What’ s Driving The Shift?

Canned alcoholic beverages have exploded in popularity as modern consumers seek convenience, portability, and novelty in their drinking experiences. The rise of ready-to-drink (RTD) culture is challenging the dominance of traditional glass-packaged wine, beer, and spirits, particularly among younger demographics who prioritize ease of consumption, on-the-go formats, and sustainable packaging. Millennials and Gen Z are leading the charge, favoring single-serve, portion-controlled drinks that align with their fast-paced, health-conscious lifestyles. The pandemic further accelerated this trend, as at-home consumption surged and consumers embraced canned cocktails, spiked seltzers, and canned wines as alternatives to mixing or opening full bottles. The rise of casual social drinking in outdoor settings - like beaches, parks, and festivals - has made the portability of cans a huge asset. In parallel, the stigma once associated with canned drinks has all but vanished, replaced by a perception of modernity, innovation, and even craft authenticity. Premiumization within the format is also expanding, with artisan distilleries, craft breweries, and boutique wineries launching high-quality offerings in sleek, eye-catching cans. This shift is not merely aesthetic - it's driven by consumers demanding transparency, low-calorie options, clean-label ingredients, and flavor variety, all of which the canned format easily accommodates. As drinking becomes more personalized and occasion-based, canned alcoholic beverages are delivering on multiple fronts: quality, accessibility, environmental friendliness, and lifestyle alignment.How Is Innovation In Ingredients, Flavors, And Formulations Powering This Market?

The canned alcoholic beverage market is thriving on the back of relentless product innovation. What began with hard seltzers has expanded into a dynamic category that includes canned cocktails, canned wine, wine spritzers, sake, craft beer, hard kombucha, and even canned craft spirits. Brands are tapping into flavor experimentation to stand out - offering everything from blood orange margaritas and cucumber gin tonics to lavender-infused rosé and mango chili tequila. Many of these beverages are low in sugar, gluten-free, and made with organic or natural ingredients, which align with the health-forward preferences of modern consumers. The rise of functional alcohol - such as adaptogen-infused or electrolyte-enhanced drinks - is opening new premium segments. Meanwhile, alcohol by volume (ABV) is being tailored for micro occasions, with brands offering low-, mid-, and high-ABV variants to serve both casual and celebratory contexts. Advances in canning technology have also helped preserve carbonation, freshness, and taste integrity, making canned formats a viable option even for traditionally bottle-only drinks like prosecco or craft IPAs. Shelf stability and improved barrier linings ensure that flavor isn't compromised, while nitrogen-infused options are also gaining traction for smoother, creamier finishes. QR codes, interactive packaging, and AR-enabled labels are further driving consumer engagement and storytelling, helping brands differentiate in a crowded aisle. As consumer palates become more sophisticated, the ability to deliver craft-quality experiences in a can is fueling widespread adoption and repeat purchases across demographics.Where Is Demand Coming From, And How Are Channels Evolving?

Demand for canned alcoholic beverages is surging across multiple consumption occasions, retail channels, and customer segments. In the off-trade segment, supermarkets, convenience stores, and liquor retailers are aggressively expanding shelf space for RTDs, especially single-serve formats ideal for impulse purchases and trial. Online alcohol delivery platforms and e-commerce channels are also seeing strong growth, as the single-can or variety-pack model fits seamlessly into direct-to-consumer logistics. Subscription boxes, flash sales, and influencer-driven campaigns are helping new brands gain rapid traction. In the on-trade space, bars, hotels, airlines, and stadiums are incorporating canned options for faster service, portion control, and inventory management - particularly post-COVID, where hygiene and single-serve became priorities. Events, outdoor concerts, and sporting venues have become major volume drivers, as canned formats eliminate the need for glass bans and simplify beverage service. In tourism and hospitality, canned cocktails are appearing in minibars and room service menus as high-margin, low-prep options. The category’ s accessibility also appeals to underrepresented consumer groups: women are a key growth demographic, particularly for low-ABV and fruit-forward beverages. Older consumers seeking controlled portions and sugar-conscious choices are also embracing the format. The variety of price points - ranging from entry-level to super-premium - makes canned alcohol suitable for both mass-market and niche audiences. Global expansion is underway, with North America, Western Europe, and parts of Asia-Pacific witnessing surging interest, driven by changing drinking cultures, younger populations, and growing openness to new formats.What’ s Powering The Unstoppable Rise Of The Canned Alcoholic Beverage Market?

The growth in the canned alcoholic beverages market is driven by several factors related to evolving consumer preferences, product innovation, retail dynamics, and packaging technology. The shift toward convenience-led drinking and casual, occasion-based consumption is pushing consumers to prefer portable, resealable, and lightweight packaging formats like cans. The demand for low-calorie, low-sugar, and naturally flavored beverages is encouraging manufacturers to develop clean-label formulations that align with wellness-conscious lifestyles. Rapid flavor innovation, multi-serve variety packs, and limited-edition seasonal releases are driving consumer excitement and brand engagement. The availability of advanced canning technologies has enabled producers to offer high-quality preservation of aroma, taste, and carbonation, even for wine, cocktails, and craft brews. Retailers are prioritizing shelf space for single-serve and multi-pack canned formats due to their high turnover and ease of display. Alcohol e-commerce platforms are supporting the growth of direct-to-consumer brands with customizable shipments and rapid fulfillment models. The expanding role of canned beverages in foodservice, travel, and events is further driving volume growth, as operators benefit from portion control, labor reduction, and safety. Younger consumers’ openness to non-traditional formats and desire for novelty are accelerating product trial and category expansion. Additionally, increased focus on sustainability and recycling is making aluminum cans more appealing compared to glass or plastic. With convergence happening across traditional alcohol categories and functional ingredients, the canned format is emerging as a versatile platform for experimentation, premiumization, and market expansion.Report Scope

The report analyzes the Canned Alcoholic Beverages market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Canned Wines, Canned RTD Cocktails, Canned Hard Seltzers); Distribution channel (Liquor Stores Distribution Channel, On-Trade Distribution Channel, Online Distribution Channel).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Canned Wines segment, which is expected to reach US$76.1 Billion by 2030 with a CAGR of a 14.7%. The Canned RTD Cocktails segment is also set to grow at 11.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $18.8 Billion in 2024, and China, forecasted to grow at an impressive 17.3% CAGR to reach $30.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Canned Alcoholic Beverages Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Canned Alcoholic Beverages Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Canned Alcoholic Beverages Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AeroFarms, AG Glide, Agro Lighting, Bowery Farming, CubicFarm Systems Corp. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Canned Alcoholic Beverages market report include:

- Anheuser-Busch InBev

- Asahi Group Holdings, Ltd.

- Avery Brewing Company

- Bacardi Limited

- Brooklyn Brewery

- Brown-Forman Corporation

- CANarchy Craft Brewery Collective

- Carlsberg Group

- Constellation Brands

- Diageo plc

- E. & J. Gallo Winery

- Heineken N.V.

- Kirin Holdings Company Limited

- Kona Brewing Co.

- Molson Coors Beverage Company

- Pernod Ricard

- Stone Brewing Co.

- Suntory Holdings Limited

- The Boston Beer Company

- Treasury Wine Estates

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Anheuser-Busch InBev

- Asahi Group Holdings, Ltd.

- Avery Brewing Company

- Bacardi Limited

- Brooklyn Brewery

- Brown-Forman Corporation

- CANarchy Craft Brewery Collective

- Carlsberg Group

- Constellation Brands

- Diageo plc

- E. & J. Gallo Winery

- Heineken N.V.

- Kirin Holdings Company Limited

- Kona Brewing Co.

- Molson Coors Beverage Company

- Pernod Ricard

- Stone Brewing Co.

- Suntory Holdings Limited

- The Boston Beer Company

- Treasury Wine Estates

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 280 |

| Published | February 2026 |

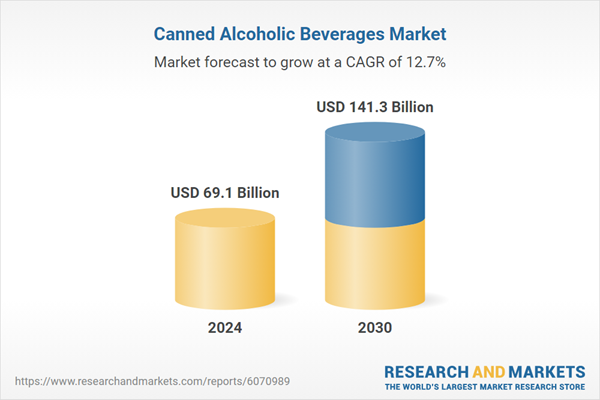

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 69.1 Billion |

| Forecasted Market Value ( USD | $ 141.3 Billion |

| Compound Annual Growth Rate | 12.7% |

| Regions Covered | Global |