Global Green Steel Market - Key Trends & Drivers Summarized

The green steel market is gaining momentum as the steel industry undergoes a paradigm shift toward carbon-neutral and environmentally responsible production methods. Traditional steelmaking is one of the most carbon-intensive industries, contributing nearly 8% of global CO2 emissions. Green steel, produced using low-carbon and renewable energy technologies, presents a transformative solution to decarbonizing the steel sector. Companies are increasingly adopting hydrogen-based direct reduced iron (DRI), electric arc furnace (EAF) technology, and carbon capture utilization and storage (CCUS) to minimize emissions and transition toward fossil-free steel production.A major trend influencing the green steel market is the rise of hydrogen-based steelmaking, where green hydrogen replaces coal in the reduction process. Leading steel manufacturers in Europe, Japan, and North America are investing in hydrogen DRI technology to achieve carbon neutrality. Additionally, the integration of renewable energy sources, such as wind and solar power, into electric arc furnace operations is reducing reliance on fossil fuels and improving sustainability in secondary steel production. The demand for green steel is also being propelled by regulatory pressure, corporate sustainability targets, and the increasing adoption of environmentally friendly materials across industries.

How Is Green Steel Reshaping Key Industries?

The automotive and construction sectors are at the forefront of green steel adoption, driven by stringent emissions targets and sustainability commitments. Automakers are increasingly sourcing low-carbon steel for vehicle production, aligning with the industry’ s transition to electric and hybrid vehicles. Companies such as Tesla, Volvo, and BMW are actively integrating green steel into their supply chains to minimize their environmental footprint and appeal to eco-conscious consumers.The construction industry is also witnessing a growing demand for green steel in sustainable infrastructure projects, green buildings, and energy-efficient structures. Developers and architects are prioritizing low-carbon materials to meet sustainability certifications such as LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method). Moreover, industries such as shipbuilding, consumer electronics, and renewable energy are incorporating green steel into turbines, structural components, and appliances to achieve their carbon reduction goals.

What Are the Latest Innovations & Technological Advancements in Green Steel?

Technological advancements in green steel production are revolutionizing the industry, with hydrogen-based reduction and renewable energy integration emerging as key enablers. One of the most promising innovations is the use of green hydrogen in direct reduction iron (DRI) processes, eliminating the need for coal and significantly reducing CO2 emissions. Major steel manufacturers are investing in pilot projects and large-scale hydrogen steel plants to accelerate this transition.Another major breakthrough is the development of carbon capture utilization and storage (CCUS) technology in traditional steel plants. By capturing and repurposing CO2 emissions, steelmakers can reduce their environmental impact while maintaining efficiency. Additionally, advancements in electric arc furnace (EAF) technology, powered by renewable energy, are making steel recycling more sustainable. The shift toward circular economy models, where scrap steel is efficiently reused and repurposed, is further enhancing the sustainability profile of green steel.

What Is Driving the Growth of the Green Steel Market?

The growth in the green steel market is driven by several factors, including stringent global emissions regulations, rising demand for sustainable construction materials, and increasing investments in hydrogen-based steel production. Governments worldwide are implementing policies and carbon pricing mechanisms to encourage the decarbonization of the steel industry. The European Union’ s Carbon Border Adjustment Mechanism (CBAM) and the U.S. Inflation Reduction Act are examples of initiatives promoting the transition to low-emission steel.Another critical growth driver is the commitment of major corporations to reduce their carbon footprint. Automotive, construction, and consumer goods manufacturers are setting ambitious net-zero targets, driving the demand for green steel in supply chains. Furthermore, the expansion of renewable energy projects, including wind and solar farms, is increasing the need for low-carbon steel in infrastructure development. With continued technological advancements, government incentives, and corporate sustainability initiatives, the green steel market is poised for substantial growth, reshaping the future of steel manufacturing.

Report Scope

The report analyzes the Green Steel market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Production Technology (Natural Gas DR, Electric Arc Furnace, Hydrogen-based DR); End-Use (Building & Construction End-Use, Automotive & Transportation End-Use, Electronics End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Natural Gas DR Production Technology segment, which is expected to reach US$558.5 Billion by 2030 with a CAGR of a 5.8%. The Electric Arc Furnace Production Technology segment is also set to grow at 4.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $189.9 Billion in 2024, and China, forecasted to grow at an impressive 9.3% CAGR to reach $199.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Green Steel Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Green Steel Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Green Steel Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Agrilectric Power, Amyris, Inc., AntenChem Co., Ltd., Blue Ocean Biotech, Brisil and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Green Steel market report include:

- ArcelorMittal

- Boston Metal

- CELSA Group

- China Baowu Steel Group Corporation Limited

- Emirates Steel Arkan

- H2 Green Steel

- JFE Steel Corporation

- JSW Steel

- Klöckner & Co

- Nippon Steel Corporation

- Nucor Corporation

- Outokumpu

- Ovako

- POSCO

- Salzgitter AG

- SSAB

- Tata Steel

- thyssenkrupp AG

- United States Steel Corporation

- voestalpine AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ArcelorMittal

- Boston Metal

- CELSA Group

- China Baowu Steel Group Corporation Limited

- Emirates Steel Arkan

- H2 Green Steel

- JFE Steel Corporation

- JSW Steel

- Klöckner & Co

- Nippon Steel Corporation

- Nucor Corporation

- Outokumpu

- Ovako

- POSCO

- Salzgitter AG

- SSAB

- Tata Steel

- thyssenkrupp AG

- United States Steel Corporation

- voestalpine AG

Table Information

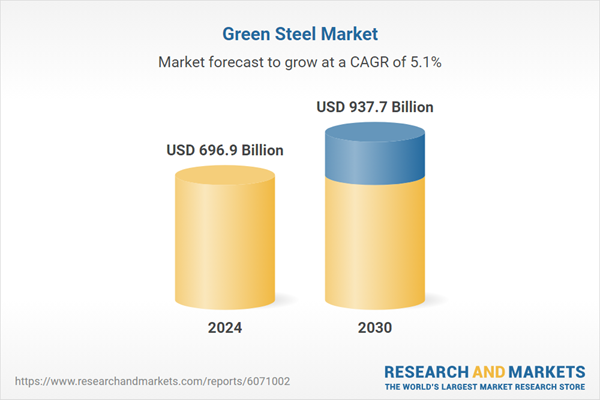

| Report Attribute | Details |

|---|---|

| No. of Pages | 282 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 696.9 Billion |

| Forecasted Market Value ( USD | $ 937.7 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |