Global Motorized Gas Insulated Smart Ring Main Unit Market - Key Trends & Drivers Summarized

Why Is the Motorized Gas Insulated Smart Ring Main Unit Gaining Widespread Adoption?

The motorized gas insulated smart ring main unit (RMU) has emerged as a crucial component in modern power distribution networks, revolutionizing the way utilities manage electricity distribution. Traditional RMUs, though widely used for secondary power distribution, faced challenges in terms of manual operation, maintenance complexity, and limited real-time monitoring capabilities. The advent of motorized gas insulated smart RMUs has addressed these limitations, offering automated and remotely controlled switching operations that enhance grid reliability and efficiency. These advanced RMUs integrate smart sensors, Internet of Things (IoT) technology, and SCADA (Supervisory Control and Data Acquisition) systems, allowing for real-time data monitoring and fault detection. As urbanization accelerates and power demand surges, utilities are increasingly adopting motorized gas insulated smart RMUs to optimize network performance, minimize downtime, and enhance operational efficiency. Their compact, gas-insulated design also provides superior insulation and arc fault protection, making them ideal for high-density urban environments where space constraints are a concern. The shift toward smart grid infrastructure and the increasing focus on energy automation have further fueled the adoption of motorized gas insulated RMUs, positioning them as a cornerstone of modern power distribution systems.How Is Technological Innovation Transforming the Functionality of Smart RMUs?

Technological advancements have played a pivotal role in enhancing the efficiency, intelligence, and reliability of motorized gas insulated smart RMUs. One of the most significant innovations has been the integration of remote monitoring and automation capabilities, allowing utilities to control switchgear operations from centralized control centers. Advanced communication protocols such as IEC 61850 and cloud-based analytics enable seamless data exchange, real-time diagnostics, and predictive maintenance, reducing the risk of unexpected outages. The implementation of artificial intelligence (AI) and machine learning (ML) algorithms further enhances RMU functionality by analyzing load patterns, predicting faults, and optimizing grid operations. Moreover, improvements in gas insulation technology, particularly the development of eco-friendly alternatives to SF6 gas, have enhanced the sustainability of these systems while maintaining their superior insulation properties. The adoption of digital twin technology has also transformed RMU maintenance, enabling utilities to simulate real-time operating conditions and proactively address issues before they lead to failures. Additionally, the incorporation of cybersecurity measures has strengthened grid security, mitigating risks associated with cyber threats and unauthorized access. As power grids become more complex and interconnected, the continued evolution of motorized gas insulated smart RMUs is expected to drive greater reliability, efficiency, and sustainability in electricity distribution networks.How Are Sustainability and Grid Modernization Influencing Market Trends?

Sustainability and grid modernization efforts are shaping the future of the motorized gas insulated smart RMU market, with utilities and governments prioritizing eco-friendly and efficient power distribution solutions. The transition toward renewable energy sources such as solar and wind has increased the need for intelligent RMUs capable of managing distributed energy resources (DERs) and ensuring grid stability. The growing push to reduce greenhouse gas emissions has also led to a shift away from traditional SF6-insulated RMUs toward environmentally friendly alternatives that use vacuum or solid-state insulation technologies. Additionally, the rise of microgrids and decentralized power distribution systems has fueled demand for smart RMUs that can seamlessly integrate renewable energy, battery storage, and demand-response mechanisms. Smart cities and industrial automation projects are further driving adoption, as these advanced RMUs support the real-time monitoring and fault detection capabilities necessary for efficient energy management. Governments worldwide are investing in grid modernization initiatives, providing incentives for utilities to deploy smart RMUs and upgrade aging infrastructure. With a growing emphasis on reducing carbon footprints and enhancing energy resilience, the role of motorized gas insulated smart RMUs in shaping future power grids continues to expand, driving both technological advancements and sustainable energy solutions.What Are the Key Growth Drivers of the Motorized Gas Insulated Smart RMU Market?

The growth in the motorized gas insulated smart RMU market is driven by several factors, including the increasing demand for smart grid infrastructure, the transition to renewable energy, and advancements in automation technology. The need for uninterrupted and efficient power distribution has led utilities to adopt smart RMUs that offer remote monitoring, fault isolation, and self-healing capabilities, reducing downtime and operational costs. The rapid urbanization and industrialization in emerging economies have further increased the demand for compact and high-performance switchgear solutions that can handle complex distribution networks. The expansion of renewable energy projects has also contributed to market growth, as utilities require smart RMUs to manage distributed energy resources and ensure grid stability. Additionally, the rise of digitalization in power utilities, coupled with investments in IoT-based smart distribution systems, has accelerated the deployment of intelligent RMUs equipped with predictive maintenance and real-time analytics features. The regulatory push for sustainable energy solutions has encouraged the development of SF6-free RMUs, offering environmentally friendly alternatives to conventional gas-insulated switchgear. Furthermore, the growing focus on cybersecurity and grid resilience has led to increased adoption of smart RMUs with advanced security features, protecting critical power infrastructure from cyber threats. As utilities continue to modernize power distribution networks, the motorized gas insulated smart RMU market is poised for sustained growth, driven by innovations in automation, sustainability, and digital intelligence.Report Scope

The report analyzes the Motorized Gas Insulated Smart Ring Main Unit market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Position (2-3-4 Position RMU, 5-6 Position RMU, 7-10 Position RMU, Other Positions); Application (Distribution Utilities Application, Infrastructure Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the 2-3-4 Position RMU segment, which is expected to reach US$659.2 Million by 2030 with a CAGR of a 5.6%. The 5-6 Position RMU segment is also set to grow at 4.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $262.6 Million in 2024, and China, forecasted to grow at an impressive 9.3% CAGR to reach $276.1 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Motorized Gas Insulated Smart Ring Main Unit Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Motorized Gas Insulated Smart Ring Main Unit Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Motorized Gas Insulated Smart Ring Main Unit Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ConMed Corporation, DePuy Synthes, Medtronic PLC, NuVasive, Inc., Smith & Nephew PLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Motorized Gas Insulated Smart Ring Main Unit market report include:

- ABB Ltd.

- Alfanar Group

- CG Power and Industrial Solutions Ltd.

- CHINT Group

- Eaton Corporation plc

- Entec Electric & Electronic Co., Ltd.

- EPE Switchgear (M) Sdn. Bhd

- G&W Electric Company

- General Electric Company

- Hitachi Energy Ltd.

- Larsen & Toubro Limited

- LS Electric Co., Ltd.

- Lucy Electric Ltd.

- Mitsubishi Electric Corporation

- NOJA Power Switchgear Pty Ltd

- Ormazabal

- Rockwill Electric Group

- Schneider Electric SE

- Siemens AG

- Toshiba Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Ltd.

- Alfanar Group

- CG Power and Industrial Solutions Ltd.

- CHINT Group

- Eaton Corporation plc

- Entec Electric & Electronic Co., Ltd.

- EPE Switchgear (M) Sdn. Bhd

- G&W Electric Company

- General Electric Company

- Hitachi Energy Ltd.

- Larsen & Toubro Limited

- LS Electric Co., Ltd.

- Lucy Electric Ltd.

- Mitsubishi Electric Corporation

- NOJA Power Switchgear Pty Ltd

- Ormazabal

- Rockwill Electric Group

- Schneider Electric SE

- Siemens AG

- Toshiba Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 204 |

| Published | January 2026 |

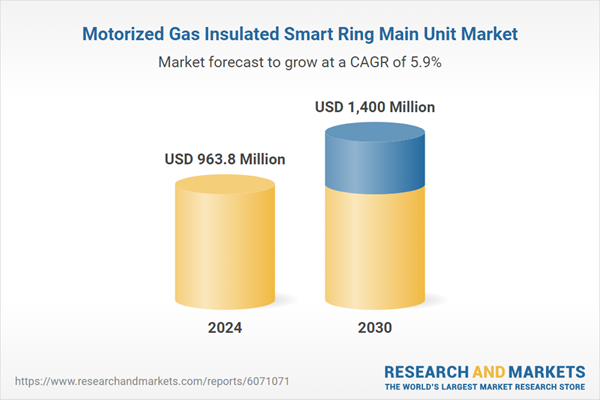

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 963.8 Million |

| Forecasted Market Value ( USD | $ 1400 Million |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |