Global Research Department Explosive Market - Key Trends & Drivers Summarized

Why Is Research Department Explosive (RDX) a Critical Component in Modern Defense and Industrial Applications?

Research Department Explosive (RDX), also known as cyclotrimethylene trinitramine, has been a cornerstone of military and industrial explosives due to its high explosive velocity, stability, and energy output. Initially developed during World War II, RDX remains widely used in military-grade munitions, including warheads, artillery shells, and missile systems, where precision and destructive efficiency are paramount. Beyond defense applications, RDX is also extensively utilized in civilian industries such as mining, construction, and demolition, where controlled explosions are necessary for large-scale excavation and infrastructure development. Its superior detonation characteristics make it a preferred choice for composite explosives and plastic-bonded formulations, offering greater versatility across applications. With increasing global defense expenditures and infrastructure development projects, the demand for RDX continues to grow, reinforcing its significance in both security and industrial operations.How Are Advancements in Explosive Formulations Improving the Performance and Safety of RDX?

The development of advanced explosive formulations has significantly enhanced the safety, efficiency, and precision of RDX-based applications. Researchers and defense manufacturers are investing in chemically stabilized RDX variants to minimize sensitivity to shock, friction, and heat, thereby reducing the risk of unintended detonation. The introduction of polymer-bonded explosives (PBX) that incorporate RDX with synthetic binders has further improved its stability while maintaining its high-energy output. Additionally, nanotechnology is playing a transformative role in explosive formulations, enabling the production of nano-RDX particles that enhance burn rate control, boost explosive efficiency, and lower toxicity levels. The integration of AI-driven detonation modeling is also refining blast impact assessments, optimizing the application of RDX in precision-guided munitions. As research in energetic materials advances, the role of RDX is evolving to meet modern safety and tactical requirements while ensuring minimal environmental impact.What Market Trends Are Shaping the Demand for RDX in Defense and Civilian Sectors?

The expansion of military modernization programs worldwide has been a major driver for RDX demand, with governments increasing investments in high-performance explosives for next-generation warfare and defense systems. The rise of asymmetric warfare and counterterrorism operations has further accelerated the need for sophisticated explosive technologies, reinforcing RDX's role in advanced munitions. Meanwhile, the mining and construction industries are experiencing a surge in infrastructure development projects, driving demand for high-energy explosives to facilitate efficient land excavation and tunneling operations. Additionally, the growing emphasis on eco-friendly explosives has led to research in biodegradable and low-emission RDX formulations, addressing environmental concerns without compromising performance. As defense and industrial sectors prioritize precision and efficiency, RDX continues to be a crucial element in explosive technology innovations.What Are the Key Growth Drivers of the Research Department Explosive Market?

The growth in the global Research Department Explosive (RDX) market is driven by several factors, including increased defense spending on advanced weaponry, rising infrastructure and mining activities, and technological advancements in explosive formulation. The expansion of aerospace and defense industries, particularly in emerging economies, has fueled demand for high-performance explosives, with RDX playing a critical role in tactical weapon systems. The surge in military modernization programs focusing on precision-guided explosives has further accelerated RDX production and procurement. Additionally, the growing emphasis on environmentally friendly explosives has led to the development of stabilized and low-toxicity RDX variants, expanding its adoption across industries. As governments and private sector players invest in research to enhance explosive efficiency and safety, the RDX market is poised for sustained growth, adapting to evolving defense and industrial requirements while maintaining its strategic importance in global security and engineering applications.Report Scope

The report analyzes the Research Department Explosives market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Application (Military, Civilian).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Some of the 41 companies featured in this Research Department Explosives market report include -

- Austin Powder Company

- BAE Systems

- Chemring Group PLC

- Chemring Nobel

- Dahana (Persero)

- Dyno Nobel

- Ensign-Bickford Aerospace & Defense

- EPC Groupe

- Eurenco

- Eurenco Bergerac

- Eurenco Bofors AB

- Explosia a.s.

- General Dynamics Ordnance and Tactical Systems

- Hanwha Corporation

- LSB Industries Inc.

- MAXAM Corp.

- Mil-Spec Industries Corporation

- NEXPLO Bofors AB

- Nitro-Chem S.A.

- NITRO-CHEM S.A.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Military Application segment, which is expected to reach US$6.1 Billion by 2030 with a CAGR of a 4%. The Civilian Application segment is also set to grow at 2.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2 Billion in 2024, and China, forecasted to grow at an impressive 3.3% CAGR to reach $1.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Research Department Explosives Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Research Department Explosives Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Research Department Explosives Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Akamai Technologies, Inc., Arctic Wolf Networks, Inc., Bitdefender LLC, Broadcom Inc., Check Point Software Technologies Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Select Competitors (Total 41 Featured):

- Austin Powder Company

- BAE Systems

- Chemring Group PLC

- Chemring Nobel

- Dahana (Persero)

- Dyno Nobel

- Ensign-Bickford Aerospace & Defense

- EPC Groupe

- Eurenco

- Eurenco Bergerac

- Eurenco Bofors AB

- Explosia a.s.

- General Dynamics Ordnance and Tactical Systems

- Hanwha Corporation

- LSB Industries Inc.

- MAXAM Corp.

- Mil-Spec Industries Corporation

- NEXPLO Bofors AB

- Nitro-Chem S.A.

- NITRO-CHEM S.A.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Austin Powder Company

- BAE Systems

- Chemring Group PLC

- Chemring Nobel

- Dahana (Persero)

- Dyno Nobel

- Ensign-Bickford Aerospace & Defense

- EPC Groupe

- Eurenco

- Eurenco Bergerac

- Eurenco Bofors AB

- Explosia a.s.

- General Dynamics Ordnance and Tactical Systems

- Hanwha Corporation

- LSB Industries Inc.

- MAXAM Corp.

- Mil-Spec Industries Corporation

- NEXPLO Bofors AB

- Nitro-Chem S.A.

- NITRO-CHEM S.A.

Table Information

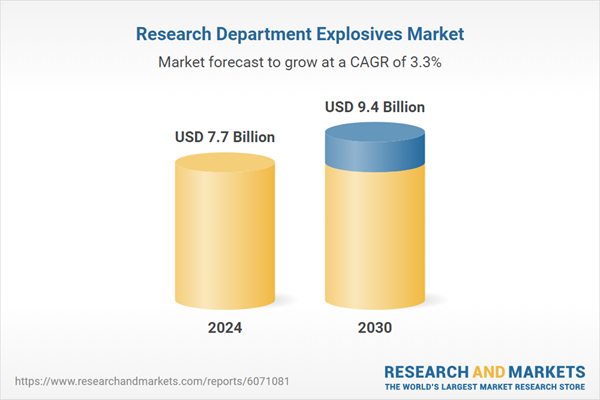

| Report Attribute | Details |

|---|---|

| No. of Pages | 125 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 7.7 Billion |

| Forecasted Market Value ( USD | $ 9.4 Billion |

| Compound Annual Growth Rate | 3.3% |

| Regions Covered | Global |