Global Crude Oil Transportation Market - Key Trends & Drivers Summarized

How Is the Crude Oil Transportation Industry Adapting to Global Supply Chain Dynamics?

Crude oil transportation is a critical component of the global energy supply chain, ensuring the seamless movement of raw petroleum from extraction sites to refineries and end markets. As geopolitical tensions, shifting trade policies, and fluctuating oil demand reshape global energy markets, crude oil transportation networks must continuously adapt to evolving conditions. The industry relies on a combination of pipelines, tankers, rail, and road transport to move crude oil efficiently across domestic and international markets. However, supply chain disruptions caused by conflicts, natural disasters, and regulatory changes often lead to fluctuations in crude oil transportation costs and transit times. For instance, the rerouting of shipments due to sanctions on Russian crude oil has significantly altered global trade flows, increasing reliance on alternative transport modes such as liquefied petroleum gas (LPG) carriers and expanding pipeline infrastructure. Similarly, pipeline projects like the Trans Mountain Expansion in Canada and the East African Crude Oil Pipeline (EACOP) in Africa are reshaping regional oil transportation capabilities. While the demand for crude oil remains high, the industry must navigate logistical challenges, regulatory hurdles, and environmental concerns to ensure stable supply chain operations in a rapidly changing global market.What Are the Key Modes of Crude Oil Transportation, and How Are They Evolving?

Crude oil is transported through four primary methods: pipelines, tankers, rail, and trucking, each offering distinct advantages depending on distance, cost, and regional infrastructure. Pipelines remain the most efficient and cost-effective means of transporting large volumes of crude oil over land, but their expansion faces significant regulatory and environmental opposition, particularly in North America and Europe. The increasing shift toward pipeline automation and leak detection technologies has improved efficiency and reduced environmental risks, ensuring safer transportation. On the maritime front, Very Large Crude Carriers (VLCCs) and Ultra Large Crude Carriers (ULCCs) dominate the international shipping of crude oil, with advancements in double-hull tanker designs and digital navigation systems enhancing operational safety. Rail transport has gained prominence in regions where pipeline infrastructure is lacking, particularly in North America, where crude-by-rail shipments have become an essential alternative for moving oil from production sites to refineries. Meanwhile, road transportation, though costlier and limited in capacity, plays a crucial role in short-distance crude oil movement, especially in landlocked regions. The industry is witnessing a transition toward more sustainable and technologically advanced solutions, such as digital tracking systems, AI-driven logistics optimization, and autonomous oil tankers, which are gradually transforming crude oil transportation into a more efficient and safer process.How Are Environmental and Regulatory Challenges Impacting Crude Oil Transport?

Environmental concerns and stringent regulations are reshaping the crude oil transportation landscape, compelling companies to adopt greener and more sustainable practices. Oil spills, pipeline leaks, and marine pollution have led to increased public scrutiny and tighter regulatory frameworks, such as the International Maritime Organization’ s (IMO) sulfur emission regulations and stricter pipeline safety standards in North America and Europe. The push for decarbonization is also driving innovations in crude oil transport, including the development of cleaner-burning ship fuels, electrified pipeline operations, and enhanced rail safety measures to reduce derailments and hazardous material spills. Additionally, carbon pricing policies and environmental impact assessments are increasing operational costs for oil transport companies, forcing them to invest in emissions reduction technologies and advanced spill response systems. Another emerging challenge is the shift toward renewable energy sources, which is influencing long-term demand projections for crude oil transportation infrastructure. While crude oil will remain a dominant energy source for decades, the industry must continuously adapt to evolving regulatory landscapes and environmental standards to maintain operational viability and ensure compliance with international safety protocols.What Is Driving the Growth of the Crude Oil Transportation Market?

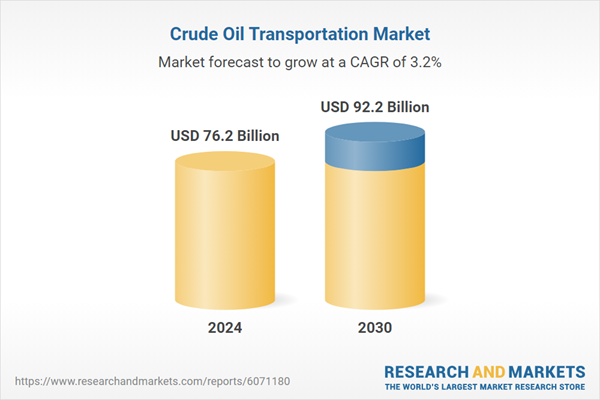

The growth in the crude oil transportation market is driven by several factors, including rising global energy demand, advancements in transportation technologies, and increasing investments in infrastructure development. The expansion of oil production in regions such as the Middle East, North America, and Africa is fueling the need for efficient transportation networks, leading to the construction of new pipelines and the expansion of shipping fleets. Additionally, the adoption of digital supply chain solutions, including blockchain-based cargo tracking, AI-driven route optimization, and predictive maintenance systems, is improving operational efficiency and reducing transit times. The increasing use of liquefied natural gas (LNG) as a marine fuel is also transforming the crude oil tanker segment, as shipowners seek to comply with stringent emission regulations. Moreover, the integration of automated systems in pipeline monitoring and rail transport is enhancing safety and reducing environmental risks. The growing importance of oil exports from emerging economies is further driving the demand for cross-border transportation solutions, necessitating investments in port expansions and logistics infrastructure. As technology continues to evolve, the crude oil transportation market is poised for sustained growth, adapting to changing trade patterns, regulatory landscapes, and energy sector transformations.Report Scope

The report analyzes the Crude Oil Transportation market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Transportation Mode (Pipeline Transportation, Marine (Tankers) Transportation, Railways Transportation, Truck Transportation); Transportation Destination (International Transportation, Domestic Transportation).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Pipeline Transportation segment, which is expected to reach US$49.7 Billion by 2030 with a CAGR of a 4.1%. The Marine (Tankers) Transportation segment is also set to grow at 2.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $20.7 Billion in 2024, and China, forecasted to grow at an impressive 6.2% CAGR to reach $18.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Crude Oil Transportation Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Crude Oil Transportation Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Crude Oil Transportation Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Acros Organics, Actylis, Alfa Aesar, Avantor, Capot Chemical Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Crude Oil Transportation market report include:

- BP plc

- Chevron Corporation

- China National Petroleum Corporation (CNPC)

- Enbridge Inc.

- Enterprise Products Partners L.P.

- ExxonMobil

- Kinder Morgan, Inc.

- Marathon Petroleum Corporation

- MOL Group

- ONEOK, Inc.

- Petrobras

- Phillips 66

- Plains All American Pipeline, L.P.

- Saudi Aramco

- Shell plc

- Sinopec (China Petroleum & Chemical Corp.)

- TC Energy Corporation

- Transneft

- Valero Energy Corporation

- Williams Companies, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BP plc

- Chevron Corporation

- China National Petroleum Corporation (CNPC)

- Enbridge Inc.

- Enterprise Products Partners L.P.

- ExxonMobil

- Kinder Morgan, Inc.

- Marathon Petroleum Corporation

- MOL Group

- ONEOK, Inc.

- Petrobras

- Phillips 66

- Plains All American Pipeline, L.P.

- Saudi Aramco

- Shell plc

- Sinopec (China Petroleum & Chemical Corp.)

- TC Energy Corporation

- Transneft

- Valero Energy Corporation

- Williams Companies, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 279 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 76.2 Billion |

| Forecasted Market Value ( USD | $ 92.2 Billion |

| Compound Annual Growth Rate | 3.2% |

| Regions Covered | Global |