Global Piperidine Market - Key Trends & Drivers Summarized

The piperidine market is experiencing steady growth, driven by its expanding use in pharmaceuticals, agrochemicals, rubber processing, and chemical synthesis. Piperidine, a heterocyclic organic compound (C5H10NH), is widely used as a solvent, catalyst, and chemical intermediate in various industrial applications. With increasing pharmaceutical and pesticide production, the demand for high-purity piperidine derivatives is rising, particularly in active pharmaceutical ingredient (API) synthesis, crop protection chemicals, and polymer additives.One of the most significant trends shaping the piperidine market is its growing role in pharmaceutical research and drug development. Piperidine and its derivatives serve as key building blocks in the synthesis of antidepressants, antipsychotics, muscle relaxants, and antiviral drugs. With the rise in chronic diseases, mental health disorders, and infectious diseases, pharmaceutical companies are investing in piperidine-based drug formulations, increasing market demand. Additionally, continuous R&D in oncology and neurological disorders is driving the adoption of piperidine-containing drug candidates, further boosting its consumption.

Another major driver is the expanding use of piperidine in the agrochemical sector. Piperidine-based compounds are extensively used in pesticides, herbicides, and fungicides, ensuring higher crop yields and pest resistance. With the global population growth and rising food demand, the agricultural industry is adopting advanced crop protection solutions, increasing the demand for piperidine-derived agrochemicals. Additionally, regulatory approval of piperidine-based insecticides and herbicides in key agricultural markets, including the U.S., Europe, and China, is fueling market expansion.

Furthermore, rising applications in polymer and rubber industries are influencing piperidine demand. Piperidine acts as a catalyst and chain extender in polyurethane foam manufacturing, which is widely used in automotive interiors, furniture, and construction materials. The global expansion of the automotive and construction sectors is driving demand for durable, lightweight materials, positioning piperidine-based additives as essential components in polymer and rubber processing.

How Are Pharmaceuticals and Agrochemicals Driving the Piperidine Market?

The pharmaceutical industry is one of the largest consumers of piperidine and its derivatives, with applications in drug synthesis, formulation research, and medicinal chemistry. Piperidine-based compounds serve as key intermediates in producing cardiovascular drugs, analgesics, anti-cancer agents, and antimalarial medications. As pharmaceutical companies continue to develop next-generation drugs, the need for high-purity and functionalized piperidine derivatives is increasing.Another rapidly growing application is in central nervous system (CNS) drugs, where piperidine moieties enhance drug bioavailability and receptor binding efficiency. Many antidepressants, opioid antagonists, and Parkinson's disease treatments contain piperidine-based structures, making them essential for neurological drug development. Additionally, antiviral research, particularly in COVID-19 and emerging infectious diseases, has increased the exploration of piperidine-containing antiviral compounds, further expanding its pharmaceutical applications.

The agrochemical industry is another key growth driver, with piperidine derivatives playing a crucial role in modern pesticide formulations. Piperidine-based insecticides, such as piperdyl-based neonicotinoids, provide high efficacy against crop-damaging pests while maintaining low environmental impact. Additionally, herbicides containing piperidine rings are widely used to control weed growth and improve crop yields, particularly in corn, soybean, and wheat cultivation.

With growing concerns over food security, climate change, and pesticide resistance, the demand for novel, high-performance agrochemicals is increasing. As a result, major agrochemical companies are investing in piperidine-based research to develop next-generation biopesticides and sustainable crop protection solutions.

What Role Does Piperidine Play in Polymer & Specialty Chemical Applications?

Beyond pharmaceuticals and agrochemicals, piperidine is widely used in polymer and specialty chemical industries for catalysis, stabilization, and performance enhancement.One of its major applications is in polyurethane production, where piperidine derivatives act as chain extenders and catalysts in foam manufacturing. With rising demand for flexible and rigid foams in automotive, furniture, and insulation materials, piperidine-based additives are critical for enhancing foam durability, resilience, and thermal stability.

The rubber processing industry also relies on piperidine as a vulcanization accelerator and curing agent. By improving the cross-linking efficiency of rubber compounds, piperidine helps enhance elasticity, heat resistance, and wear properties in tires, conveyor belts, and industrial rubber components. As global demand for high-performance rubber products continues to rise, piperidine-modified rubber formulations are gaining commercial significance.

Additionally, piperidine is used as a key precursor in specialty chemical synthesis, including corrosion inhibitors, surfactants, and catalysts. In the oil & gas sector, piperidine-based corrosion inhibitors help prevent pipeline degradation, improving operational efficiency in offshore and refinery applications. Similarly, in industrial coatings and adhesives, piperidine derivatives contribute to chemical resistance, adhesion, and longevity, further expanding market opportunities.

What Are the Key Factors Driving the Growth of the Piperidine Market?

The growth in the piperidine market is driven by several factors, including expanding pharmaceutical and agrochemical production, increasing polymer industry applications, and rising demand for high-performance specialty chemicals. As global healthcare and agricultural sectors advance, the need for piperidine-based intermediates and formulations continues to rise.One of the primary growth drivers is the expansion of pharmaceutical manufacturing, particularly in emerging markets. Countries such as India, China, and Brazil are witnessing rapid drug production growth, supported by government initiatives, generic drug approvals, and increasing R&D investments. This is fueling the demand for piperidine-based pharmaceutical intermediates, positioning it as a high-value raw material in the drug development pipeline.

Another key factor is the rising global demand for high-efficiency pesticides and herbicides. As climate change impacts crop yields and pest resistance increases, farmers are seeking advanced chemical solutions to improve agricultural productivity. Piperidine's role in next-generation pesticide formulations makes it a crucial component in sustainable farming and food security initiatives.

The growth of the automotive and construction industries is also contributing to increased demand for polyurethane foams, rubber additives, and high-performance coatings, where piperidine derivatives play a crucial role. With automakers shifting toward lightweight materials and energy-efficient designs, the need for piperidine-based catalysts and stabilizers in polymer processing is expected to grow.

Additionally, regulatory policies and environmental concerns are shaping the piperidine market. Manufacturers are investing in greener production methods, renewable feedstocks, and eco-friendly synthesis routes to align with sustainability goals and chemical safety regulations. The development of low-toxicity, biodegradable piperidine derivatives is emerging as a key trend in the specialty chemicals and pharmaceutical industries.

As industries continue to seek high-performance, sustainable chemical solutions, the piperidine market is poised for steady growth. Companies that invest in innovative applications, advanced synthesis techniques, and strategic supply chain expansion will be well-positioned to capitalize on the rising demand for piperidine-based compounds across pharmaceuticals, agrochemicals, and specialty polymers.

Report Scope

The report analyzes the Piperidine market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (99% Purity Piperidine, 98% Purity Piperidine); End-Use (Pharmaceuticals End-Use, Agrochemicals End-Use, Rubber End-Use, & Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the 99% Purity Piperidine segment, which is expected to reach US$71.9 Million by 2030 with a CAGR of a 7.1%. The 98% Purity Piperidine segment is also set to grow at 4.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $20.4 Million in 2024, and China, forecasted to grow at an impressive 5.8% CAGR to reach $17.6 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Piperidine Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Piperidine Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Piperidine Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

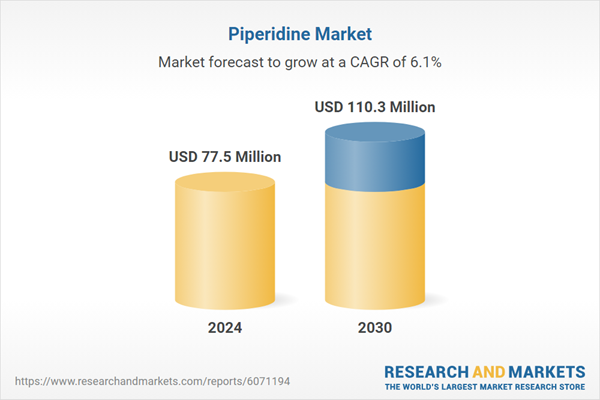

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alfa Aesar (a Thermo Fisher Scientific brand), Allchem Lifescience Pvt. Ltd., Avantor Inc., BASF SE, BOC Sciences and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Piperidine market report include:

- Alfa Aesar (a Thermo Fisher Scientific brand)

- Allchem Lifescience Pvt. Ltd.

- Avantor Inc.

- BASF SE

- BOC Sciences

- Catapharma

- Corey Organics

- Jubilant Ingrevia Limited

- Junsei Chemical Co., Ltd.

- Koei Chemical Co., Ltd.

- Lanxess AG

- Merck KGaA

- Parchem - fine & specialty chemicals

- Robinson Brothers

- Simson Pharma Limited

- Taj Pharmaceuticals Ltd.

- Toronto Research Chemicals

- Vasudha Pharma Chem Limited

- Vertellus

- Watanabe Chemical Industries, Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alfa Aesar (a Thermo Fisher Scientific brand)

- Allchem Lifescience Pvt. Ltd.

- Avantor Inc.

- BASF SE

- BOC Sciences

- Catapharma

- Corey Organics

- Jubilant Ingrevia Limited

- Junsei Chemical Co., Ltd.

- Koei Chemical Co., Ltd.

- Lanxess AG

- Merck KGaA

- Parchem – fine & specialty chemicals

- Robinson Brothers

- Simson Pharma Limited

- Taj Pharmaceuticals Ltd.

- Toronto Research Chemicals

- Vasudha Pharma Chem Limited

- Vertellus

- Watanabe Chemical Industries, Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 136 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 77.5 Million |

| Forecasted Market Value ( USD | $ 110.3 Million |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |