Global Citrus Extracts Market - Key Trends & Drivers Summarized

What’ s Driving the Growing Prominence of Citrus Extracts in Modern Ingredient Ecosystems?

Citrus extracts, derived from various components of citrus fruits such as peels, rinds, seeds, and pulp, are becoming increasingly vital in global ingredient systems spanning food and beverage, cosmetics, pharmaceuticals, and nutraceuticals. Their appeal lies in their high concentration of bioactive compounds, including flavonoids, terpenes, limonoids, citric acid, and essential oils, which offer both functional and therapeutic benefits. As consumers shift toward natural, plant-based, and multi-functional ingredients, citrus extracts are gaining prominence for their antimicrobial, antioxidant, anti-inflammatory, and flavor-enhancing properties. Unlike synthetic additives, citrus extracts are perceived as clean and authentic - attributes that are central to evolving consumer values. In food and beverage products, they serve dual roles: as flavor enhancers and natural preservatives, contributing to shelf stability while improving taste profiles. In the pharmaceutical space, their bioactive compounds are being explored for applications in immunity support, anti-cancer properties, and cardiovascular health. Additionally, in cosmetic and personal care formulations, citrus extracts are increasingly used for skin-brightening, collagen support, and oil-balancing functions. The adaptability of citrus extracts across such a wide range of industries makes them a cornerstone of future-focused ingredient innovation, and their alignment with clean-label product development ensures long-term growth potential across global markets.How Are Clean Label Trends and Functional Health Needs Expanding Citrus Extract Applications?

The surge in clean label product demand has significantly influenced how citrus extracts are being integrated into formulations across multiple categories. Modern consumers are more label-conscious than ever, seeking products made with fewer ingredients, clear sourcing transparency, and functional benefits derived from nature. Citrus extracts tick all these boxes, offering a recognizable, multi-benefit ingredient that supports label simplification while delivering enhanced product performance. In beverages, citrus extracts are being utilized not only for flavor modulation but also for delivering added health benefits in detox waters, energy drinks, herbal teas, and immune-boosting shots. They help achieve a fresh, tangy taste profile while supporting claims such as “ naturally preserved,” “ with real fruit extract,” or “ plant-powered.” In food products, they are replacing synthetic preservatives and flavoring agents, improving consumer trust and product positioning. Additionally, the rise in demand for natural oral care and cosmetic products has opened up new market avenues for citrus extracts in formulations for toothpaste, mouthwashes, facial cleansers, and shampoos. In this space, the extracts are valued for their antibacterial, clarifying, and toning properties. The integration of citrus extracts into “ beauty-from-within” supplements is also growing, where they contribute to formulations aimed at skin health and anti-aging. These versatile use cases, driven by clean label imperatives and functional wellness demands, are expanding the commercial scope of citrus extracts far beyond their traditional roles.Is Innovation in Extraction and Standardization Enhancing Product Efficacy and Market Viability?

Rapid technological innovation in extraction and processing is redefining the value and potential of citrus extracts in commercial applications. Advancements in cold-pressing, solvent-free extraction, ultrasonic-assisted extraction, and supercritical CO2 methods are allowing producers to isolate specific bioactives with greater purity, consistency, and potency. These methods ensure minimal degradation of sensitive phytochemicals, improving both the sensory quality and efficacy of the final extract. Standardization of citrus extracts - particularly in terms of flavonoid content (like hesperidin, naringin, and limonin) and terpene profiles - is playing a critical role in establishing quality benchmarks for use in regulated industries such as pharmaceuticals and nutraceuticals. Manufacturers are also investing in water-soluble, encapsulated, and nano-emulsified forms of citrus extracts to improve solubility, stability, and bioavailability in different product formats. Such innovations are expanding the application potential of citrus extracts in ready-to-drink beverages, gummies, capsules, powders, and even functional confectionery. Furthermore, the integration of citrus extracts into hybrid ingredient solutions - blended with adaptogens, herbal extracts, or vitamins - is facilitating product diversification and meeting rising demand for multifunctional formulations. These technological advancements are not only improving the performance of citrus extracts but also enhancing their scalability, making them more accessible to manufacturers across small, mid-size, and large enterprises. As companies increasingly seek high-performance, natural alternatives to synthetic ingredients, citrus extracts - powered by innovation - are becoming the gold standard in functional ingredient systems.What’ s Fueling the Rapid Growth of the Global Citrus Extracts Market?

The growth in the citrus extracts market is driven by several factors directly linked to evolving industry demands, consumer preferences, technological innovation, and product formulation trends. One of the key drivers is the rising global appetite for natural functional ingredients that deliver health benefits while enhancing flavor and sensory experience. As clean-label positioning becomes a competitive differentiator, food and beverage companies are increasingly replacing synthetic additives with citrus extracts that offer dual utility as both flavor and functionality agents. The expanding wellness and immunity-support markets are also contributing to the uptake of citrus extracts, as consumers actively seek out botanicals with antioxidant and immune-enhancing properties. In parallel, demand from the personal care industry - fueled by interest in natural skincare, sulfate-free haircare, and botanical-infused grooming products - is broadening the extract’ s reach beyond food and pharma. The growth of plant-based, vegan, and allergen-free product categories is also creating new spaces for citrus extracts to thrive, especially in applications where consumers want natural taste, aroma, and active compounds without synthetic components. On the supply side, improved extraction yields, standardized active content, and scalable sourcing from citrus waste streams are helping manufacturers maintain cost-efficiency and sustainability credentials. Moreover, regulatory acceptance of citrus bioactives and global movement toward natural preservatives and GRAS ingredients are reducing market barriers and facilitating adoption across multiple regions. Digital commerce channels, private label innovations, and D2C health brands are accelerating consumer access to citrus extract-infused products, thereby enhancing market penetration. Together, these factors are powering a strong and sustained growth trajectory for citrus extracts, cementing their role as one of the most dynamic and high-potential categories in the global natural ingredient market landscape.Report Scope

The report analyzes the Citrus Extracts market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Extract Type (Orange Extracts, Lemon Extracts, Lime Extracts, Grapefruit Extracts, Other Extracts); Application (Carbonated Soft Drinks Application, Fruit Beverages Application, Food Application, Sports and Energy Drinks Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Orange Extracts segment, which is expected to reach US$4.1 Billion by 2030 with a CAGR of a 3.5%. The Lemon Extracts segment is also set to grow at 3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.2 Billion in 2024, and China, forecasted to grow at an impressive 5.8% CAGR to reach $1.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Citrus Extracts Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Citrus Extracts Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Citrus Extracts Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Archer Daniels Midland Company (ADM), Cargill Incorporated, Citromax Flavors Inc., Citrosuco S.A., Cutrale and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Citrus Extracts market report include:

- Bontoux S.A.S.

- Botanic Healthcare

- Citromax Flavors Inc.

- Citrus and Allied Essences Ltd.

- Citrus Extracts LLC

- Citrus Oleo

- Crodarom SA

- Global Essence

- Green Chem

- Henry Lamotte Oils GmbH

- Hunan Huacheng Biotech Inc.

- Kerry Group

- Lionel Hitchen Essential Oils Ltd.

- Mountain Rose Herbs

- Plantae Extracts Private Limited

- Qingdao VNI BioScience Co., Ltd.

- Symrise AG

- Ultra International B.V.

- XENA Bio Herbals Private Limited

- Young Living Essential Oils LC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Bontoux S.A.S.

- Botanic Healthcare

- Citromax Flavors Inc.

- Citrus and Allied Essences Ltd.

- Citrus Extracts LLC

- Citrus Oleo

- Crodarom SA

- Global Essence

- Green Chem

- Henry Lamotte Oils GmbH

- Hunan Huacheng Biotech Inc.

- Kerry Group

- Lionel Hitchen Essential Oils Ltd.

- Mountain Rose Herbs

- Plantae Extracts Private Limited

- Qingdao VNI BioScience Co., Ltd.

- Symrise AG

- Ultra International B.V.

- XENA Bio Herbals Private Limited

- Young Living Essential Oils LC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 281 |

| Published | February 2026 |

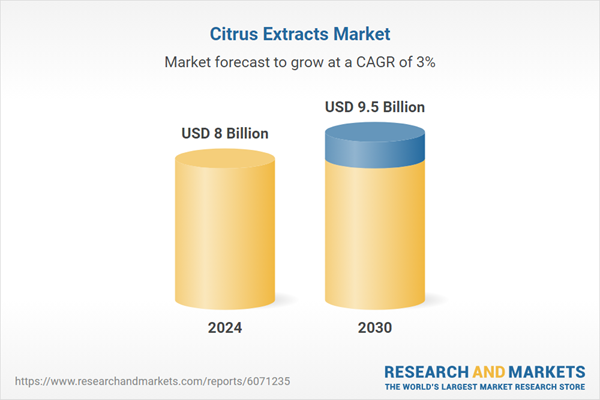

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 8 Billion |

| Forecasted Market Value ( USD | $ 9.5 Billion |

| Compound Annual Growth Rate | 3.0% |

| Regions Covered | Global |