Global Sequencing Consumables Market - Key Trends & Drivers Summarized

Is Next-Generation Sequencing Fueling an Unprecedented Rise in Consumables Demand?

The widespread adoption of next-generation sequencing (NGS) platforms across research, clinical, and industrial domains has significantly amplified the demand for sequencing consumables worldwide. Sequencing consumables - which include reagents, flow cells, kits, enzymes, and other single-use items necessary for sequencing workflows - form a critical backbone of the genomic value chain. As the throughput, accuracy, and accessibility of sequencing technologies improve, consumable utilization scales exponentially, driven by the sheer volume of sequencing tests being performed across a growing array of applications. In research, expanding large-scale genomic studies such as population genetics, oncology, epigenetics, and microbiome analyses are consuming vast quantities of high-fidelity sequencing kits and reagents. Additionally, clinical sequencing is gaining traction due to the increasing emphasis on personalized medicine, leading to a rise in diagnostic sequencing for cancer, rare diseases, infectious disease profiling, and pharmacogenomics - all requiring specialized, clinical-grade consumables. Each of these use cases brings unique requirements for quality, sensitivity, and processing speed, prompting a surge in both general-purpose and application-specific consumables. Furthermore, the rapid pace of innovation in sequencing instrumentation is leading to constant iterations and upgrades in compatible consumables, adding layers of complexity and fueling recurrent demand.How Are Automation and Workflow Optimization Redefining Product Development?

Advancements in laboratory automation and integrated sequencing workflows have significantly altered the expectations surrounding consumable products. In high-throughput settings, whether in biopharma R&D, academic labs, or commercial sequencing service providers, there is an increasing preference for consumables that are optimized for speed, consistency, and compatibility with automated systems. This shift is particularly visible in the design of pre-filled reagent cartridges, ready-to-use sample prep kits, and streamlined library preparation reagents that reduce human error and hands-on time. Manufacturers are also innovating in packaging formats, reagent stability, and temperature tolerance, catering to the operational needs of decentralized sequencing environments such as clinical labs, mobile testing units, and smaller research facilities. Moreover, single-cell sequencing, spatial transcriptomics, and multi-omics approaches are ushering in specialized consumable formats with ultra-high sensitivity and specificity. These innovations are critical in supporting emerging use cases like precision oncology, neurogenetics, and pathogen surveillance. The move toward end-to-end workflow solutions has made sequencing instrument manufacturers double down on proprietary consumables, locking users into specific ecosystems while ensuring optimal performance - a trend that, although controversial, is proving lucrative and strategically advantageous.Can Global Disparities and Supply Chain Dynamics Influence Market Momentum?

Geographic disparities in research funding, healthcare infrastructure, and regulatory frameworks have created uneven patterns in sequencing consumables adoption. North America continues to lead due to robust investments in biomedical research, favorable reimbursement for genetic testing, and the concentration of genomics firms and sequencing technology leaders. Europe follows closely with extensive precision medicine initiatives and public-private partnerships driving uptake. Meanwhile, the Asia-Pacific region is emerging as a high-growth zone, fueled by expanding genomic programs in China, India, and Japan, alongside improvements in diagnostic infrastructure and local manufacturing capabilities. However, supply chain constraints - exacerbated by geopolitical tensions, pandemic-related disruptions, and logistics limitations - have occasionally hindered the timely availability of critical consumables. The market has responded with efforts to regionalize manufacturing, enhance inventory resilience, and diversify supplier networks. Environmental concerns surrounding single-use plastics and hazardous chemical waste in consumables are also prompting industry players to explore greener alternatives and sustainable production models. In regions with cost-sensitive markets, demand is growing for affordable, modular consumable options that balance performance with accessibility, paving the way for tiered product lines and localized pricing strategies.What's Driving the Surging Momentum in the Sequencing Consumables Market?

The growth in the sequencing consumables market is driven by several factors directly tied to technology evolution, end-user expansion, and changing consumption patterns. First, the increasing global adoption of high-throughput sequencers, particularly benchtop and clinical-grade platforms, is pushing up routine consumable usage in both core and satellite labs. Second, the emergence of novel sequencing techniques - including long-read, nanopore, and single-molecule sequencing - is generating demand for new categories of specialized reagents and chemistry kits tailored to these platforms. Third, the diversification of sequencing applications across agriculture, food safety, forensics, and veterinary sciences is creating new end-use verticals that rely heavily on consumables for sample prep, amplification, and sequencing. Fourth, the growing prevalence of decentralized testing models and point-of-care sequencing, particularly in infectious disease detection and newborn screening, is increasing the need for portable, stable, and user-friendly consumable formats. Fifth, end-users are demanding higher throughput and reproducibility, leading to increased preference for pre-validated, automated-ready consumables compatible with integrated lab ecosystems. Finally, competitive dynamics among sequencing system manufacturers have intensified, with consumables serving as a high-margin, recurring revenue stream - prompting aggressive strategies around proprietary product ecosystems, subscription models, and value-added service bundles. Together, these factors are cementing sequencing consumables not just as supporting elements but as central revenue and innovation drivers within the broader genomics market landscape.Scope of Study:

The report analyzes the Sequencing Consumables market in terms of units by the following Segments, and Geographic Regions/Countries:- Segments: Product (Kits, Reagents, Accessories); Application (Cancer Diagnostics, Infectious Disease Diagnostics, Reproductive Health Diagnostics, Pharmacogenomics, Agrigenomics, Others); End-Use (Pharma & Biotech Companies, Hospitals & Laboratories, Academic Research Institutes, Others)

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Kits segment, which is expected to reach US$18.3 Billion by 2030 with a CAGR of a 23.6%. The Reagents segment is also set to grow at 17.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, estimated at $2.2 Billion in 2024, and China, forecasted to grow at an impressive 29.2% CAGR to reach $6.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Sequencing Consumables Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Sequencing Consumables Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Sequencing Consumables Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Agilent Technologies, Inc., Analytik Jena AG, Beckman Coulter, Inc., BGI Genomics, Bio-Rad Laboratories, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Sequencing Consumables market report include:

- Agilent Technologies, Inc.

- Analytik Jena AG

- Beckman Coulter, Inc.

- BGI Genomics

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Eurofins Genomics

- F. Hoffmann-La Roche Ltd.

- GATC Biotech (Eurofins Genomics)

- GenScript Biotech Corporation

- Illumina, Inc.

- Integrated DNA Technologies, Inc.

- Invitrogen (Thermo Fisher Scientific)

- LGC Biosearch Technologies

- Lucigen Corporation

- Macrogen Inc.

- MGI Tech Co., Ltd.

- Micronit

- Millipore Sigma

- New England Biolabs, Inc.

- Nugen Technologies, Inc.

- Oxford Nanopore Technologies Ltd.

- Pacific Biosciences of California, Inc.

- PerkinElmer, Inc.

- Promega Corporation

- QIAGEN N.V.

- Swift Biosciences, Inc.

- Takara Bio Inc.

- Thermo Fisher Scientific, Inc.

- Zymo Research Corporation

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Agilent Technologies, Inc.

- Analytik Jena AG

- Beckman Coulter, Inc.

- BGI Genomics

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Eurofins Genomics

- F. Hoffmann-La Roche Ltd.

- GATC Biotech (Eurofins Genomics)

- GenScript Biotech Corporation

- Illumina, Inc.

- Integrated DNA Technologies, Inc.

- Invitrogen (Thermo Fisher Scientific)

- LGC Biosearch Technologies

- Lucigen Corporation

- Macrogen Inc.

- MGI Tech Co., Ltd.

- Micronit

- Millipore Sigma

- New England Biolabs, Inc.

- Nugen Technologies, Inc.

- Oxford Nanopore Technologies Ltd.

- Pacific Biosciences of California, Inc.

- PerkinElmer, Inc.

- Promega Corporation

- QIAGEN N.V.

- Swift Biosciences, Inc.

- Takara Bio Inc.

- Thermo Fisher Scientific, Inc.

- Zymo Research Corporation

Table Information

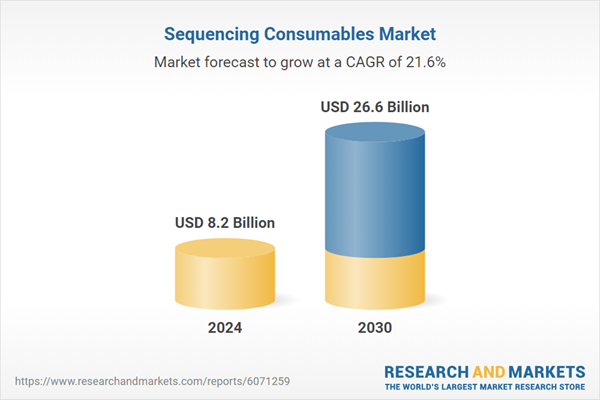

| Report Attribute | Details |

|---|---|

| No. of Pages | 381 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 8.2 Billion |

| Forecasted Market Value ( USD | $ 26.6 Billion |

| Compound Annual Growth Rate | 21.6% |

| Regions Covered | Global |