Global Hospital Acquired Infections Diagnostics Market - Key Trends & Drivers Summarized

Why Are Hospital Acquired Infections Diagnostics Becoming a Priority in Modern Healthcare Systems?

Hospital acquired infections (HAIs), also known as nosocomial infections, continue to pose a significant burden on global healthcare systems - driving up patient morbidity, length of stay, and treatment costs. Infections such as catheter-associated urinary tract infections (CAUTIs), central line-associated bloodstream infections (CLABSIs), surgical site infections (SSIs), and ventilator-associated pneumonia (VAP) are prevalent across hospitals, especially in intensive care units (ICUs). As antimicrobial resistance (AMR) escalates globally, timely identification and targeted treatment of HAIs have become critical to patient outcomes and hospital performance metrics. Diagnostics play a frontline role in rapidly detecting the causative pathogens and determining their antimicrobial susceptibility, enabling clinicians to initiate effective interventions while minimizing the misuse of broad-spectrum antibiotics. The rising adoption of infection prevention and control (IPC) protocols, driven by regulatory mandates and reimbursement models, is elevating the role of diagnostics from reactive to proactive infection containment. With hospitals facing increasing pressure to maintain accreditation, avoid penalties, and reduce healthcare-associated costs, HAI diagnostics are emerging as essential tools in risk mitigation, outbreak surveillance, and quality of care improvement.How Are Advancements in Diagnostic Technologies Accelerating HAI Detection and Clinical Response?

Technological innovations are driving a shift from culture-based diagnostics to rapid, point-of-care, and multiplex molecular solutions for hospital acquired infections. Traditional microbiology, while still a benchmark for definitive pathogen identification, is being complemented - and in many cases replaced - by real-time polymerase chain reaction (RT-PCR), nucleic acid amplification tests (NAATs), and loop-mediated isothermal amplification (LAMP) for faster turnaround. These molecular assays enable high sensitivity and specificity, often delivering results within hours compared to the multi-day window required for cultures. Automated blood culture systems with integrated microbial ID and susceptibility profiling are being increasingly adopted for sepsis and bloodstream infection diagnosis. Mass spectrometry platforms, especially matrix-assisted laser desorption/ionization- time of flight (MALDI-TOF), are accelerating organism identification while reducing lab operational costs. Next-generation sequencing (NGS) is emerging as a powerful tool for tracking infection outbreaks and characterizing resistance genes. Additionally, advancements in biosensors, microfluidics, and lab-on-chip technologies are enabling bedside diagnostics with real-time data output. Integration of AI-driven analytics and hospital-wide surveillance platforms is enhancing infection tracking, predictive modeling, and clinical decision support. These innovations are not only improving diagnostic speed and accuracy but also facilitating early isolation and targeted treatment, thereby curbing HAI spread and improving clinical outcomes.What Healthcare Dynamics and Regulatory Pressures Are Catalyzing Diagnostic Adoption in HAI Control?

The rising prevalence of multidrug-resistant organisms (MDROs), increased use of invasive devices, and an aging population with complex comorbidities are expanding the risk profile for HAIs, intensifying the need for robust diagnostic capabilities. Hospitals are under growing scrutiny from regulatory bodies such as the Centers for Disease Control and Prevention (CDC), the World Health Organization (WHO), and regional health authorities to monitor and report HAI incidence accurately and in real time. Pay-for-performance healthcare models and penalty structures under Medicare and Medicaid Services are incentivizing hospitals to reduce HAI rates or risk financial consequences. Accreditation agencies and infection control standards such as the Joint Commission’ s National Patient Safety Goals are reinforcing diagnostic compliance as a core requirement. The COVID-19 pandemic has further highlighted the importance of rapid diagnostics in preventing cross-infection within healthcare settings. Increased healthcare worker awareness and IPC training are also driving demand for integrated diagnostic solutions that support early detection and antimicrobial stewardship. Hospital labs, facing staffing shortages and workload pressures, are investing in automation and high-throughput diagnostic platforms to maintain turnaround times and improve workflow efficiency. These dynamics are converging to make diagnostics an indispensable component of infection control ecosystems within healthcare institutions globally.What Is Driving the Growth of the Hospital Acquired Infections Diagnostics Market Across Geographies and Use Cases?

The growth in the hospital acquired infections diagnostics market is driven by a combination of rising infection rates, technological innovation, and evolving healthcare accountability standards. High-income countries are investing in advanced molecular and digital diagnostic platforms to meet stringent surveillance requirements and reduce hospital liability. In emerging economies, rapid urbanization, growing healthcare access, and international funding for IPC programs are accelerating the adoption of low-cost, rapid diagnostic tools tailored for resource-limited settings. The expansion of surgical procedures, critical care units, and immunocompromised patient populations - especially in oncology, organ transplantation, and neonatal care - is fueling demand for early and precise HAI diagnostics. The trend toward decentralized diagnostics, point-of-care testing, and home-based care is also creating new application opportunities for compact, automated, and user-friendly diagnostic solutions. Public-private partnerships, favorable reimbursement structures, and government initiatives aimed at combatting antimicrobial resistance are further driving market momentum. These factors collectively are propelling the hospital acquired infections diagnostics market as a vital enabler of safer healthcare delivery, operational excellence, and infection prevention in a rapidly evolving global health landscape.Report Scope

The report analyzes the Hospital Acquired Infections Diagnostics market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Consumables, Instruments); Test (Molecular, Conventional); Type (Blood tests, Urinalysis); Infection (UTI, Pneumonia, Surgical site infection, Bloodstream infections, Others).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Consumables segment, which is expected to reach US$5.8 Billion by 2030 with a CAGR of a 1.3%. The Instruments segment is also set to grow at 0.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.3 Billion in 2024, and China, forecasted to grow at an impressive 2.1% CAGR to reach $1.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Hospital Acquired Infections Diagnostics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Hospital Acquired Infections Diagnostics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Hospital Acquired Infections Diagnostics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Hospital Acquired Infections Diagnostics market report include:

- Abbott Laboratories

- Bayer AG

- Beckman Coulter (a Danaher Company)

- Becton, Dickinson and Company (BD)

- bioMérieux

- Bio-Rad Laboratories, Inc.

- Cepheid (a Danaher Company)

- Danaher Corporation

- Ecolab Inc.

- F. Hoffmann-La Roche Ltd.

- GenMark Diagnostics (acquired by Roche)

- Hologic, Inc.

- Johnson & Johnson

- Luminex Corporation

- Merck KGaA

- Pfizer Inc.

- QIAGEN N.V.

- Siemens Healthineers

- STERIS plc

- Thermo Fisher Scientific Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories

- Bayer AG

- Beckman Coulter (a Danaher Company)

- Becton, Dickinson and Company (BD)

- bioMérieux

- Bio-Rad Laboratories, Inc.

- Cepheid (a Danaher Company)

- Danaher Corporation

- Ecolab Inc.

- F. Hoffmann-La Roche Ltd.

- GenMark Diagnostics (acquired by Roche)

- Hologic, Inc.

- Johnson & Johnson

- Luminex Corporation

- Merck KGaA

- Pfizer Inc.

- QIAGEN N.V.

- Siemens Healthineers

- STERIS plc

- Thermo Fisher Scientific Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 469 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

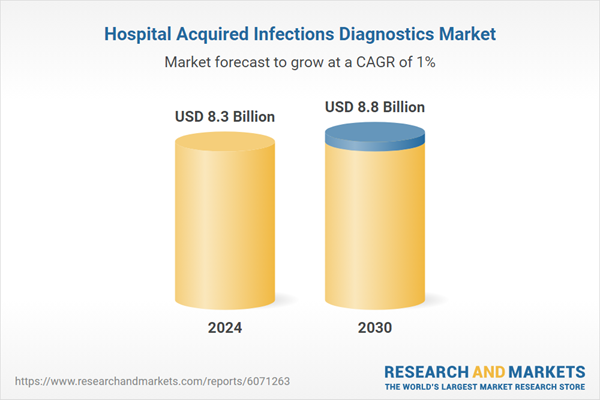

| Estimated Market Value ( USD | $ 8.3 Billion |

| Forecasted Market Value ( USD | $ 8.8 Billion |

| Compound Annual Growth Rate | 1.0% |

| Regions Covered | Global |