Global Life & Non-Life Insurance Market - Key Trends & Drivers Summarized

Why Is the Life & Non-Life Insurance Market Expanding Rapidly?

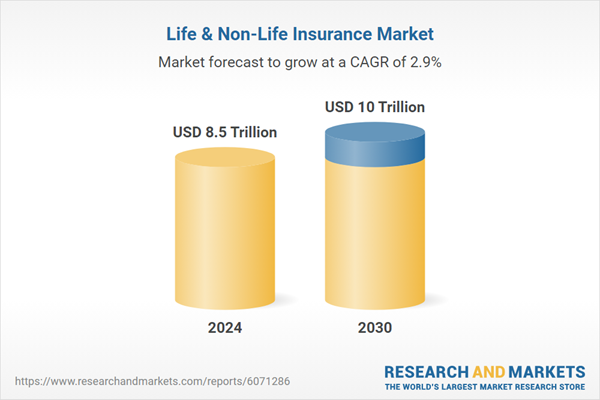

The global life and non-life insurance market has experienced steady growth due to increasing economic uncertainties, rising awareness of financial security, and evolving regulatory frameworks. Life insurance provides financial protection to policyholders and their beneficiaries in the event of death or disability, while non-life insurance (also known as general insurance) covers assets, health, liability, and other risks. The growing middle-class population, rising disposable incomes, and an increased emphasis on long-term financial planning have contributed to the surge in life insurance policies. Simultaneously, the expansion of industries, urbanization, and climate-related risks have driven demand for non-life insurance, including health, property, motor, and cyber insurance. Additionally, the adoption of digital insurance platforms has simplified policy management, claims processing, and customer service, making insurance more accessible to consumers. The COVID-19 pandemic further accelerated demand for health and term life insurance as individuals prioritized financial protection. With increasing competition among insurers, product innovation, and government initiatives promoting financial inclusion, the life and non-life insurance market is set to grow significantly.What Are the Emerging Trends in the Life & Non-Life Insurance Industry?

Several key trends are shaping the evolution of the life and non-life insurance industry, enhancing accessibility and customer experience. One of the most notable trends is the rapid digital transformation of the sector, with insurers leveraging artificial intelligence (AI), machine learning, and big data analytics to offer personalized policies and improve risk assessment. The rise of insurtech startups has disrupted traditional insurance models, introducing digital-only policies, blockchain-based claims management, and pay-as-you-go coverage. Another significant trend is the integration of wearable technology and telematics in health and motor insurance, respectively, allowing insurers to incentivize policyholders for healthy lifestyles and safe driving habits. The demand for climate risk insurance has also surged due to increasing natural disasters, prompting insurers to develop parametric insurance products that offer faster payouts based on pre-defined triggers. Additionally, the growing adoption of embedded insurance - where insurance coverage is seamlessly integrated into retail and financial transactions - has expanded market penetration. The rise of gig economy workers and freelancers has fueled demand for flexible, short-term insurance products that cater to non-traditional employment structures.What Challenges Are Hindering the Growth of the Life & Non-Life Insurance Market?

Despite its expansion, the life and non-life insurance industry faces several challenges that impact its adoption and profitability. One of the primary obstacles is the low penetration rate of insurance in emerging economies due to limited awareness, affordability constraints, and distrust in insurers. Regulatory complexities and evolving compliance requirements across different regions create operational challenges for multinational insurers. Fraudulent claims and cyber threats pose significant risks to the industry, necessitating enhanced fraud detection mechanisms and cybersecurity investments. The high cost of acquiring and retaining customers, particularly in competitive markets, has also pressured insurers to rethink their distribution strategies. Additionally, the increasing frequency of extreme weather events and pandemics has led to rising claims payouts, impacting insurer profitability and requiring better risk modeling techniques. The transition from traditional face-to-face sales to digital channels has created gaps in customer education and engagement, particularly among older demographics who may be unfamiliar with digital insurance processes. Addressing these challenges will require insurers to invest in financial literacy initiatives, strengthen regulatory collaboration, and enhance product customization to cater to diverse customer needs.What Is Driving the Growth of the Life & Non-Life Insurance Market?

The growth in the life and non-life insurance market is driven by increasing consumer awareness of financial security, advancements in digital insurance solutions, and rising economic uncertainties. The demand for personalized insurance products has accelerated as insurers leverage AI-driven underwriting and data analytics to offer tailored coverage. Government initiatives promoting microinsurance and inclusive financial policies have expanded insurance access in underpenetrated markets. The rise of hybrid work models and evolving healthcare needs have fueled demand for employer-sponsored insurance programs and flexible health plans. Additionally, the expansion of smart home and IoT-based risk prevention technologies has led to innovation in property and liability insurance. The growing importance of cybersecurity insurance, as businesses increasingly face data breaches and regulatory fines, has further driven market expansion. With continuous advancements in insurance technology, customer-centric product development, and policy flexibility, the global life and non-life insurance market is expected to maintain steady growth in the years ahead.Report Scope

The report analyzes the Life & Non-Life Insurance market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Insurance Type (Life Insurance, Non-Life Insurance); Distribution Channel (Direct Distribution Channel, Agency Distribution Channel, Banks Distribution Channel, Other Distribution Channels).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Life Insurance segment, which is expected to reach US$6.1 Trillion by 2030 with a CAGR of a 2.2%. The Non-Life Insurance segment is also set to grow at 4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.3 Trillion in 2024, and China, forecasted to grow at an impressive 5.3% CAGR to reach $1.9 Trillion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Life & Non-Life Insurance Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Life & Non-Life Insurance Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Life & Non-Life Insurance Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Bandai Namco Group, Clementoni Spa, Funko, LLC, Hasbro, Inc., JAKKS Pacific, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Life & Non-Life Insurance market report include:

- Aegon N.V.

- Allianz SE

- American International Group (AIG)

- Assicurazioni Generali S.p.A.

- Aviva plc

- AXA Group

- Berkshire Hathaway Inc.

- China Life Insurance Company

- CNP Assurances

- Dai-ichi Life Holdings, Inc.

- Legal & General Group plc

- Life Insurance Corporation of India

- Manulife Financial Corporation

- MetLife Inc.

- Munich Re

- New York Life Insurance Company

- Nippon Life Insurance Company

- Ping An Insurance Group

- Prudential Financial Inc.

- Zurich Insurance Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aegon N.V.

- Allianz SE

- American International Group (AIG)

- Assicurazioni Generali S.p.A.

- Aviva plc

- AXA Group

- Berkshire Hathaway Inc.

- China Life Insurance Company

- CNP Assurances

- Dai-ichi Life Holdings, Inc.

- Legal & General Group plc

- Life Insurance Corporation of India

- Manulife Financial Corporation

- MetLife Inc.

- Munich Re

- New York Life Insurance Company

- Nippon Life Insurance Company

- Ping An Insurance Group

- Prudential Financial Inc.

- Zurich Insurance Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 281 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 8.5 Trillion |

| Forecasted Market Value ( USD | $ 10 Trillion |

| Compound Annual Growth Rate | 2.9% |

| Regions Covered | Global |