Global Microarray Scanners Market - Key Trends & Drivers Summarized

What’ s Powering the Technological Renaissance in Microarray Scanning?

The microarray scanners market is undergoing a significant transformation as new advancements in biomedical technology and genomics converge to enhance the utility and efficiency of these devices. Microarray scanners, which are used to detect and quantify fluorescent signals in DNA, RNA, or protein arrays, have become a core element in modern molecular diagnostics, enabling researchers to analyze thousands of genetic materials in a single experiment. With increasing emphasis on precision medicine, pharmaceutical companies and research laboratories are leveraging these scanners to conduct large-scale gene expression profiling, genotyping, and biomarker discovery. Technological evolution has also pushed the envelope with high-resolution scanners offering improved signal-to-noise ratios, multiplexing capabilities, and faster scanning times, which collectively help process more data in shorter durations with enhanced accuracy.One notable trend driving innovation is the integration of AI and machine learning into scanner software, enabling real-time analytics and enhanced pattern recognition that assist in faster and more accurate interpretation of complex biological data. The deployment of these advanced features is particularly useful in fields like oncology, where microarray technology is critical for identifying cancer-specific mutations and monitoring treatment efficacy. In addition, optical innovations - such as the adoption of laser-based fluorescence systems and confocal scanning technologies - are improving sensitivity and resolution, allowing researchers to detect even low-abundance genetic material. These developments not only streamline research workflows but also reduce the risk of experimental variability, which is a long-standing challenge in molecular diagnostics.

Are Research Applications Evolving Fast Enough to Match Scanner Capabilities?

The shifting dynamics of biological and pharmaceutical research are playing a pivotal role in shaping the microarray scanners market. As academic and commercial research institutions expand their focus beyond genomics to areas like transcriptomics, proteomics, and epigenetics, the demand for versatile and highly customizable scanning platforms has surged. Microarray scanners are increasingly being optimized for broader applications such as environmental monitoring, agricultural genomics, and infectious disease surveillance, reflecting a significant departure from their traditional role confined to genomic research alone. This broadened application base is especially visible in agricultural biotechnology, where microarray data is instrumental in crop improvement through gene expression studies, stress-response analysis, and pathogen resistance profiling.Moreover, the rise in complex, multi-layered biological questions has led to a corresponding increase in multiplex assay formats, pushing scanner manufacturers to develop systems capable of handling diverse array configurations with seamless calibration and imaging performance. Collaborative projects between biotech firms and academic institutions are further expanding microarray applications, encouraging the design of niche products tailored to specific fields like marine biology, neurogenetics, and stem cell research. As a result, scanner platforms today must cater not only to a growing number of application domains but also to the unique data formats and analytical frameworks that come with each. This cross-disciplinary demand has effectively elevated the importance of interoperability, leading to the integration of open-source data processing tools and cloud-based platforms that facilitate large-scale data sharing and collaborative analysis.

How Are End-Use Sectors Shaping Market Direction and Investment?

In terms of end-use, the microarray scanners market is experiencing significant momentum across diagnostic laboratories, pharmaceutical companies, and research institutes - each presenting unique needs that are reshaping the product development landscape. Diagnostic labs, driven by the growing trend of personalized medicine and early disease detection, are increasingly turning to high-throughput scanners for rapid screening and molecular profiling of patient samples. Their preference for automation, minimal sample preparation, and high reliability is prompting scanner developers to focus on plug-and-play systems with intuitive user interfaces and minimal maintenance requirements. Meanwhile, pharmaceutical and biotech companies are integrating microarray scanners into their drug discovery pipelines, particularly during lead identification and validation phases, to enhance their high-throughput screening capabilities.Hospitals and clinical research organizations are also emerging as strong contributors to market expansion due to their rising dependence on genomic assays for patient stratification and therapy optimization. With the global rise of chronic diseases, particularly cancer, cardiovascular disorders, and neurological conditions, clinical settings are increasingly adopting microarray-based diagnostic workflows to supplement traditional diagnostic tools. Additionally, governmental and non-governmental funding for life sciences research is steadily increasing, which is encouraging both established labs and start-ups to invest in modern scanning equipment. These shifts are creating a diverse customer base, prompting manufacturers to diversify their product portfolios and offer tiered solutions that cater to varying throughput and budgetary requirements.

What’ s Fueling the Accelerated Growth of the Microarray Scanners Market?

The growth in the microarray scanners market is driven by several factors that stem directly from technological innovation, evolving end-user needs, and the growing importance of genomics in diverse industries. Technologically, the advent of high-resolution and automated scanning systems that offer greater speed, precision, and integration with data analysis platforms is playing a key role. As the volume and complexity of biological data continue to increase, these systems are addressing a critical need for real-time data processing and scalable output, especially in large-scale genomics and proteomics studies. On the end-user front, pharmaceutical firms and clinical research organizations are demanding multi-application platforms capable of supporting drug development and diagnostic assay validation, pushing manufacturers to provide scalable and modular solutions.In academia and life sciences research, rising investments and government funding initiatives targeting molecular biology and genomic studies are directly boosting scanner adoption, particularly in emerging economies where healthcare R&D infrastructure is being rapidly developed. Additionally, the growth in direct-to-consumer genetic testing and the rise of personalized healthcare are creating new avenues for microarray technologies in commercial settings. Consumer behavior is also shifting as more individuals seek comprehensive genetic insights, encouraging companies to adopt microarray scanners that deliver accurate and actionable data at consumer-acceptable turnaround times. Furthermore, the increasing application of microarray analysis in agriculture, environmental sciences, and biosecurity is expanding the market’ s geographical and industrial reach. Collectively, these growth drivers are not just accelerating market expansion but also diversifying the pathways through which microarray scanners are integrated into scientific and commercial ecosystems.

Report Scope

The report analyzes the Microarray Scanners market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Fluorescence Microarray Scanners, Charge Coupled Devices Microarray Scanners, Colorimetric Microarray Scanners, Other Product Types); Application (Gene Expression Analysis Application, Protein Microarrays Application, Drug Discovery Application, Genotyping & SNP Analysis Application, Other Applications); End-Use (Hospitals & Clinics End-Use, Pharma & Biotech Companies End-Use, Diagnostic Laboratories End-Use, Academic & Research Institutes End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Fluorescence Microarray Scanners segment, which is expected to reach US$643.4 Million by 2030 with a CAGR of a 5.1%. The Charge Coupled Devices Microarray Scanners segment is also set to grow at 8.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $268.7 Million in 2024, and China, forecasted to grow at an impressive 10% CAGR to reach $293.0 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Microarray Scanners Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Microarray Scanners Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Microarray Scanners Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ACG Group, ACG Worldwide, Alcoa Inc., Amcor Plc, Beijing ChamGo Nano-tech Co. Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 37 companies featured in this Microarray Scanners market report include:

- Affymetrix (now part of Thermo Fisher Scientific)

- Agilent Technologies

- Applied Biosystems (now part of Thermo Fisher Scientific)

- Arrayit Corporation

- Ayoxxa Biosystems

- BioMicro Systems

- Bio-Rad Laboratories

- CapitalBio Technology

- Ditabis

- Eppendorf

- GE Healthcare

- Illumina

- Innopsys

- Molecular Devices

- PerkinElmer

- Phalanx Biotech Group

- Roche Diagnostics

- STMicroelectronics

- Thermo Fisher Scientific

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Affymetrix (now part of Thermo Fisher Scientific)

- Agilent Technologies

- Applied Biosystems (now part of Thermo Fisher Scientific)

- Arrayit Corporation

- Ayoxxa Biosystems

- BioMicro Systems

- Bio-Rad Laboratories

- CapitalBio Technology

- Ditabis

- Eppendorf

- GE Healthcare

- Illumina

- Innopsys

- Molecular Devices

- PerkinElmer

- Phalanx Biotech Group

- Roche Diagnostics

- STMicroelectronics

- Thermo Fisher Scientific

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 385 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

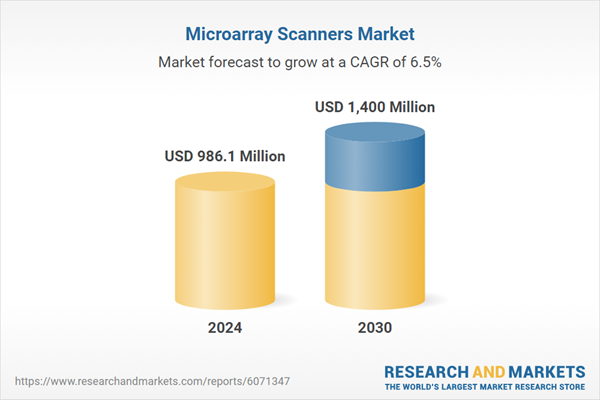

| Estimated Market Value ( USD | $ 986.1 Million |

| Forecasted Market Value ( USD | $ 1400 Million |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |