Global Medical Clothing Market - Key Trends & Drivers Summarized

Why Is the Medical Clothing Sector Gaining Unprecedented Momentum?

The global medical clothing market is experiencing a rapid surge in demand, driven by a convergence of health, hygiene, safety, and professionalization needs across the healthcare sector. Medical clothing, which encompasses scrubs, gowns, lab coats, gloves, face masks, headgear, and footwear, has become a fundamental element of infection prevention and control strategies in hospitals, clinics, research labs, and even at-home care settings. The COVID-19 pandemic served as a watershed moment, triggering massive demand for high-performance medical apparel globally and embedding long-term awareness of the importance of protective gear in clinical and non-clinical environments. As a result, healthcare institutions are now adopting stricter policies on personal protective clothing to ensure frontline workers’ safety and patient well-being.Beyond pandemic-related use, there is a growing recognition of the role of medical clothing in reducing cross-contamination risks in surgical settings, intensive care units, and outpatient departments. Advancements in antimicrobial textiles, fluid-resistant fabrics, and breathable synthetic fibers are transforming traditional garments into high-functionality performance wear. Additionally, aesthetic and comfort improvements are enhancing wearer compliance and morale, with ergonomic designs, gender-inclusive sizing, and lightweight materials now becoming standard. The rise in ambulatory care services and home-based healthcare solutions is also expanding the market beyond hospital walls, fueling demand from personal caregivers, medical assistants, and telehealth professionals who seek reliable yet stylish medical attire. Overall, the market is becoming increasingly segmented, purpose-driven, and innovation-focused, reflecting the evolving needs of a complex and multi-tiered healthcare landscape.

What Innovations Are Modernizing the Fabric and Function of Medical Wear?

Technological evolution is playing a transformative role in modernizing medical clothing, driving a shift from basic fabric-based protection to intelligent, adaptive, and sustainable solutions. Smart textiles are at the forefront of this evolution, integrating sensors and biometric monitoring systems into garments that can track vital signs, detect stress levels, or alert users about contamination exposure. These garments are particularly valuable in high-intensity environments like emergency departments or isolation wards where real-time data can guide decisions and enhance safety. Antimicrobial coatings and nanotechnology-enhanced fabrics are also reshaping the durability and hygiene profile of medical attire, significantly reducing the microbial load on garments and extending their usable life.Furthermore, manufacturers are exploring environmentally friendly production methods, including biodegradable fibers, recycled polyester blends, and waterless dyeing technologies to address the growing concern over medical textile waste. Innovations in fabric breathability, elasticity, and moisture-wicking properties have elevated user comfort and helped reduce issues such as heat stress and skin irritation, which were previously overlooked in garment design. Thermoregulating uniforms, which adapt to body temperature and working conditions, are gaining attention in surgical and long-shift environments. Even elements such as stain resistance and wrinkle-free designs are being reengineered to maintain a professional appearance while reducing laundering needs. This level of functionality is positioning medical clothing not just as a protective layer but as a tool for operational efficiency and occupational wellness.

Who’ s Wearing What and How Is Consumer Behavior Reshaping the Market?

The user base for medical clothing is expanding well beyond doctors and nurses to encompass a wider community of healthcare professionals, administrative staff, laboratory technicians, and even medical students. With healthcare becoming increasingly decentralized, the demand for professional-grade clothing is rising across outpatient care facilities, rehabilitation centers, diagnostic labs, and home health service providers. Moreover, the rising culture of 'medical fashion' is influencing purchasing decisions, with professionals now seeking attire that combines functionality with personalized expression. This trend has opened the door for brands to introduce customizable uniforms, fashionable scrubs, and branded corporate looks, transforming medical clothing from a uniform commodity into a lifestyle segment.E-commerce platforms have played a pivotal role in changing consumer behavior, offering access to a wide range of designs, fits, and technologies tailored to individual roles and preferences. Buyers are now better informed and more quality-conscious, often researching fabric specifications, user reviews, and sustainability credentials before making purchases. The shift toward private healthcare providers and premium medical services is also pushing institutions to adopt more refined, stylish, and standardized clothing as a branding strategy and morale booster. Additionally, emerging regions with expanding healthcare infrastructure are adopting modern medical clothing at an accelerated pace, fueled by rising hygiene standards, better purchasing power, and increasing exposure to global healthcare norms. This broader and more diverse customer base is driving demand for product variety, rapid restocking, and hybrid functionality, reshaping the market landscape across regions and demographics.

What’ s Fueling the Ongoing Growth in the Medical Clothing Market?

The growth in the medical clothing market is driven by several factors tied to changing healthcare delivery models, advanced textile technologies, shifting consumer expectations, and institutional procurement strategies. Technological advances in fabric engineering - such as nanofiber development, antimicrobial treatments, and moisture-control textiles - have significantly enhanced product performance, driving their adoption across medical institutions of all sizes. A growing emphasis on infection control protocols in both public and private healthcare systems is prompting increased investment in high-quality, certified garments. The expansion of surgical procedures, diagnostic testing, and long-term care facilities is also increasing demand for specialized apparel tailored to each setting, from sterile gowns to disposable gloves and isolation suits.End-use diversification is another significant driver. The increasing role of outpatient, home-based, and mobile healthcare services has led to broader application scenarios and subsequently, more nuanced clothing requirements. Additionally, rising female participation in the healthcare workforce is influencing design dynamics, pushing for more inclusive, comfortable, and functional garment options. Institutional procurement is becoming more strategic, with hospitals and healthcare organizations seeking vendors that offer not only quality and compliance but also sustainability and supply chain resilience. Bulk purchases, subscription-based supply models, and integrated apparel management services are gaining traction in regions with mature healthcare markets. Finally, global supply chain evolution, driven by both demand-side pressure and regulatory shifts, is encouraging localized manufacturing, enabling faster turnaround times and more regionally adapted product offerings. Altogether, these drivers are positioning medical clothing as an essential, fast-evolving segment within the global healthcare ecosystem.

Report Scope

The report analyzes the Medical Clothing market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Surgical drapes & gowns, Scrubs, Facial protection, Gloves, Protective apparels, Others).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Surgical Drapes & Gowns segment, which is expected to reach US$42.1 Billion by 2030 with a CAGR of a 6.8%. The Scrubs segment is also set to grow at 6.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $27.1 Billion in 2024, and China, forecasted to grow at an impressive 9.1% CAGR to reach $28.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Medical Clothing Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Medical Clothing Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Medical Clothing Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3B Scientific GmbH, 3DIEMME srl, A. Algeo Ltd., Adam Rouilly Ltd., Altay Scientific Group S.r.l. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Medical Clothing market report include:

- 3M Company

- Ansell Limited

- Barco Uniforms

- Cardinal Health, Inc.

- Careismatic Brands, Inc.

- Carhartt, Inc.

- Cherokee Uniforms

- Cintas Corporation

- DuPont de Nemours, Inc.

- Figs, Inc.

- Grey's Anatomy by Barco

- Halyard Health

- Hartmann Group

- Healing Hands

- Henry Schein, Inc.

- Jaanuu

- Landau Uniforms

- Medline Industries, LP

- Owens & Minor, Inc.

- Superior Uniform Group, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- Ansell Limited

- Barco Uniforms

- Cardinal Health, Inc.

- Careismatic Brands, Inc.

- Carhartt, Inc.

- Cherokee Uniforms

- Cintas Corporation

- DuPont de Nemours, Inc.

- Figs, Inc.

- Grey's Anatomy by Barco

- Halyard Health

- Hartmann Group

- Healing Hands

- Henry Schein, Inc.

- Jaanuu

- Landau Uniforms

- Medline Industries, LP

- Owens & Minor, Inc.

- Superior Uniform Group, Inc.

Table Information

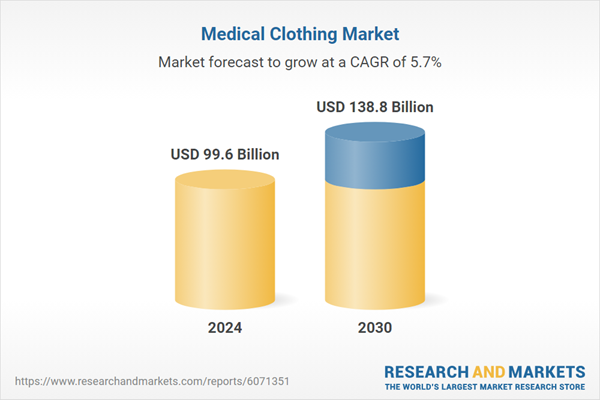

| Report Attribute | Details |

|---|---|

| No. of Pages | 192 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 99.6 Billion |

| Forecasted Market Value ( USD | $ 138.8 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |