Global Electrolysis Captive Hydrogen Generation Market - Key Trends & Growth Drivers Summarized

Why Is Captive Hydrogen Generation via Electrolysis Gaining Popularity?

Captive hydrogen generation through electrolysis is revolutionizing industries that require a steady and on-demand supply of hydrogen. Unlike merchant hydrogen production, captive hydrogen allows industrial users to generate hydrogen on-site, reducing dependency on external suppliers, enhancing energy security, and minimizing transportation costs. Industries such as steel manufacturing, refineries, chemical processing, and ammonia production are increasingly adopting captive hydrogen systems to meet decarbonization targets and improve operational efficiency.With the rise of green hydrogen initiatives, electrolysis-powered captive hydrogen generation is being positioned as a sustainable alternative to steam methane reforming (SMR), which has historically been the dominant hydrogen production method. The ability to integrate electrolysis with renewable energy sources further enhances sustainability, allowing industrial facilities to produce zero-emission hydrogen for various applications.

What Are the Latest Innovations in Captive Hydrogen Electrolysis?

The rapid development of high-efficiency electrolyzers, including proton exchange membrane (PEM) and solid oxide electrolyzer cells (SOECs), has significantly improved hydrogen production efficiency. PEM electrolyzers are particularly beneficial for captive hydrogen generation due to their ability to operate at varying loads, making them well-suited for integration with intermittent renewable energy sources.Another major advancement is the implementation of AI-driven energy optimization in hydrogen production. Smart electrolysis systems can dynamically adjust operational parameters based on electricity price fluctuations, demand patterns, and system performance. Additionally, hybrid electrolysis systems combining alkaline and PEM technologies are emerging to improve cost efficiency and reliability in captive hydrogen applications.

How Are Market Trends and Regulatory Policies Influencing Captive Hydrogen Electrolysis?

The growing global push for green hydrogen adoption has led to substantial government incentives for electrolysis-based hydrogen production. Policies such as the European Green Hydrogen Strategy and the U.S. Department of Energy’ s Hydrogen Shot initiative are providing financial support for industrial-scale electrolysis deployment.Market trends indicate an increasing focus on decentralized hydrogen production, where captive electrolysis systems enable industrial users to achieve energy independence. Additionally, industries are investing in electrolysis infrastructure to future-proof operations against potential carbon taxes and emissions regulations. As electrolyzer costs continue to decline and renewable electricity becomes more abundant, captive hydrogen generation is expected to become the preferred choice for industrial hydrogen consumers.

What Is Driving the Growth of the Captive Hydrogen Electrolysis Market?

The growth in the captive hydrogen electrolysis market is driven by increasing industrial demand for sustainable hydrogen, advancements in electrolyzer efficiency, and government policies promoting decarbonization. Industries are investing in captive hydrogen solutions to enhance energy security, reduce emissions, and optimize operational costs.End-use expansion is another key driver, with captive hydrogen systems being widely adopted in refining, steel production, ammonia synthesis, and fuel cell applications. The integration of AI-driven system management, hybrid electrolyzer technologies, and renewable energy integration is further accelerating market adoption. Additionally, partnerships between electrolyzer manufacturers, industrial users, and government agencies are fostering innovation, ensuring the continued expansion of captive hydrogen generation.

Report Scope

The report analyzes the Electrolysis Captive Hydrogen Generation market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Petroleum Refinery, Chemical, Metal, Others).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Petroleum Refinery End-Use segment, which is expected to reach US$6.1 Billion by 2030 with a CAGR of a 4.3%. The Chemical End-Use segment is also set to grow at 3.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.1 Billion in 2024, and China, forecasted to grow at an impressive 7.7% CAGR to reach $3.0 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Electrolysis Captive Hydrogen Generation Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Electrolysis Captive Hydrogen Generation Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Electrolysis Captive Hydrogen Generation Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aclarity, APRIA Systems, Arvia Technology, AVA Biochem AG, Bloom Energy Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Electrolysis Captive Hydrogen Generation market report include:

- Air Liquide SA

- Air Products and Chemicals, Inc.

- Beijing PERIC Hydrogen Technologies Co., Ltd.

- Cummins, Inc.

- Electric Hydrogen

- Enapter GmbH

- HydrogenPro ASA

- Hygreen Energy

- John Cockerill

- Linde plc

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Air Liquide SA

- Air Products and Chemicals, Inc.

- Beijing PERIC Hydrogen Technologies Co., Ltd.

- Cummins, Inc.

- Electric Hydrogen

- Enapter GmbH

- HydrogenPro ASA

- Hygreen Energy

- John Cockerill

- Linde plc

Table Information

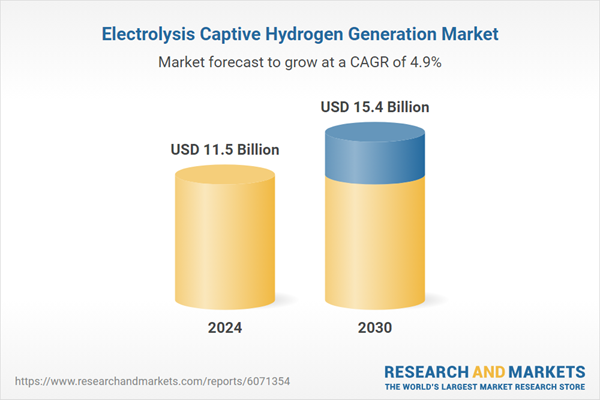

| Report Attribute | Details |

|---|---|

| No. of Pages | 279 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 11.5 Billion |

| Forecasted Market Value ( USD | $ 15.4 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |