Global Shared Vehicles Market - Key Trends & Drivers Summarized

Is the Decline in Vehicle Ownership Fueling Demand for Shared Access Models?

The global shared vehicles market is expanding rapidly as consumers increasingly shift from ownership to access-based mobility solutions. Economic pressures, growing urban congestion, limited parking, and rising environmental consciousness are prompting individuals - especially in urban centers - to forgo owning vehicles in favor of on-demand access to cars, bikes, scooters, and other shared transport modes. This shift is particularly pronounced among younger demographics who prioritize flexibility, affordability, and convenience over the responsibilities of car ownership. Shared vehicle services such as car-sharing, peer-to-peer rentals, and subscription-based vehicle models offer users the ability to access transportation only when needed, aligning with a growing preference for minimalist and sustainable lifestyles. The convergence of urbanization, changing commuter habits, and real estate constraints is reinforcing this trend, with municipalities actively encouraging shared vehicle use through dedicated parking zones, emissions-related driving restrictions, and mobility-as-a-service (MaaS) integrations. This changing mindset is driving robust demand for scalable and tech-enabled vehicle access solutions, marking a fundamental transition in how individuals and businesses approach personal and fleet mobility.Can Technology and Data-Driven Optimization Shape the Future of Shared Fleets?

Technology is at the heart of the shared vehicles revolution, powering everything from vehicle tracking and booking platforms to dynamic pricing and predictive maintenance systems. The use of GPS, IoT sensors, and telematics allows operators to monitor vehicle usage in real time, optimize asset deployment, and enhance user safety. AI-driven analytics are being deployed to predict peak demand periods, identify idle zones, and improve fleet rotation, thereby increasing efficiency and reducing operational costs. User-facing apps now offer seamless access, verification, booking, and payment options - essential components in delivering a frictionless experience. In addition, integration with smart city infrastructure is enabling shared vehicle services to align with broader transportation and energy policies. Electrification is another major driver, with operators investing in electric vehicles (EVs) to reduce emissions and meet sustainability mandates. This transition is facilitated by improvements in charging infrastructure, battery range, and energy management systems. Meanwhile, shared autonomous vehicle (SAV) pilots are laying the groundwork for the next generation of vehicle-sharing, where driverless fleets could offer hyper-efficient, 24/7 mobility at scale. These innovations are pushing the industry toward more responsive, intelligent, and user-centric transportation networks.Is Multi-Modal Integration Expanding the Use Case for Shared Vehicles?

The role of shared vehicles is evolving from standalone services to integral components of larger, interconnected transportation ecosystems. As cities aim to reduce traffic congestion and encourage more sustainable commuting patterns, shared vehicles are being integrated into public transit systems, forming the backbone of first-mile and last-mile connectivity solutions. Car-sharing services are often stationed near transit hubs, bike-share docks are strategically placed near business districts, and ride-hailing apps now offer multimodal route planning that includes shared bikes, cars, and public buses. This convergence is being accelerated by the rise of all-in-one mobility platforms, or MaaS solutions, which provide users with a single app to plan, book, and pay for trips across various transport modes. Employers are also recognizing the value of shared vehicles for employee mobility, offering corporate car-sharing programs to reduce parking demand and transport costs. At the same time, the tourism and leisure sectors are leveraging shared vehicles to provide more personalized, on-demand travel experiences. These expanded use cases are driving greater utilization, improving fleet economics, and embedding shared vehicles more deeply into daily life.What's Driving the Growth in the Shared Vehicles Market?

The growth in the shared vehicles market is driven by several factors directly linked to technology trends, urban mobility needs, and changing consumer preferences. First, the rising cost of vehicle ownership, including fuel, insurance, and maintenance, is prompting consumers to seek more cost-efficient transportation alternatives. Second, growing urbanization and environmental regulations are encouraging cities to limit private vehicle use and support shared mobility options through infrastructure and incentives. Third, technological advancements in connectivity, real-time data analytics, and user experience design are making shared vehicles more accessible, reliable, and user-friendly. Fourth, the expansion of electric vehicle infrastructure is aligning with the goals of shared vehicle operators to reduce operational costs and carbon footprints. Fifth, the increasing popularity of flexible work arrangements and hybrid commuting is boosting demand for short-term, need-based vehicle access. Sixth, strong venture capital interest and strategic partnerships among automakers, tech companies, and mobility startups are accelerating innovation and geographic expansion. Lastly, evolving attitudes toward ownership - especially among digital-native generations - are fostering a cultural shift that embraces shared access as a modern, responsible, and convenient approach to mobility. Together, these factors are propelling the shared vehicles market toward sustained, long-term growth across both developed and emerging economies.Report Scope

The report analyzes the Shared Vehicles market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Service (Car Rental, Bike Sharing, Car Sharing).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Car Rental segment, which is expected to reach US$236.8 Billion by 2030 with a CAGR of a 13.6%. The Bike Sharing segment is also set to grow at 10.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $50.6 Billion in 2024, and China, forecasted to grow at an impressive 17.4% CAGR to reach $81.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Shared Vehicles Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Shared Vehicles Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Shared Vehicles Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Bird Rides Inc., BlaBlaCar, Blu-Smart Mobility Pvt. Ltd., Bolt Technology, Cabify and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Shared Vehicles market report include:

- Anytime

- BlaBlaCar

- Bolt Technology

- Cambio Mobilitätsservice GmbH & Co. KG

- Car Next Door

- Car2Go (Share Now)

- Cityhop

- Communauto

- Delimobil

- DiDi Chuxing

- DriveNow (Share Now)

- Ekar

- Emov (Free2Move)

- Enterprise CarShare (Enterprise Holdings)

- Getaround

- GoGet CarShare

- Grab Holdings Inc.

- GreenMobility

- Hiyacar

- Lyft Inc.

- Mevo

- Modo Co-operative

- Ola Cabs (ANI Technologies Pvt. Ltd.)

- SnappCar

- Socar

- Turo

- Uber Technologies Inc.

- Udrive

- Zipcar (Avis Budget Group)

- Zity by Mobilize

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Anytime

- BlaBlaCar

- Bolt Technology

- Cambio Mobilitätsservice GmbH & Co. KG

- Car Next Door

- Car2Go (Share Now)

- Cityhop

- Communauto

- Delimobil

- DiDi Chuxing

- DriveNow (Share Now)

- Ekar

- Emov (Free2Move)

- Enterprise CarShare (Enterprise Holdings)

- Getaround

- GoGet CarShare

- Grab Holdings Inc.

- GreenMobility

- Hiyacar

- Lyft Inc.

- Mevo

- Modo Co-operative

- Ola Cabs (ANI Technologies Pvt. Ltd.)

- SnappCar

- Socar

- Turo

- Uber Technologies Inc.

- Udrive

- Zipcar (Avis Budget Group)

- Zity by Mobilize

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | February 2026 |

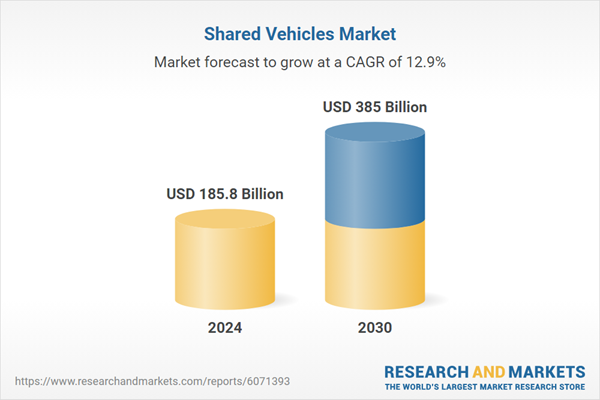

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 185.8 Billion |

| Forecasted Market Value ( USD | $ 385 Billion |

| Compound Annual Growth Rate | 12.9% |

| Regions Covered | Global |