Global Shielding Gas for Welding Market - Key Trends & Drivers Summarized

Is Industrial Expansion Fueling the Demand for High-Quality Welding Protection?

The global shielding gas for welding market is experiencing significant momentum as industrial manufacturing, construction, and infrastructure development projects scale up worldwide. Shielding gases play a critical role in arc welding processes by protecting the weld area from atmospheric gases like oxygen, nitrogen, and water vapor, which can cause porosity, weak welds, or contamination. As industries prioritize quality, durability, and productivity in their fabrication operations, the demand for specialized shielding gas blends is rising. Applications in automotive manufacturing, shipbuilding, pipeline construction, heavy machinery, and aerospace are increasingly reliant on optimized gas mixtures to ensure consistent, high-performance welds. Moreover, with tighter production timelines and quality control mandates, companies are standardizing on welding gases that offer improved arc stability, deeper penetration, and reduced spatter. The rapid growth of automated and robotic welding systems across industrial plants has also created a need for shielding gases that can support high-speed, precision welding with minimal disruption. As industrialization expands in emerging economies and the global focus on infrastructure intensifies, shielding gas consumption is expected to rise proportionately across key verticals.Can Gas Mixture Customization and Automation Advance Welding Efficiency?

The growing diversity of base metals, filler materials, and welding techniques is pushing manufacturers and fabricators to adopt customized shielding gas mixtures tailored to specific welding processes and performance goals. Argon, carbon dioxide, helium, hydrogen, and oxygen - alone or in various combinations - are being formulated to enhance the quality of MIG, TIG, FCAW, and plasma arc welding methods. These gas mixtures can influence bead appearance, mechanical properties, and operational costs, offering users the flexibility to optimize for specific materials such as stainless steel, aluminum, or carbon steel. Meanwhile, the increased adoption of automated welding solutions in sectors like automotive and aerospace is driving demand for gases that can maintain performance consistency in repetitive, high-speed environments. Gas suppliers are developing advanced delivery systems and real-time flow control solutions that can be integrated with smart manufacturing ecosystems. Innovations in gas cylinder design, telemetry-enabled tanks, and mobile refill services are also helping to reduce downtime and improve supply chain efficiency. These enhancements are making shielding gas selection a strategic decision that directly affects productivity, welding quality, and cost efficiency - especially in high-volume, precision-driven applications.Is Sustainability and Safety Influencing Purchasing Decisions in Industrial Welding?

Environmental and workplace safety considerations are becoming increasingly important factors in the shielding gas for welding market. With regulations tightening around greenhouse gas emissions, waste management, and operator safety, companies are exploring cleaner, low-emission shielding gas alternatives. The shift toward argon-rich blends and the reduction of carbon dioxide usage in some processes reflect an industry-wide focus on reducing fumes and improving indoor air quality. Additionally, health-conscious workplaces are emphasizing the need for low-reactivity gases that minimize ozone generation and welder exposure to toxic fumes. Supply chain transparency and gas purity are also becoming key concerns, especially in sectors where weld integrity has critical safety implications, such as aerospace, nuclear, and medical equipment manufacturing. As part of broader ESG (Environmental, Social, and Governance) goals, organizations are evaluating gas consumption patterns, implementing waste reduction programs, and integrating gas recycling systems. These sustainability-driven trends are compelling gas producers to invest in cleaner production processes, recyclable cylinders, and eco-friendly packaging. The alignment of shielding gas offerings with safety standards and sustainability benchmarks is emerging as a crucial differentiator in purchasing decisions across global markets.What's Driving the Growth in the Shielding Gas for Welding Market?

The growth in the shielding gas for welding market is driven by several factors directly linked to manufacturing trends, technological advancements, and end-use expansion. First, the rising demand for high-precision and defect-free welds in automotive, aerospace, energy, and construction sectors is boosting the use of optimized shielding gas mixtures. Second, the global shift toward automated and robotic welding solutions is accelerating the need for consistent, high-performance gases that can operate effectively in mechanized systems. Third, the diversification of welding processes and the use of advanced alloys are increasing the reliance on application-specific gas blends that enhance weld quality and reduce post-processing requirements. Fourth, the expansion of infrastructure projects - especially in emerging economies - is driving large-scale welding activity and associated shielding gas consumption. Fifth, technological innovation in gas delivery systems, real-time monitoring, and bulk storage is improving operational efficiency and gas utilization. Sixth, growing awareness of worker safety and environmental compliance is pushing industries to adopt cleaner and safer gas solutions that meet regulatory standards. Lastly, the strategic investments by gas suppliers in regional distribution, cylinder tracking, and industrial partnerships are enabling better market penetration and customer retention. Together, these forces are shaping a dynamic and steadily expanding global market for shielding gases across both traditional and next-generation welding applications.Report Scope

The report analyzes the Shielding Gas for Welding market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product (Argon, Carbon Dioxide, Oxygen, Hydrogen, Other Products); Distribution (Cylinder & Packaged Gas, Merchant Liquid / Bulk); End-Use(Metal Manufacturing & Fabrication, Construction, Energy, Aerospace, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Argon segment, which is expected to reach US$1.4 Billion by 2030 with a CAGR of a 3.2%. The Carbon Dioxide segment is also set to grow at 3.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $845 Million in 2024, and China, forecasted to grow at an impressive 6.6% CAGR to reach $765.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Shielding Gas for Welding Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Shielding Gas for Welding Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Shielding Gas for Welding Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Anytime, BlaBlaCar, Bolt Technology, Cambio Mobilitätsservice GmbH & Co. KG, Car Next Door and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Shielding Gas for Welding market report include:

- Air Liquide S.A.

- Air Products & Chemicals, Inc.

- Air Water Inc.

- Airgas, Inc.

- AllGas Technologies

- American Welding & Gas, Inc.

- Central Welding Supply Co., Inc.

- City Welding Sales & Service Inc.

- Gas and Supply

- Greco Gas

- Gulf Cryo

- Gulf Cryo

- Gulf Gases & Technology

- Iceblick Ltd.

- Iwatani Corporation

- Keen Compressed Gas Co.

- Linde Gas & Equipment Inc.

- Linde plc

- Machinery & Welder Corporation

- Matheson Tri-Gas, Inc.

- Messer Canada Inc.

- Messer Group GmbH

- Miller Welding Supply Company

- Nippon Gases Co., Ltd.

- Praxair, Inc.

- SIG Gases Berhad

- Southern Industrial Gas Sdn Bhd

- Taiyo Nippon Sanso Corporation

- Toll Company

- Welsco

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Air Liquide S.A.

- Air Products & Chemicals, Inc.

- Air Water Inc.

- Airgas, Inc.

- AllGas Technologies

- American Welding & Gas, Inc.

- Central Welding Supply Co., Inc.

- City Welding Sales & Service Inc.

- Gas and Supply

- Greco Gas

- Gulf Cryo

- Gulf Cryo

- Gulf Gases & Technology

- Iceblick Ltd.

- Iwatani Corporation

- Keen Compressed Gas Co.

- Linde Gas & Equipment Inc.

- Linde plc

- Machinery & Welder Corporation

- Matheson Tri-Gas, Inc.

- Messer Canada Inc.

- Messer Group GmbH

- Miller Welding Supply Company

- Nippon Gases Co., Ltd.

- Praxair, Inc.

- SIG Gases Berhad

- Southern Industrial Gas Sdn Bhd

- Taiyo Nippon Sanso Corporation

- Toll Company

- Welsco

Table Information

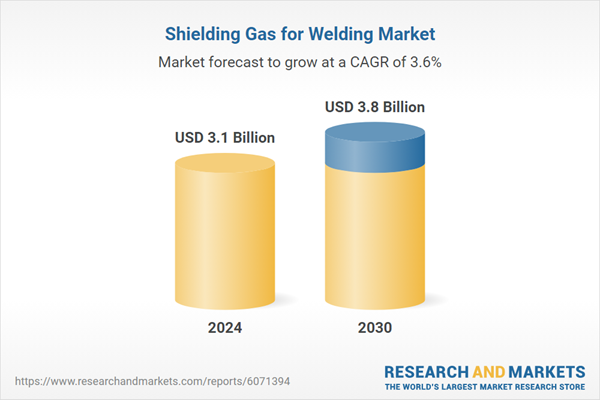

| Report Attribute | Details |

|---|---|

| No. of Pages | 376 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.1 Billion |

| Forecasted Market Value ( USD | $ 3.8 Billion |

| Compound Annual Growth Rate | 3.6% |

| Regions Covered | Global |