Global SiC-On-Insulator and Other Substrates Market - Key Trends & Drivers Summarized

Why Is the Demand for SiC-On-Insulator and Other Substrates Increasing? Understanding Their Growing Role in Semiconductor Applications

The semiconductor industry is witnessing a paradigm shift with the increasing adoption of silicon carbide-on-insulator (SiC-OI) and other advanced substrates, primarily driven by the demand for high-performance electronics, power devices, and next-generation semiconductor components. As industries such as electric vehicles (EVs), telecommunications, aerospace, and renewable energy continue to expand, the need for materials that offer superior thermal conductivity, high voltage resistance, and energy efficiency has intensified. SiC-on-insulator technology provides significant advantages over traditional silicon-based semiconductors by enhancing power efficiency, reducing heat dissipation, and improving device longevity. Additionally, the rising demand for 5G infrastructure, high-frequency RF applications, and power electronics in industrial automation has further propelled the need for advanced substrate materials. The transition toward wide-bandgap semiconductors is reshaping the semiconductor manufacturing landscape, positioning SiC-OI as a key enabler of energy-efficient and high-performance electronics.How Are Technological Advancements Enhancing SiC-On-Insulator and Other Substrate Materials? Exploring Innovations in Semiconductor Fabrication

Recent advancements in material science, epitaxial growth techniques, and wafer fabrication have significantly improved the performance, scalability, and cost-effectiveness of SiC-on-insulator and other specialized substrates. The development of larger SiC wafers, such as 200mm substrates, has increased manufacturing efficiency and reduced production costs, enabling mass adoption in high-power applications. Additionally, innovations in bonding and thinning techniques have enhanced the mechanical stability and electrical performance of SiC-based substrates, making them more suitable for high-voltage and high-temperature environments. The integration of AI-driven process control in wafer fabrication has further optimized yield rates, reducing defects and improving material consistency. Additionally, advancements in alternative substrates, such as gallium nitride (GaN) on silicon, sapphire, and diamond-based semiconductors, have expanded the range of options available for high-frequency and power applications. As semiconductor manufacturers continue to push the limits of material engineering, SiC-OI and other advanced substrates are becoming critical components in the evolution of high-efficiency electronics.What Challenges Are Hindering the Growth of SiC-On-Insulator and Other Substrates? Addressing Market Constraints and Production Limitations

Despite their promising potential, the adoption of SiC-on-insulator and other advanced substrates faces several challenges, including high manufacturing costs, complex fabrication processes, and supply chain constraints. The production of high-quality SiC wafers requires precision engineering and specialized equipment, leading to higher costs compared to traditional silicon-based substrates. The limited availability of raw materials and the complexity of wafer processing have also resulted in supply chain bottlenecks, affecting the scalability of production. Additionally, the integration of SiC-based substrates into existing semiconductor manufacturing processes requires technological adaptations, increasing development time and costs for semiconductor manufacturers. Another challenge is the competition from alternative materials, such as GaN and diamond-based semiconductors, which offer distinct advantages in specific applications. Overcoming these challenges will require continued investments in research and development, process optimization, and strategic collaborations across the semiconductor ecosystem.What's Driving the Growth of the SiC-On-Insulator and Other Substrates Market? Identifying Key Expansion Factors

The growth in the SiC-on-insulator and other substrates market is driven by several factors, including the increasing adoption of power-efficient electronics, the expansion of the electric vehicle market, and advancements in 5G and high-frequency communication technologies. The push toward electrification in the automotive sector has created a strong demand for SiC-based power devices, which offer improved efficiency and reduced energy losses in EV powertrains and charging systems. Additionally, the deployment of 5G networks and high-frequency RF applications has accelerated the adoption of advanced substrates that support faster data transmission and lower power consumption. The rise of renewable energy systems, such as solar inverters and wind power converters, has also contributed to market expansion, as SiC-based components enable higher energy conversion efficiency. Government initiatives and funding for semiconductor research and domestic production have further bolstered the growth of advanced substrate technologies. With ongoing innovations in semiconductor materials and increasing investments in next-generation electronics, the SiC-on-insulator market is poised for strong growth, shaping the future of high-performance semiconductor manufacturing.Report Scope

The report analyzes the SiC-On-Insulator and Other Substrates market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Substrate Type (Semi-insulating SiC Substrates, Conductive SiC Substrates); Wafer Size (100mm Size, 150mm Size, 200mm Size); Application (Power Devices Application, RF Devices Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Some of the 43 companies featured in this SiC-On-Insulator and Other Substrates market report include -

- Coherent Corp.

- GeneSiC Semiconductor Inc.

- GlobalWafers Co., Ltd.

- Infineon Technologies AG

- MTI Corporation

- NGK Insulators, Ltd.

- ON Semiconductor Corporation

- Resonac Holdings Corporation

- ROHM Co., Ltd.

- Semiconductor Wafer Inc.

- SICC Co., Ltd.

- SICOXS Corporation

- SiCrystal GmbH

- SK Siltron Co., Ltd.

- Soitec

- STMicroelectronics N.V.

- Sumitomo Electric Industries, Ltd.

- TankeBlue Co., Ltd.

- Wolfspeed, Inc.

- Xiamen Powerway Advanced Material Co.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Semi-insulating SiC Substrates segment, which is expected to reach US$110.1 Million by 2030 with a CAGR of a 9%. The Conductive SiC Substrates segment is also set to grow at 5.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $26.2 Million in 2024, and China, forecasted to grow at an impressive 12.5% CAGR to reach $32.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global SiC-On-Insulator and Other Substrates Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global SiC-On-Insulator and Other Substrates Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global SiC-On-Insulator and Other Substrates Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

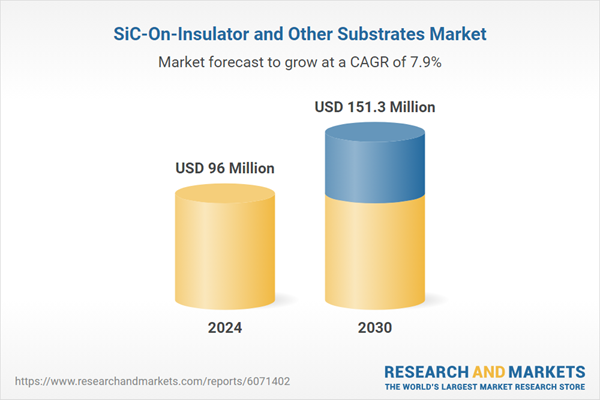

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alpha Laboratories, ASI (Analytical Services International), Atlas Medical, Beam Therapeutics, BioMedomics Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Select Competitors (Total 43 Featured):

- Coherent Corp.

- GeneSiC Semiconductor Inc.

- GlobalWafers Co., Ltd.

- Infineon Technologies AG

- MTI Corporation

- NGK Insulators, Ltd.

- ON Semiconductor Corporation

- Resonac Holdings Corporation

- ROHM Co., Ltd.

- Semiconductor Wafer Inc.

- SICC Co., Ltd.

- SICOXS Corporation

- SiCrystal GmbH

- SK Siltron Co., Ltd.

- Soitec

- STMicroelectronics N.V.

- Sumitomo Electric Industries, Ltd.

- TankeBlue Co., Ltd.

- Wolfspeed, Inc.

- Xiamen Powerway Advanced Material Co.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Coherent Corp.

- GeneSiC Semiconductor Inc.

- GlobalWafers Co., Ltd.

- Infineon Technologies AG

- MTI Corporation

- NGK Insulators, Ltd.

- ON Semiconductor Corporation

- Resonac Holdings Corporation

- ROHM Co., Ltd.

- Semiconductor Wafer Inc.

- SICC Co., Ltd.

- SICOXS Corporation

- SiCrystal GmbH

- SK Siltron Co., Ltd.

- Soitec

- STMicroelectronics N.V.

- Sumitomo Electric Industries, Ltd.

- TankeBlue Co., Ltd.

- Wolfspeed, Inc.

- Xiamen Powerway Advanced Material Co.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 373 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 96 Million |

| Forecasted Market Value ( USD | $ 151.3 Million |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Global |