Global Space Sensors and Actuators Market - Key Trends & Drivers Summarized

Why Are Sensors and Actuators the Unsung Heroes of Spacecraft Functionality?

In the highly specialized and unforgiving environment of space, sensors and actuators play a mission-critical role in enabling autonomous operation, navigation, payload control, and system stability. Despite being less visible than high-profile mission systems, these components form the operational backbone of nearly every space platform - from small CubeSats and high-throughput satellites to deep-space probes and interplanetary rovers. Sensors provide real-time data on parameters such as temperature, pressure, orientation, acceleration, magnetic field, and radiation levels - data that is essential for maintaining spacecraft health, guiding attitude control systems, and protecting sensitive instruments. Actuators, in turn, convert electrical signals into precise mechanical actions - controlling positioning systems, steering mechanisms, robotic arms, and solar panel deployments. As missions grow longer, more complex, and increasingly autonomous, the demand for high-precision, radiation-hardened, and highly reliable sensor-actuator networks continues to rise. Without these components, essential spacecraft functions - like solar tracking, antenna orientation, orbit correction, or sample collection - would be impossible. Their role is even more significant in manned missions, where fail-safe automation is crucial to life support and mission continuity. In essence, sensors and actuators are the invisible link between onboard intelligence and physical response, translating intent into motion and data into action.How Are Emerging Technologies Enhancing the Intelligence and Resilience of Space Components?

Recent advancements in microelectronics, materials science, and system integration are transforming the design and performance of space sensors and actuators. The miniaturization of sensors through MEMS (Micro-Electro-Mechanical Systems) technology is enabling the development of ultra-compact, lightweight, and low-power sensor arrays that are ideal for nanosatellites and multi-sensor constellations. These microdevices can now integrate multiple sensing functions - such as inertial, magnetic, and thermal detection - into a single chip, reducing size and complexity while increasing functional versatility. On the actuator side, piezoelectric, electrostatic, and shape memory alloy-based systems are being adopted for their fast response times, low energy consumption, and resistance to environmental stress. In parallel, the use of wide bandgap semiconductors and advanced shielding techniques is improving the radiation tolerance and operational lifespan of both sensors and actuators. Integration with AI and edge computing platforms is allowing smart sensors to perform local data processing, anomaly detection, and predictive diagnostics, reducing reliance on ground-based control. Modular design principles and standardized interfaces are making it easier to plug and play sensors and actuators into various satellite platforms, streamlining system upgrades and mission customizations. These innovations are reshaping the capabilities of space systems, allowing for more intelligent, autonomous, and mission-adaptive spacecraft.Which Applications and Missions Are Accelerating Demand for Sensing and Actuation Systems?

The expansion of space-based activities across commercial, civil, scientific, and defense domains is generating strong, sustained demand for advanced sensing and actuation technologies. In Earth observation satellites, high-resolution sensors are required for imaging, thermal monitoring, atmospheric data collection, and precision geo-location. Communication satellites rely on actuators for antenna alignment, orbital station-keeping, and thermal control panel adjustments. Space exploration missions, including Mars rovers, asteroid landers, and lunar surface platforms, deploy sophisticated sensor-actuator combinations to navigate terrain, conduct experiments, collect samples, and handle equipment. Human spaceflight systems, such as the International Space Station and future lunar habitats, rely heavily on environmental sensors and automated actuators for life support, robotics, and system safety. The rise of satellite servicing and on-orbit manufacturing has also increased the demand for precise positioning, robotic manipulation, and contact-sensitive force feedback systems - capabilities only possible through tightly integrated sensor-actuator loops. Even missile detection and space situational awareness systems use high-sensitivity optical sensors, gyros, and motion control actuators for surveillance and object tracking. Across these diverse missions, real-time responsiveness, redundancy, and resilience of sensing and actuation components are fundamental to achieving mission objectives and mitigating risks.What Is Driving the Long-term Growth of the Space Sensors and Actuators Market?

The growth in the space sensors and actuators market is driven by a confluence of factors tied to satellite proliferation, autonomous systems, robotic innovation, and mission diversification. A major driver is the explosive rise in small satellite deployments, which require compact, energy-efficient, and highly integrated sensing and actuation systems to support agile maneuvering, payload calibration, and system diagnostics. The transition toward spacecraft autonomy - driven by AI, machine learning, and edge computing - demands sensors that can feed real-time data to onboard systems and actuators that can execute decisions without ground intervention. The ongoing evolution of active payloads, such as reconfigurable antennas, dynamic optics, and robotic instruments, is creating new requirements for precision motion control and adaptive sensing. Defense and surveillance missions are investing in secure, encrypted, and hardened sensor-actuator platforms to withstand electromagnetic and kinetic threats. In the realm of planetary exploration and in-situ resource utilization, the need for smart robotic systems with terrain-adaptive sensors and dexterous actuators is set to grow significantly. Additionally, technological progress in additive manufacturing and component standardization is lowering development and integration costs, making advanced components accessible even to smaller space players. As the space ecosystem becomes more competitive, complex, and reliant on in-orbit autonomy, the demand for robust, multi-functional, and intelligent sensor and actuator systems is poised for sustained, long-term growth.Report Scope

The report analyzes the Space Sensors and Actuators market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Sensors, Actuators); Platform (Satellites Platform, Capsules / Cargos Platform, Interplanetary Spacecraft & Probes Platform, Rovers / Spacecraft Landers Platform, Launch Vehicles Platform); End-Use (Commercial End-Use, Government & Defense End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Sensors segment, which is expected to reach US$4.4 Billion by 2030 with a CAGR of a 10.8%. The Actuators segment is also set to grow at 15.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $973.3 Million in 2024, and China, forecasted to grow at an impressive 12% CAGR to reach $1.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Space Sensors and Actuators Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Space Sensors and Actuators Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Space Sensors and Actuators Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Airbus Defence and Space, Analog Devices Inc., BAE Systems plc, Cobham Limited, Efficient Power Conversion Corporation (EPC) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Space Sensors and Actuators market report include:

- Airbus Defence and Space

- AMETEK, Inc.

- Analog Devices, Inc.

- Cedrat Technologies

- Cobham Limited

- Comat

- CubeSpace Satellite Systems

- Ensign-Bickford Aerospace & Defense Company (EBAD)

- Honeywell International Inc.

- Maxar Technologies Inc.

- MinebeaMitsumi Inc.

- Moog Inc.

- PHI Drive

- Raytheon Technologies Corporation

- Renesas Electronics Corporation

- Space-Lock

- STMicroelectronics N.V.

- TE Connectivity Ltd.

- Teledyne Technologies Incorporated

- Texas Instruments Incorporated

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Airbus Defence and Space

- AMETEK, Inc.

- Analog Devices, Inc.

- Cedrat Technologies

- Cobham Limited

- Comat

- CubeSpace Satellite Systems

- Ensign-Bickford Aerospace & Defense Company (EBAD)

- Honeywell International Inc.

- Maxar Technologies Inc.

- MinebeaMitsumi Inc.

- Moog Inc.

- PHI Drive

- Raytheon Technologies Corporation

- Renesas Electronics Corporation

- Space-Lock

- STMicroelectronics N.V.

- TE Connectivity Ltd.

- Teledyne Technologies Incorporated

- Texas Instruments Incorporated

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 166 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

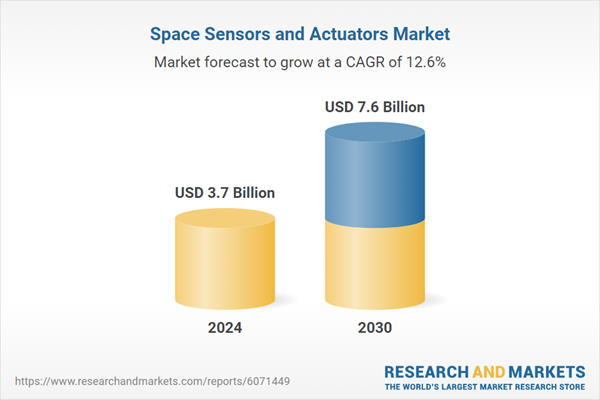

| Estimated Market Value ( USD | $ 3.7 Billion |

| Forecasted Market Value ( USD | $ 7.6 Billion |

| Compound Annual Growth Rate | 12.6% |

| Regions Covered | Global |