Global Sulfur-Based Micronutrients Market - Key Trends & Drivers Summarized

Why Is Sulfur Gaining Renewed Importance in Modern Crop Nutrition?

Sulfur, once an overlooked component in crop nutrition, is now regaining prominence due to its vital role in plant development and the increasing evidence of widespread soil sulfur deficiencies. As farming intensifies and global food demand rises, sulfur-based micronutrients are being re-evaluated for their contribution to protein synthesis, chlorophyll production, enzyme activation, and nitrogen efficiency in crops. Historically, sulfur was available as a byproduct of industrial pollution and fertilizers, but cleaner air regulations have led to a significant reduction in atmospheric sulfur deposition, causing measurable drops in natural soil sulfur levels. As a result, deficiency symptoms - such as pale leaves, stunted growth, and reduced yields - are becoming more common, especially in high-yield, high-input systems. Sulfur is also crucial for oilseed crops like canola, legumes, and cruciferous vegetables, which have a particularly high sulfur demand. In regions with sandy soils or high rainfall, leaching further exacerbates sulfur loss. These agronomic realities are driving a surge in demand for sulfur-based fertilizers and micronutrients tailored to specific crops and geographies, positioning sulfur not as a secondary nutrient, but as a critical factor in sustainable yield optimization and soil fertility restoration.How Are Technological Advancements Improving Sulfur Micronutrient Delivery?

Technological innovations in fertilizer formulation and application are playing a transformative role in enhancing the efficiency and uptake of sulfur-based micronutrients. Modern sulfur products are increasingly designed for controlled or slow release, ensuring steady nutrient availability throughout the crop cycle and minimizing leaching losses. Micronized elemental sulfur, sulfur-coated urea, and sulfate-based compounds are now being tailored with advanced granulation and dispersion technologies that improve solubility, uniformity, and compatibility with other nutrients. These technologies ensure that sulfur is available in the right form - whether as elemental sulfur requiring microbial oxidation, or as readily available sulfates - depending on crop and soil conditions. Precision agriculture is also changing the landscape: variable-rate technology (VRT), soil mapping, and sensor-based nutrient monitoring are enabling farmers to identify sulfur-deficient zones and apply tailored solutions at scale. Furthermore, the integration of sulfur with other micronutrients like zinc, boron, or magnesium is becoming more common, promoting synergistic uptake and reducing labor costs through one-pass applications. These innovations are not only improving crop response but also making sulfur nutrition more cost-effective and environmentally aligned with regenerative agriculture practices.What Role Do Environmental and Regulatory Pressures Play in Market Expansion?

Environmental sustainability concerns and evolving regulatory frameworks are significantly influencing the sulfur-based micronutrients market. As policymakers and consumers push for climate-resilient and low-impact farming methods, sulfur is being recognized for its role in enhancing nutrient use efficiency, particularly nitrogen. Proper sulfur management reduces nitrogen losses to the environment, thereby curbing greenhouse gas emissions and nitrate leaching into water bodies - two major concerns in intensive agriculture. In Europe, the Common Agricultural Policy (CAP) encourages nutrient stewardship, including balanced sulfur application, while countries like India and China are promoting sulfur-enriched fertilizers through national subsidy programs and soil health initiatives. Fertilizer manufacturers are also responding to market and regulatory pressure by developing eco-labeled and low-emission sulfur fertilizers. Moreover, climate change itself is altering sulfur dynamics in soil - drought conditions, for instance, can reduce microbial oxidation of elemental sulfur, necessitating more soluble or bioavailable forms. Certification programs for organic and sustainable agriculture are further validating sulfur-based products derived from natural sources or designed to meet clean-label criteria. All of these regulatory and environmental levers are accelerating the adoption of sulfur-based micronutrients across conventional, precision, and organic farming systems worldwide.What's Driving Global Demand for Sulfur-Based Micronutrients Across Farming Regions?

The growth in the sulfur-based micronutrients market is driven by several factors tied to soil health trends, crop diversification, technological adoption, and macroeconomic influences in agriculture. Rising soil degradation and widespread sulfur deficiency - especially in high-yielding agricultural belts of North America, South Asia, and Sub-Saharan Africa - are creating urgent demand for corrective inputs. As farmers aim to boost productivity while maintaining soil fertility, sulfur is becoming indispensable in balanced fertilizer programs. The shift toward high-value crops like oilseeds, pulses, fruits, and vegetables - which are sulfur-sensitive - is amplifying market need. Additionally, the intensification of crop cycles and reduced fallow periods are depleting sulfur faster than it can naturally regenerate, increasing reliance on targeted inputs. Technological advancements in micronutrient blending, soil diagnostics, and GPS-guided application are making sulfur products more accessible and precise in use. Moreover, global trade in specialty fertilizers is expanding, supported by infrastructure improvements and digital ag platforms that educate farmers and streamline logistics. Government policies that encourage micronutrient application - through subsidies, crop-specific guidelines, and soil testing mandates - are further catalyzing adoption. Coupled with growing awareness of nutrient interactions and environmental sustainability, these factors are collectively driving a robust, geographically diversified growth trajectory for sulfur-based micronutrients.Report Scope

The report analyzes the Sulfur-based Micronutrients market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Sulfur-Bentonite, Sulfur-Bentonite-Zinc, Sulfur-Bentonite-Molybdenum, Sulfur-Bentonite-Manganese, Sulfur-Bentonite-Iron, Other Types); Application (Oilseeds & Pulses Application, Cereals & Grains Application, Fruits & Vegetables Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Sulfur-Bentonite segment, which is expected to reach US$160.7 Million by 2030 with a CAGR of a 5.7%. The Sulfur-Bentonite-Zinc segment is also set to grow at 5.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $118.7 Million in 2024, and China, forecasted to grow at an impressive 9.9% CAGR to reach $128.8 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Sulfur-based Micronutrients Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Sulfur-based Micronutrients Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Sulfur-based Micronutrients Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

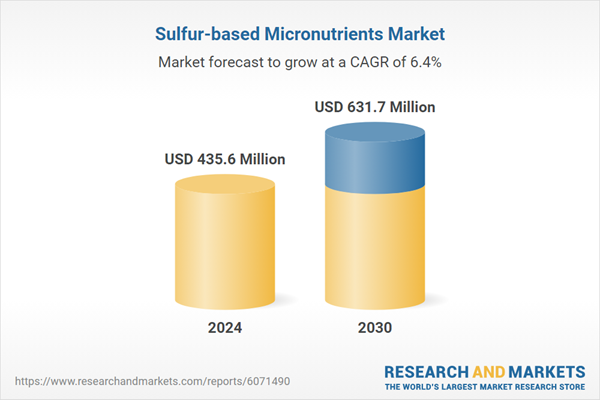

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AmazonBasics, American Tourister, Antler, Away, Away and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Sulfur-based Micronutrients market report include:

- Agrium (now part of Nutrien)

- Aries Agro Limited

- BASF SE

- Compass Minerals International, Inc.

- Coromandel International Limited

- Deepak Fertilisers and Petrochemicals

- Haifa Group

- Helena Agri-Enterprises, LLC

- ICL Group Ltd.

- K+S Group

- Koch Agronomic Services

- Kugler Company

- Nufarm Ltd.

- Nutrien Ltd.

- SQM (Sociedad Química y Minera)

- The Mosaic Company

- Valagro S.p.A.

- Van Iperen International

- Yara International ASA

- Zuari Agro Chemicals Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Agrium (now part of Nutrien)

- Aries Agro Limited

- BASF SE

- Compass Minerals International, Inc.

- Coromandel International Limited

- Deepak Fertilisers and Petrochemicals

- Haifa Group

- Helena Agri-Enterprises, LLC

- ICL Group Ltd.

- K+S Group

- Koch Agronomic Services

- Kugler Company

- Nufarm Ltd.

- Nutrien Ltd.

- SQM (Sociedad Química y Minera)

- The Mosaic Company

- Valagro S.p.A.

- Van Iperen International

- Yara International ASA

- Zuari Agro Chemicals Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 285 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 435.6 Million |

| Forecasted Market Value ( USD | $ 631.7 Million |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |