Global Sustainable Adhesives Market - Key Trends & Drivers Summarized

What's Triggering the Shift from Conventional to Sustainable Adhesive Solutions?

As sustainability becomes a strategic imperative rather than a niche commitment, the adhesives industry is undergoing a paradigm shift. Traditional adhesives, largely derived from petroleum-based feedstocks, pose significant environmental and health challenges - both in terms of raw material sourcing and post-use disposal. In response, industries ranging from packaging to construction are embracing bio-based, biodegradable, and low-VOC adhesive solutions. This transition is particularly pronounced in Europe and North America, where stringent environmental regulations and consumer expectations are accelerating the demand for green alternatives. Brands are now under increasing pressure to ensure that every element of their product, including adhesives used in assembly or packaging, aligns with broader sustainability claims. Bio-based adhesives - formulated using starch, lignin, casein, soy, and natural rubber - are finding favor due to their reduced environmental footprint and compatibility with circular economy models. In high-performance sectors such as automotive and electronics, hybrid solutions that combine synthetic and bio-based materials are gaining ground, allowing manufacturers to strike a balance between sustainability and functionality. Furthermore, growing public awareness around microplastics and chemical leaching has brought hidden adhesive layers into the spotlight, turning consumer scrutiny into a strong market force. Overall, the shift is no longer about product differentiation - it's about market access and regulatory compliance.How Are Regulations and Material Science Innovations Disrupting the Adhesive Value Chain?

Regulatory frameworks such as REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in Europe and TSCA (Toxic Substances Control Act) in the U.S. are reshaping the adhesive industry's material landscape. These directives are increasingly restricting or banning volatile organic compounds (VOCs), formaldehyde, phthalates, and other hazardous substances traditionally used in adhesive formulations. As a result, R&D labs are now focused on developing next-generation adhesives that comply with evolving environmental and health standards without compromising performance. Innovations in green chemistry are enabling this transition - researchers are leveraging enzymatic polymerization, click chemistry, and advanced cross-linking techniques to design adhesives with tunable properties and lower ecological footprints. Pressure-sensitive adhesives (PSAs) used in labels and tapes are now being reformulated with water-based or solvent-free technologies, while reactive hot-melt adhesives are gaining popularity in furniture and construction applications due to their strong bonding capabilities and reduced emissions. The recycling compatibility of adhesives is also emerging as a critical issue, particularly in the packaging industry, where clean separation of bonded layers is essential for efficient reprocessing. Adhesive manufacturers are responding by designing 'washable' or 'switchable' adhesives that debond under specific conditions, facilitating recycling and reuse. This convergence of regulatory compliance and material innovation is creating a new class of adhesives that not only meet sustainability criteria but also enhance the overall life-cycle performance of end products.Can End-Use Demand and Circular Economy Goals Reshape Adhesive Application Trends?

End-use industries are playing a pivotal role in reshaping how and where sustainable adhesives are applied. In the packaging sector, especially within food and consumer goods, there is growing demand for compostable and recyclable adhesive solutions that align with plastic-free and zero-waste packaging initiatives. Flexible packaging, once reliant on solvent-based adhesives, is now transitioning toward water-borne and bio-based alternatives to meet recyclability goals. Similarly, in the automotive industry, lightweighting and modularity trends are pushing the need for adhesives that are not only environmentally friendly but also capable of bonding dissimilar materials like composites, plastics, and aluminum - without adding unnecessary weight. Electronics manufacturers are exploring sustainable adhesives for PCB assembly and thermal management that meet RoHS (Restriction of Hazardous Substances) directives while ensuring high reliability and low outgassing. Construction adhesives are witnessing a similar evolution, as green building certifications such as LEED and BREEAM encourage the use of low-emission and renewable-content bonding agents in flooring, insulation, and wall systems. Even the textile and footwear industries, historically heavy users of solvent-based adhesives, are undergoing transformation due to consumer demand for vegan and non-toxic materials. The circular economy agenda is acting as a cohesive force across all these sectors, prompting stakeholders to seek adhesives that enable material disassembly, enhance recyclability, and reduce lifecycle emissions. In this landscape, sustainability is no longer an add-on - it is fundamentally redefining adhesive application strategies.Why Is the Sustainable Adhesives Market Gaining Traction Across Diverse Fronts?

The growth in the sustainable adhesives market is driven by several factors spanning technology innovation, end-use industry shifts, evolving consumer behavior, and global policy alignment. Technologically, the emergence of bio-based polymers, solvent-free formulations, and advanced water-based systems is enabling performance parity with traditional adhesives, removing key barriers to adoption. On the industry front, sectors such as packaging, automotive, construction, electronics, and healthcare are all pursuing carbon neutrality and waste reduction goals - creating targeted demand for adhesives that align with sustainability criteria. In packaging, for instance, mono-material designs and compostable laminates rely heavily on compatible sustainable adhesive systems to ensure functional integrity. In construction, sustainable adhesives contribute directly to indoor air quality standards and green building certifications. From a consumer perspective, rising awareness around product toxicity and environmental impact is translating into preferences for products labeled “low-VOC,” “bio-based,” or “safe for recycling,” creating downstream demand pressure on manufacturers and brands. The integration of sustainable adhesives into product design is also becoming a differentiator in B2B procurement, particularly for companies with public sustainability disclosures. Furthermore, government procurement policies, ecolabeling mandates, and sustainability-linked financing are reinforcing this demand trajectory, incentivizing manufacturers to scale up eco-conscious adhesive offerings. The market's growth is thus not a linear trend, but the result of intersecting shifts across material science, application engineering, compliance frameworks, and stakeholder expectations - all converging to drive a robust and multi-dimensional expansion of the sustainable adhesives industry.Report Scope

The report analyzes the Sustainable Adhesives market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Recyclable Adhesives, Renewable Adhesives, Biodegradable Adhesives, Green Adhesives, Other Adhesives); Raw Material (Water-based Raw Material, Plant-based Raw Material, EVA-based Raw Material Raw Material, Acrylic-based Raw Material, Other Raw Materials); End-Use (Packaging End-Use, Woodworking End-Use, Construction End-Use, Medical End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Recyclable Adhesives segment, which is expected to reach US$1.1 Billion by 2030 with a CAGR of a 3%. The Renewable Adhesives segment is also set to grow at 2.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $759.1 Million in 2024, and China, forecasted to grow at an impressive 6.2% CAGR to reach $671.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Sustainable Adhesives Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Sustainable Adhesives Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Sustainable Adhesives Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

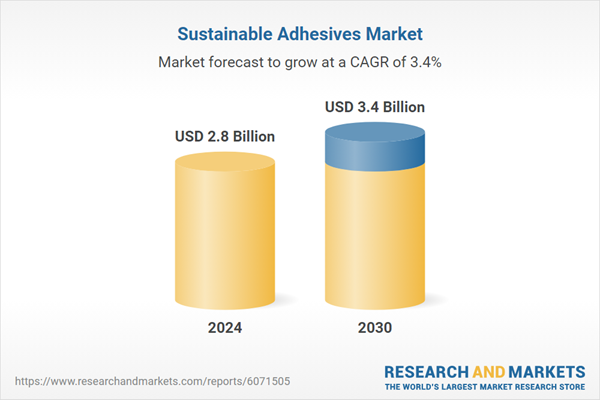

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Arlo Technologies, Inc., Avigilon (Motorola Solutions), Axis Communications AB (Canon Inc.), Bosch Sicherheitssysteme GmbH (Robert Bosch GmbH), CP PLUS GmbH & Co. KG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Sustainable Adhesives market report include:

- 3M Company

- Arkema (Bostik)

- Artimelt AG

- Avery Dennison Corporation

- BASF SE

- Beardow Adams

- Biophilica Ltd.

- Cargill Incorporated

- Dow Inc.

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Ingredion Incorporated

- Jowat SE

- LD Davis Industries

- Master Bond Inc.

- Paramelt B.V.

- Permabond LLC

- Sika AG

- Synthos S.A.

- Weiss Chemie + Technik GmbH

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- Arkema (Bostik)

- Artimelt AG

- Avery Dennison Corporation

- BASF SE

- Beardow Adams

- Biophilica Ltd.

- Cargill Incorporated

- Dow Inc.

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Ingredion Incorporated

- Jowat SE

- LD Davis Industries

- Master Bond Inc.

- Paramelt B.V.

- Permabond LLC

- Sika AG

- Synthos S.A.

- Weiss Chemie + Technik GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 399 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.8 Billion |

| Forecasted Market Value ( USD | $ 3.4 Billion |

| Compound Annual Growth Rate | 3.4% |

| Regions Covered | Global |