Global Sustainable Aviation Fuel Market - Key Trends & Drivers Summarized

Why Is Sustainable Aviation Fuel Gaining Altitude in the Aviation Industry?

The aviation industry, long viewed as a hard-to-abate sector due to its reliance on high energy-density fossil fuels, is now rapidly transitioning toward decarbonization - and sustainable aviation fuel (SAF) lies at the heart of this transformation. With global passenger air travel recovering post-pandemic and international cargo volumes rising, emissions from aviation are projected to surge unless aggressively mitigated. SAF offers a viable and immediate pathway to reducing lifecycle carbon emissions by up to 80% compared to conventional jet fuel. Unlike other decarbonization technologies like hydrogen or electric propulsion, SAF is a “drop-in” fuel, compatible with existing aircraft engines and fueling infrastructure, enabling near-term impact with minimal operational disruption. Leading airlines, in response to net-zero pledges and mounting investor pressure, are incorporating SAF into their fuel mix and forming long-term offtake agreements to secure supply. Several major airports and fuel suppliers have begun integrating SAF blending and distribution facilities, especially in North America and Europe, establishing early-stage ecosystems for sustainable fueling. Moreover, SAF adoption is no longer confined to commercial aviation; business jets and cargo carriers are joining the shift, further expanding the addressable market. With growing awareness among climate-conscious travelers and corporate clients, SAF is increasingly seen not just as a compliance strategy but as a competitive differentiator in airline sustainability branding.How Are Policies, Carbon Markets, and Mandates Reshaping the SAF Market Landscape?

Government regulations and international frameworks are playing a pivotal role in steering the SAF market from niche to mainstream. In Europe, the ReFuelEU Aviation initiative mandates minimum SAF blending quotas beginning in 2025, with targets set to increase steadily through 2050. The U.S., through the Inflation Reduction Act and the Sustainable Aviation Fuel Grand Challenge, offers substantial tax credits and R&D incentives to scale domestic SAF production. Meanwhile, ICAO's CORSIA framework, aimed at offsetting international aviation emissions, is pushing airlines to invest in cleaner fuels to meet voluntary and soon-to-be-mandatory carbon reduction targets. Carbon pricing mechanisms, both current and emerging, are increasing the cost of emitting, further enhancing the economic case for SAF as a low-carbon alternative. Voluntary carbon markets are also becoming more sophisticated, allowing airlines and corporations to purchase SAF certificates or participate in book-and-claim systems that decouple SAF use from geography. These mechanisms allow entities to claim emissions reductions, even if SAF isn't available at their local airport. National fuel blending mandates, renewable energy targets, and clean fuel standards in countries like Norway, Japan, and Canada are further globalizing the SAF movement. As policy clarity improves, investor confidence in the scalability of SAF ventures is also increasing, unlocking capital flows into refinery development and advanced conversion technologies.Is Feedstock Innovation and Technological Diversification Unlocking the Next Wave of SAF Growth?

A critical enabler of SAF market scalability is the expansion and diversification of feedstocks and conversion pathways. Today's SAF can be produced through multiple technological routes - HEFA (Hydroprocessed Esters and Fatty Acids), FT-SPK (Fischer-Tropsch Synthetic Paraffinic Kerosene), ATJ (Alcohol-to-Jet), and emerging technologies such as Power-to-Liquid (PtL) and Gasification of Municipal Solid Waste. HEFA, currently the most commercially viable pathway, relies heavily on used cooking oil and animal fats, but its scalability is constrained by limited feedstock availability. This bottleneck has spurred research and commercial investment into non-traditional and second-generation sources such as algae, lignocellulosic biomass, forestry residues, and even CO2-derived synthetic fuels. These innovations are supported by advancements in catalysis, microbial engineering, and process intensification, which are lowering costs and improving fuel yields. Simultaneously, modular biorefineries and co-processing strategies are being piloted to decentralize SAF production and make use of regional waste streams. Engine manufacturers are also validating 100% SAF compatibility, laying the foundation for eventual full replacement of fossil jet fuel. Technology-specific pathways offer varying benefits in terms of GHG reduction potential, cost structure, and regional feasibility - creating a dynamic and competitive innovation landscape. As pathways diversify and new players enter, the SAF market is moving beyond a one-size-fits-all approach, accelerating both geographic reach and volume output.What's Powering the Market Momentum Behind Sustainable Aviation Fuel?

The growth in the sustainable aviation fuel market is driven by several factors spanning technology readiness, evolving end-use demand, shifting consumer behavior, and global sustainability alignment. On the technology front, significant strides in feedstock-to-fuel conversion efficiency, catalyst design, and modular SAF plant deployment are reducing production costs and enhancing scalability. The aviation sector itself is undergoing structural transformation, with airlines, OEMs, and fuel suppliers integrating SAF targets into strategic planning and product design. Major air carriers are incorporating SAF procurement into their long-term carbon strategies, often bundled with carbon offsetting and digital emissions tracking tools. Business travel buyers and corporate clients are pressuring airlines to offer SAF-backed flight options to meet internal ESG benchmarks. In the logistics space, global cargo carriers and e-commerce giants are embedding SAF into their sustainable logistics frameworks. At the consumer level, increasing awareness around “flight shame” and carbon footprints is influencing purchasing decisions - particularly among millennials and Gen Z - creating downstream pressure for airlines to act. Furthermore, access to sustainability-linked loans, green bonds, and public-private funding partnerships is enabling capital-intensive SAF projects to reach financial close. The convergence of these factors - technological validation, multi-sectoral demand, informed consumers, and supportive finance - is collectively fueling an upward trajectory for the SAF market that is expected to continue intensifying over the next two decades.Report Scope

The report analyzes the Sustainable Aviation Fuel market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Biofuel, Hydrogen Fuel Cell, Power to Liquid Fuel, Gas to Liquid Fuel); Blending Capacity (Below 30% Blending Capacity, 30% - 50% Blending Capacity, Above 50% Blending Capacity); Platform (Commercial Aviation, Military Aviation, Business & General Aviation, Unmanned Aerial Vehicles).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Biofuel segment, which is expected to reach US$6.6 Billion by 2030 with a CAGR of a 51.5%. The Hydrogen Fuel Cell segment is also set to grow at 49.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $429.5 Million in 2024, and China, forecasted to grow at an impressive 58.1% CAGR to reach $4.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Sustainable Aviation Fuel Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Sustainable Aviation Fuel Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Sustainable Aviation Fuel Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M Company, Arkema (Bostik), Artimelt AG, Avery Dennison Corporation, BASF SE and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Sustainable Aviation Fuel market report include:

- Aemetis, Inc.

- Alder Fuels

- Avfuel Corporation

- BP plc

- Eni S.p.A.

- Fulcrum BioEnergy, Inc.

- Gevo Inc.

- Honeywell International Inc.

- LanzaJet Inc.

- Montana Renewables

- Neste Oyj

- OMV Aktiengesellschaft

- Red Rock Biofuels

- SG Preston Company

- Shell plc

- SkyNRG

- Swedish Biofuels AB

- TotalEnergies SE

- Velocys plc

- World Energy

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aemetis, Inc.

- Alder Fuels

- Avfuel Corporation

- BP plc

- Eni S.p.A.

- Fulcrum BioEnergy, Inc.

- Gevo Inc.

- Honeywell International Inc.

- LanzaJet Inc.

- Montana Renewables

- Neste Oyj

- OMV Aktiengesellschaft

- Red Rock Biofuels

- SG Preston Company

- Shell plc

- SkyNRG

- Swedish Biofuels AB

- TotalEnergies SE

- Velocys plc

- World Energy

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 381 |

| Published | February 2026 |

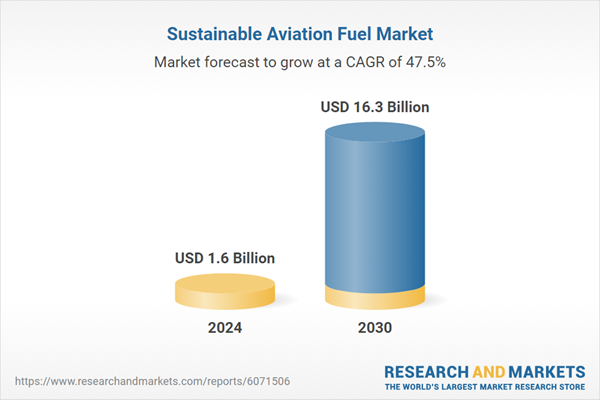

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.6 Billion |

| Forecasted Market Value ( USD | $ 16.3 Billion |

| Compound Annual Growth Rate | 47.5% |

| Regions Covered | Global |