Global Utility Markers Market - Key Trends & Drivers Summarized

Is Infrastructure Modernization Fueling the Demand for Advanced Utility Markers?

With rapid urbanization and a renewed global focus on infrastructure modernization, the need to accurately locate and protect underground utilities has never been more critical - driving strong demand for utility markers. These markers play a vital role in identifying buried cables, gas lines, water pipes, fiber optics, and other underground infrastructure to prevent accidental damage during excavation or construction activities. As governments and private players invest in large-scale infrastructure projects such as smart cities, renewable energy grids, and telecommunications networks, accurate utility location is a top priority. Utility markers, both passive and electronic, help reduce service disruptions, safety incidents, and costly repairs by providing clear, long-lasting identification of subsurface assets. The expansion of utility infrastructure in emerging markets, where rapid urban growth often outpaces digital recordkeeping, is further fueling the need for physical and radio-frequency identification (RFID) markers. Regulatory mandates and safety standards are also pushing utility companies and contractors to adopt more reliable and visible marking systems. As infrastructure networks become more complex and densely packed underground, utility markers are no longer optional - they are essential tools in ensuring the safe, efficient, and cost-effective management of buried assets.How Are Material Innovations and Technology Integration Enhancing Marker Performance?

Utility marker manufacturers are increasingly integrating advanced materials and smart technologies to improve durability, readability, and detection accuracy. Traditional plastic or metal markers are being replaced or supplemented with weather-resistant, UV-stabilized, and impact-resistant materials that can withstand harsh environmental conditions for years without degradation. In parallel, electronic markers - also known as electronic marker systems (EMS) - have become more prevalent, using passive RFID signals that can be precisely located using handheld detectors. These systems allow utility operators to identify not just the location, but also the type and depth of buried infrastructure, reducing guesswork and excavation risks. Color-coded and barcoded markers help field crews rapidly identify asset categories according to global or regional standards (e.g., red for electric, blue for water, yellow for gas). New developments are also focusing on GPS-enabled smart markers that link physical locations to cloud-based asset management systems, improving mapping accuracy and integration with GIS platforms. Additionally, biodegradable marker options are emerging in environmentally sensitive areas to minimize long-term ecological impact. These innovations are driving a transformation in how utility networks are marked and managed - making markers smarter, stronger, and better aligned with the needs of a digital, connected infrastructure environment.Are Regulatory Standards and Safety Initiatives Reshaping Industry Adoption Patterns?

The growing enforcement of excavation safety regulations and utility locating standards is reshaping adoption patterns in the utility markers market. Programs such as 'Call Before You Dig' (811 in the U.S.) and similar initiatives in Canada, the UK, Australia, and other countries mandate pre-excavation utility location to avoid service interruptions and accidents. As a result, municipalities, utility providers, and civil engineering firms are under pressure to ensure accurate and accessible underground asset identification - fueling the routine use of markers in both new installations and retroactive labeling of legacy networks. Industry bodies such as the American Public Works Association (APWA) and Occupational Safety and Health Administration (OSHA) have established standardized color codes and protocols for utility marking, driving market uniformity and compliance. Moreover, in the wake of climate-related disasters and infrastructure stress, governments are prioritizing the protection of critical underground assets such as power and water lines, further emphasizing the role of utility markers in resilience planning. Insurance requirements and contractor liability considerations are also contributing to more stringent utility mapping and marking practices. These regulatory and safety frameworks are creating a structured environment that strongly incentivizes the use of high-quality, compliant, and tamper-resistant utility markers across industries.What Forces Are Powering the Global Growth of the Utility Markers Market?

The growth in the utility markers market is driven by an interplay of infrastructure development, safety regulations, technological progress, and the digitization of asset management. A core driver is the ongoing expansion and rehabilitation of underground utility networks - spanning energy, water, gas, telecommunications, and sewer systems - which require accurate, long-term location marking for safe operation and maintenance. Rising excavation activities linked to urban development, smart city initiatives, and 5G fiber rollout projects are adding complexity to subsurface environments, further elevating the demand for precise marking systems. Technological advancements in EMS markers, RFID-based solutions, and GPS-integrated smart markers are making these tools more versatile and easier to integrate with digital asset databases and GIS systems. The emergence of predictive maintenance and digital twin models for utility infrastructure is also pushing utility companies to improve the granularity and traceability of underground assets through reliable marking solutions. Growing awareness around worker safety, environmental protection, and operational efficiency is increasing the value proposition of utility markers in both public and private sector projects. As global infrastructure investment accelerates and underground networks become more interconnected and data-driven, these converging trends are expected to fuel long-term growth and innovation in the global utility markers market.Report Scope

The report analyzes the Utility Markers market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Ball Markers, Disk Markers, Tape Markers, Spike Markers, Other Markers); Configuration (Passive Configuration, Programmable Configuration); Utility Type (Gas Utilities, Power Utilities, Telecommunications, Water & Wastewater Utilities, Other Utility Types).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Ball Markers segment, which is expected to reach US$191.1 Million by 2030 with a CAGR of a 6.8%. The Disk Markers segment is also set to grow at 6.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $96.2 Million in 2024, and China, forecasted to grow at an impressive 9.3% CAGR to reach $100.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Utility Markers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Utility Markers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Utility Markers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

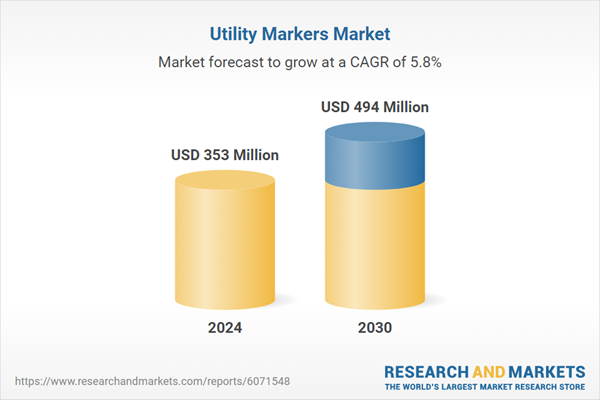

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AMI - Agency for Medical Innovations, Aspen Surgical, B. Braun Melsungen AG, Blue Endo, Clinical Innovations, LLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Utility Markers market report include:

- 3M Company

- Avery Dennison Corporation

- Berntsen International, Inc.

- Carsonite Composites

- Ennis Traffic Safety Solutions

- Farwest Corrosion Control Company

- Forestry Suppliers, Inc.

- Fox Valley Paint

- Full Source LLC

- Grainger Industrial Supply

- Hexatronic Group AB

- J. P. Nissen Co

- Komplex

- LEM Products, Inc.

- ProMark Utility Supply

- Radiodetection Ltd.

- Rhino Marking & Protection Systems

- Rycom Instruments, Inc.

- Seton

- TAPCO (Traffic and Parking Control Co., LLC)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- Avery Dennison Corporation

- Berntsen International, Inc.

- Carsonite Composites

- Ennis Traffic Safety Solutions

- Farwest Corrosion Control Company

- Forestry Suppliers, Inc.

- Fox Valley Paint

- Full Source LLC

- Grainger Industrial Supply

- Hexatronic Group AB

- J. P. Nissen Co

- Komplex

- LEM Products, Inc.

- ProMark Utility Supply

- Radiodetection Ltd.

- Rhino Marking & Protection Systems

- Rycom Instruments, Inc.

- Seton

- TAPCO (Traffic and Parking Control Co., LLC)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 384 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 353 Million |

| Forecasted Market Value ( USD | $ 494 Million |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |