Global Plastic Resin Market - Key Trends & Drivers Summarized

The plastic resin market is experiencing significant growth, driven by expanding applications in packaging, automotive, healthcare, construction, and consumer goods. Plastic resins serve as the base material for manufacturing a wide range of plastic products, offering lightweight, durable, and cost-effective solutions across multiple industries. With the increasing global demand for high-performance plastics, manufacturers are investing in innovative resin formulations, bio-based alternatives, and sustainable recycling solutions to meet evolving market needs.One of the most prominent trends shaping the market is the shift toward biodegradable and bio-based resins. As environmental concerns and government regulations on plastic waste intensify, industries are adopting plant-derived resins such as polylactic acid (PLA), polyhydroxyalkanoates (PHA), and bio-based polyethylene (PE) and polypropylene (PP). These eco-friendly alternatives offer comparable mechanical properties to conventional petroleum-based resins while reducing carbon footprint and landfill waste. Major brands in packaging and FMCG sectors are increasingly using compostable plastic resins to comply with sustainability initiatives and plastic bans.

Another key driver is the growing demand for high-performance engineered resins in automotive, aerospace, and electronics sectors. Advanced polymer materials such as polyether ether ketone (PEEK), polycarbonate (PC), acrylonitrile butadiene styrene (ABS), and thermoplastic polyurethanes (TPU) are replacing traditional materials due to their high strength, heat resistance, chemical resistance, and lightweight properties. These high-performance plastics are essential for lightweight vehicle manufacturing, electric vehicle (EV) battery casings, medical device components, and 5G telecommunications equipment.

Furthermore, plastic resin recycling and circular economy initiatives are reshaping market dynamics. The emergence of mechanical and chemical recycling technologies has enabled post-consumer and post-industrial plastic waste to be converted into high-quality resins for reuse in packaging, textiles, and automotive interiors. Companies are investing in recycled PET (rPET), recycled PP, and recycled polyethylene resins to meet corporate sustainability goals and regulatory mandates on recycled content in plastic products.

How Are Technological Innovations Transforming Plastic Resin Manufacturing?

Advancements in polymer chemistry, nanotechnology, and resin processing techniques are driving the development of next-generation plastic resins with enhanced properties, sustainability, and performance. Innovations in catalyst technology, bio-polymer synthesis, and additive manufacturing are enabling the production of stronger, lighter, and more versatile plastic resins.One of the most significant breakthroughs is the development of smart polymers and self-healing resins. These materials exhibit adaptive properties, such as shape memory, self-repairing capabilities, and responsiveness to environmental stimuli (e.g., heat, light, or pH changes). Smart resins are being integrated into self-healing coatings, aerospace components, and medical implants, offering improved longevity and reduced maintenance costs.

Another major innovation is chemical recycling and depolymerization technology, which allows for plastic waste to be broken down into monomers and repolymerized into virgin-quality resins. Unlike traditional mechanical recycling, chemical recycling processes retain the structural integrity of plastic resins, making them suitable for food-grade applications and high-performance engineering plastics. Companies are leveraging advanced pyrolysis, enzymatic depolymerization, and solvent-based recycling techniques to enhance the circularity of plastic materials.

Additionally, 3D printing and additive manufacturing are expanding the applications of custom-engineered plastic resins. The introduction of high-performance thermoplastic filaments, liquid resins, and reinforced polymer composites is enabling on-demand manufacturing of complex plastic parts in aerospace, healthcare, and industrial tooling. Advanced materials such as carbon fiber-reinforced PEEK, UV-curable photopolymers, and biodegradable PLA blends are enhancing the mechanical strength and precision of 3D-printed plastic components.

Moreover, nanocomposites and polymer blending technologies are improving the mechanical, thermal, and barrier properties of plastic resins. The incorporation of graphene, carbon nanotubes, and nano-clay reinforcements is creating ultra-strong, lightweight plastic materials suitable for automotive, defense, and high-temperature applications. Innovations in polymer alloying and hybrid resin formulations are also expanding the possibilities for tailored material performance in consumer electronics, industrial coatings, and biocompatible medical devices.

What Are the Key Market Applications Driving Plastic Resin Demand?

The plastic resin market is highly diverse, with applications spanning packaging, automotive, construction, healthcare, electronics, and consumer goods. Each industry is driving demand for specialized resin formulations that meet performance, cost, and regulatory requirements.The packaging sector remains the largest consumer of plastic resins, accounting for a significant share of global resin production. Materials such as polyethylene terephthalate (PET), polypropylene (PP), high-density polyethylene (HDPE), and polystyrene (PS) are widely used in food packaging, beverage containers, flexible films, and industrial packaging. The rise of sustainable packaging solutions, including compostable and recycled plastic resins, is reshaping the future of plastic packaging.

In the automotive industry, the push for lightweight vehicles and fuel efficiency has led to increased use of plastic resins to replace metal components. High-performance polymers such as polyamide (PA), polycarbonate (PC), thermoplastic elastomers (TPE), and polyurethane (PU) are used in interior trims, under-the-hood components, structural reinforcements, and electric vehicle battery enclosures. The transition to electric and hybrid vehicles is further accelerating demand for heat-resistant, flame-retardant, and lightweight plastic resins.

The healthcare and medical device industry is another major consumer of medical-grade plastic resins. Materials such as polyether ether ketone (PEEK), polyethylene (PE), and polyvinyl chloride (PVC) are used in surgical instruments, medical tubing, implantable devices, and drug-delivery systems. The demand for biocompatible, sterilizable, and antimicrobial plastic resins is growing due to stringent regulatory requirements and advancements in medical technology.

In the electronics and electrical industry, plastic resins are essential for insulation, circuit boards, enclosures, and heat-resistant components. High-performance thermoplastics such as polyphenylene sulfide (PPS), liquid crystal polymers (LCP), and polyimides (PI) are enabling miniaturization, high-temperature stability, and enhanced electrical performance in 5G infrastructure, semiconductors, and IoT devices.

What Factors Are Driving the Growth of the Plastic Resin Market?

The growth in the plastic resin market is driven by several factors, including technological advancements in polymer manufacturing, increasing demand for high-performance and sustainable resins, regulatory policies on plastic waste, and shifting consumer preferences toward recyclable materials.One of the major market drivers is the growing emphasis on sustainability and circular economy principles. Governments and corporations worldwide are implementing plastic waste reduction policies, mandating recycled content in plastic products, and promoting compostable alternatives. This has led to increased investments in bio-based resins, chemical recycling infrastructure, and advanced waste management solutions.

Another key factor is the rising demand for lightweight, durable materials in the automotive and aerospace sectors. As electric vehicle production scales up and fuel efficiency regulations tighten, the need for high-strength, heat-resistant plastic resins is expanding. Manufacturers are focusing on thermoplastics and composites that reduce vehicle weight while maintaining structural integrity.

Additionally, innovation in polymer chemistry and advanced manufacturing techniques is enabling the development of next-generation resins with enhanced performance and lower environmental impact. The rise of smart plastics, conductive polymers, and antimicrobial resins is driving new applications in healthcare, electronics, and industrial automation.

As industries continue to prioritize material efficiency, regulatory compliance, and sustainability, the plastic resin market is poised for sustained growth. Companies that invest in cutting-edge polymer science, sustainable material innovation, and recycling technologies will lead the next phase of plastic industry transformation, ensuring a more sustainable and high-performance future for plastic resins.

Report Scope

The report analyzes the Plastic Resins market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product (Crystalline Resin, Non-crystalline Resin, Engineering Plastics, Super Engineering Plastics); Application (Packaging, Automotive, Construction, Electrical & Electronics, Logistics, Consumer Goods, Textiles & Clothing, Furniture & Bedding, Agriculture, Medical Devices, Others).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Crystalline Resin segment, which is expected to reach US$389.1 Billion by 2030 with a CAGR of a 2.3%. The Non-crystalline Resin segment is also set to grow at 3.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $229.1 Billion in 2024, and China, forecasted to grow at an impressive 5.4% CAGR to reach $193.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Plastic Resins Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Plastic Resins Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Plastic Resins Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alpek, BASF SE, Braskem, Celanese Corporation, Chevron Phillips Chemical and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Plastic Resins market report include:

- Alpek

- BASF SE

- Braskem

- Celanese Corporation

- Chevron Phillips Chemical

- Covestro AG

- Dow Chemical Company

- Evonik Industries

- ExxonMobil Chemical

- Formosa Plastics Corporation

- Hanwha Total Petrochemical

- INEOS Group

- LG Chem

- LyondellBasell Industries

- Mitsubishi Chemical Corporation

- PetroChina Company Limited

- Reliance Industries Limited

- Sumitomo Chemical

- Toray Industries

- Westlake Chemical

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alpek

- BASF SE

- Braskem

- Celanese Corporation

- Chevron Phillips Chemical

- Covestro AG

- Dow Chemical Company

- Evonik Industries

- ExxonMobil Chemical

- Formosa Plastics Corporation

- Hanwha Total Petrochemical

- INEOS Group

- LG Chem

- LyondellBasell Industries

- Mitsubishi Chemical Corporation

- PetroChina Company Limited

- Reliance Industries Limited

- Sumitomo Chemical

- Toray Industries

- Westlake Chemical

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 306 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

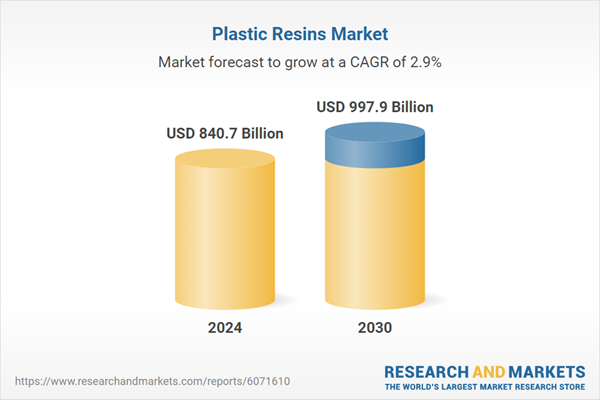

| Estimated Market Value ( USD | $ 840.7 Billion |

| Forecasted Market Value ( USD | $ 997.9 Billion |

| Compound Annual Growth Rate | 2.9% |

| Regions Covered | Global |