Global Electric Vehicle Fluids Market - Key Trends & Drivers Summarized

Why Are Electric Vehicle Fluids Essential for EV Performance and Longevity?

While electric vehicles (EVs) may not require traditional fluids like engine oil or transmission fluid, they still rely on specialized fluids to ensure optimal performance and longevity. These fluids, which include coolants, lubricants, and transmission fluids, play crucial roles in the functioning of various electric powertrain components, such as batteries, electric motors, and inverters. For instance, the cooling fluid used in EV battery packs helps maintain the temperature within an optimal range, preventing overheating and improving the battery’ s efficiency and lifespan. Similarly, the lubrication fluid in electric motors minimizes friction, reducing wear and tear while enhancing motor performance. As electric vehicles become more advanced and performance-driven, the demand for high-quality, specialized fluids has grown. These fluids are engineered to operate under the specific temperature and operational conditions that electric vehicle systems require, and they are designed to maximize energy efficiency, improve system reliability, and extend the overall lifespan of critical components. As EV adoption increases, the global market for these essential fluids is expanding to meet the evolving needs of the electric mobility industry.How Are Innovations in Fluid Technology Enhancing Electric Vehicle Performance?

The development of advanced fluid technologies is playing a key role in improving the overall performance and efficiency of electric vehicles. With the growing complexity of EV powertrains, including high-performance electric motors and high-capacity batteries, traditional fluid technologies are no longer sufficient. Manufacturers are investing in next-generation fluids designed to handle higher operating temperatures, greater electrical loads, and longer operational cycles. For example, new dielectric coolants are being introduced that allow for better heat dissipation in the battery and power electronics, improving the thermal stability and performance of electric vehicles. These coolants are formulated to maintain optimal temperatures, preventing overheating and ensuring safe operation under high power demands, such as during rapid acceleration or fast charging. Additionally, more advanced lubrication technologies are improving the efficiency and lifespan of electric motors, allowing them to run at higher speeds while reducing friction. The shift towards electric drivetrains, which often require integrated systems like gearboxes and inverters, is also driving innovation in fluid technologies, as manufacturers seek to develop fluid solutions that can support the unique requirements of these systems. These innovations are crucial in enabling the continued growth of the electric vehicle market, as they directly impact the vehicle’ s performance, durability, and customer satisfaction.What Regulatory Factors Are Shaping the Electric Vehicle Fluids Market?

As the electric vehicle market grows, the need for specialized fluids is being influenced by both regulatory frameworks and environmental considerations. Many countries are setting increasingly stringent environmental regulations that govern vehicle emissions, fuel economy, and chemical usage, which directly affect the types of fluids used in electric vehicles. While electric vehicles themselves do not produce tailpipe emissions, they still require environmentally responsible fluids to minimize their environmental impact. Regulations such as the European Union’ s REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and the U.S. Environmental Protection Agency (EPA) standards require manufacturers to use fluids that meet specific environmental and safety guidelines. Additionally, the development of circular economy principles is encouraging the automotive industry to adopt more sustainable fluid solutions, including those that are biodegradable, recyclable, and free from harmful chemicals. The demand for low-impact, non-toxic fluids that can be safely disposed of or recycled after use is growing, and companies are focusing on creating fluids that reduce overall environmental harm. As governments continue to push for cleaner and more sustainable technologies, the electric vehicle fluids market will be increasingly shaped by these regulations, pushing the industry to innovate with more eco-friendly products that align with global environmental goals.What Are the Key Drivers of Growth in the Electric Vehicle Fluids Market?

The growth in the electric vehicle fluids market is driven by several factors, including the global rise in EV adoption, technological advancements, and an increasing focus on performance and sustainability. First, as more consumers and businesses transition to electric vehicles, the demand for specialized fluids required to maintain and optimize EV components, such as batteries, motors, and power electronics, is growing rapidly. The continuous improvement of EV battery technology, including the development of higher-capacity and faster-charging battery systems, requires advanced cooling and lubrication fluids to manage heat dissipation and maintain performance under high energy loads. Second, advancements in motor and power electronics design are pushing the need for more specialized lubrication and fluid solutions that can operate effectively in higher-performance and more compact systems. Third, as the electric vehicle market diversifies - spanning passenger vehicles, buses, trucks, and two-wheelers - there is a growing demand for fluids that can be tailored to specific vehicle types and use cases, such as heavy-duty electric trucks or electric buses. Finally, as automakers and fluid manufacturers embrace sustainable practices, the push for eco-friendly fluids that align with environmental regulations and consumer preferences is creating significant growth opportunities. These drivers, combined with a broader shift toward electrification in the transportation sector, are fueling the expansion of the electric vehicle fluids market as the demand for specialized products continues to rise.Report Scope

The report analyzes the Electric Vehicle Fluids market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Electric Vehicle Engine Oil, Electric Vehicle Coolant, Electric Vehicle Transmission Fluids, Electric Vehicle Greases); Propulsion (Battery Electric Vehicle Propulsion, Hybrid Electric Vehicle / Plug-in Hybrid Electric Vehicle Propulsion); Vehicle (Commercial Vehicle, Passenger Vehicle).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Engine Oil segment, which is expected to reach US$1.6 Billion by 2030 with a CAGR of a 22.5%. The Coolant segment is also set to grow at 22.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $245.0 Million in 2024, and China, forecasted to grow at an impressive 31.5% CAGR to reach $780.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Electric Vehicle Fluids Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Electric Vehicle Fluids Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Electric Vehicle Fluids Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ally Financial Inc., Bank of America Corporation, BNP Paribas Personal Finance, Capital One Auto Finance, Citizens Financial Group, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Electric Vehicle Fluids market report include:

- Afton Chemical Corporation

- BP plc (Castrol)

- Chevron Corporation

- ENEOS Corporation

- ExxonMobil Corporation

- FUCHS Petrolub SE

- Gulf Oil International

- Idemitsu Kosan Co., Ltd.

- Lukoil Lubricants Company

- Motul

- Petroliam Nasional Berhad (PETRONAS)

- Phillips 66 Lubricants

- PTT Public Company Limited

- Repsol S.A.

- Shell plc

- Sinopec Lubricant Company

- SK Lubricants Co., Ltd.

- The Lubrizol Corporation

- TotalEnergies SE

- Valvoline Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Afton Chemical Corporation

- BP plc (Castrol)

- Chevron Corporation

- ENEOS Corporation

- ExxonMobil Corporation

- FUCHS Petrolub SE

- Gulf Oil International

- Idemitsu Kosan Co., Ltd.

- Lukoil Lubricants Company

- Motul

- Petroliam Nasional Berhad (PETRONAS)

- Phillips 66 Lubricants

- PTT Public Company Limited

- Repsol S.A.

- Shell plc

- Sinopec Lubricant Company

- SK Lubricants Co., Ltd.

- The Lubrizol Corporation

- TotalEnergies SE

- Valvoline Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 377 |

| Published | February 2026 |

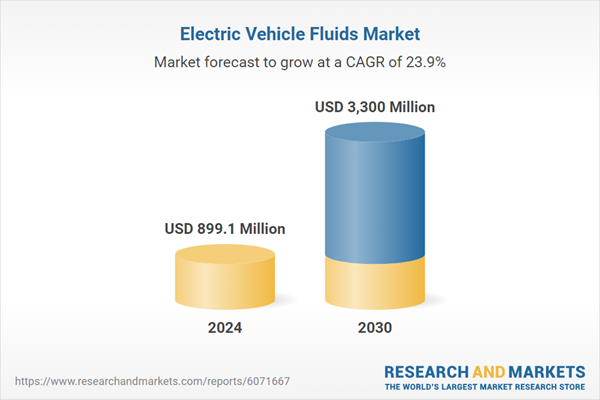

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 899.1 Million |

| Forecasted Market Value ( USD | $ 3300 Million |

| Compound Annual Growth Rate | 23.9% |

| Regions Covered | Global |