Global Feminine Hygiene Wash Market - Key Trends & Drivers Summarized

Why Is Feminine Hygiene Wash Becoming an Essential Part of Personal Care Routines?

Feminine hygiene wash has transitioned from being a niche product to a daily essential for a growing segment of health-conscious women worldwide. As awareness around intimate health expands, more consumers are recognizing the importance of using pH-balanced, gynecologist-recommended products specifically formulated for the vulvovaginal area. Unlike traditional soaps or body washes, which may contain harsh chemicals or fragrances that disrupt the natural flora, feminine hygiene washes offer targeted cleansing without irritation or imbalance. Rising levels of education, better access to reproductive health information, and social media-driven wellness conversations have contributed to this shift. Increasing urbanization and lifestyle changes - such as greater participation of women in the workforce, more frequent travel, and higher usage of synthetic underwear and tight clothing - are creating a heightened focus on daily intimate hygiene. The normalization of feminine wellness conversations, both in digital media and healthcare settings, is further encouraging consumers to view intimate care as part of overall well-being. In parallel, rising incidences of bacterial vaginosis, yeast infections, and pH imbalances are prompting preventive hygiene practices, driving adoption across both mature and emerging markets.How Are Product Innovations and Clean Beauty Trends Transforming the Market?

Product innovation is redefining the feminine hygiene wash segment, aligning it with the broader clean beauty and wellness movements. Today’ s consumers are increasingly looking for products that are not only effective but also safe, natural, and environmentally friendly. This has led to a wave of product launches featuring plant-based ingredients such as tea tree oil, aloe vera, chamomile, and lactic acid - known for their soothing and antibacterial properties. Many brands are eliminating sulfates, parabens, and synthetic fragrances, while promoting hypoallergenic and dermatologically tested formulas. Another notable shift is the emergence of probiotic-infused washes aimed at supporting healthy vaginal flora, as well as washes tailored to specific life stages such as menstruation, pregnancy, menopause, or post-surgery care. Sustainable packaging, cruelty-free certifications, and transparency in ingredient sourcing are also gaining importance, especially among Gen Z and millennial consumers. Additionally, the rise of e-commerce and influencer marketing is allowing direct-to-consumer brands to innovate rapidly and build trust through educational campaigns, product reviews, and user testimonials - accelerating consumer trial and loyalty.What Role Do Cultural Shifts and Demographic Trends Play in Market Penetration?

Cultural evolution and demographic shifts are significantly shaping the global demand for feminine hygiene wash. In many Western countries, the product is now seen as part of a holistic self-care routine, with personal hygiene marketed as empowerment rather than embarrassment. Conversely, in parts of Asia, Africa, and the Middle East - where traditional taboos surrounding menstruation and genital health persist - rising female literacy, urban migration, and targeted awareness campaigns are helping dismantle long-held stigmas. Younger women, particularly in urban centers, are driving adoption through greater openness to discussing intimate care and experimenting with new health and beauty products. Aging populations in developed nations are also contributing to market growth, as menopausal women seek gentle solutions for dryness, sensitivity, and odor control. Across all age groups, the inclusion of intimate washes in educational health kits, workplace wellness programs, and pharmacy-based recommendations is encouraging trial and regular usage. Government and NGO-led initiatives promoting menstrual and reproductive hygiene, especially in underserved areas, are further broadening the market's reach. Cultural influencers, celebrity endorsements, and wellness communities are making intimate care more mainstream and accessible, helping normalize these products in regions where demand has long been latent.What Are the Key Market Drivers Fueling Global Expansion and Innovation?

The growth in the Feminine Hygiene Wash market is driven by several factors directly linked to evolving consumer behavior, regulatory support, and advancements in product formulation. Chief among these is the increasing global awareness of intimate health as an integral aspect of personal wellness, supported by digital health platforms, influencers, and healthcare professionals who advocate preventive hygiene practices. The rapid expansion of online retail channels and direct-to-consumer models is enabling niche and emerging brands to reach wider audiences with targeted marketing and subscription-based services. Simultaneously, growing demand for natural and organic products - driven by sensitivity concerns and sustainability values - is pushing established players to reformulate and innovate. Regulatory bodies in many countries are now mandating greater transparency in ingredient labeling, which is fostering consumer trust and encouraging trial. Urbanization and changing lifestyle patterns, especially among working women and students, are also contributing to higher frequency of product use. Additionally, strategic partnerships between pharmaceutical companies and personal care brands are leading to the creation of clinically validated, multifunctional products. The entry of wellness-centric beauty conglomerates and the increasing presence of feminine care in mainstream retail aisles signal that feminine hygiene wash is no longer a discreet afterthought but a central pillar of modern personal care regimens across the globe.Report Scope

The report analyzes the Feminine Hygiene Wash market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Product (Creams, Wipes, Spray, Bar, Gel, Foam, Powder, Cleanser, Other Feminine Hygiene Wash Products); Distribution Channel (Offline Distribution Channel, Online Distribution Channel); End-Use (Female Teenager End-Use, Female Adult End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Creams segment, which is expected to reach US$2.9 Billion by 2030 with a CAGR of a 5.7%. The Wipes segment is also set to grow at 4.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.4 Billion in 2024, and China, forecasted to grow at an impressive 8.4% CAGR to reach $2.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Feminine Hygiene Wash Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Feminine Hygiene Wash Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Feminine Hygiene Wash Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AbbVie Inc., Allergan plc, AMAG Pharmaceuticals, Inc., Apricus Biosciences, Inc., Bayer AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Feminine Hygiene Wash market report include:

- August

- Bella (TZMO SA)

- Blume

- Bodywise (Natracare)

- Bonafide

- Cora

- Edgewell Personal Care

- Essity AB

- Evvy

- Johnson & Johnson

- Kao Corporation

- Kimberly-Clark Corporation

- LOLA

- Marea Wellness

- Procter & Gamble

- Rael

- Semaine Health

- The Honey Pot Company

- Unicharm Corporation

- Uqora

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- August

- Bella (TZMO SA)

- Blume

- Bodywise (Natracare)

- Bonafide

- Cora

- Edgewell Personal Care

- Essity AB

- Evvy

- Johnson & Johnson

- Kao Corporation

- Kimberly-Clark Corporation

- LOLA

- Marea Wellness

- Procter & Gamble

- Rael

- Semaine Health

- The Honey Pot Company

- Unicharm Corporation

- Uqora

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 381 |

| Published | February 2026 |

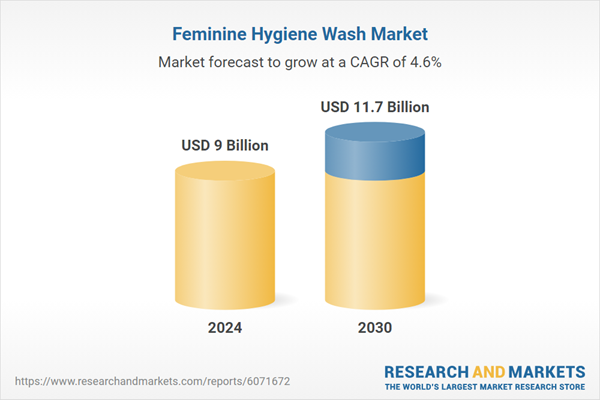

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 9 Billion |

| Forecasted Market Value ( USD | $ 11.7 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |