Global Dyspepsia Drugs Market - Key Trends & Drivers Summarized

Why Is the Global Demand for Dyspepsia Drugs on the Rise?

Dyspepsia - commonly referred to as indigestion - continues to be a widespread gastrointestinal disorder affecting millions of people worldwide, and this has led to a consistent rise in demand for dyspepsia drugs. Characterized by upper abdominal discomfort, bloating, nausea, and early satiety, dyspepsia can stem from functional issues, peptic ulcers, or as a side effect of lifestyle choices, medications, and other gastrointestinal conditions. The global rise in poor dietary habits, increased consumption of processed foods, alcohol, caffeine, and the prevalence of stressful lifestyles - especially in urban settings - have significantly contributed to the surge in dyspepsia cases. Additionally, the aging population, which is more prone to gastrointestinal disorders due to declining digestive efficiency and polypharmacy, has become a major consumer base for such medications. Over-the-counter (OTC) drugs like antacids, H2 receptor antagonists, and proton pump inhibitors (PPIs) remain the frontline treatment, with branded and generic options widely available. Meanwhile, prescription drugs are commonly used for chronic or refractory cases, especially in patients with Helicobacter pylori infection or functional dyspepsia. The easy availability of OTC products, growing health awareness, and increasing patient inclination toward self-medication have also supported market expansion. As dyspepsia increasingly overlaps with other gastrointestinal conditions like gastroesophageal reflux disease (GERD) and irritable bowel syndrome (IBS), the demand for versatile and multi-action drugs continues to grow, making dyspepsia drugs a staple in both pharmacies and household medicine cabinets across the globe.How Are Innovations and Drug Reformulations Reshaping the Treatment Landscape?

Innovation in pharmaceutical formulations and drug delivery systems is driving a transformation in the dyspepsia drugs market. Pharmaceutical companies are focusing on creating faster-acting, longer-lasting, and combination drugs to enhance patient convenience and adherence. Novel drug combinations that address overlapping symptoms of dyspepsia and related GI disorders are gaining favor, particularly in regions with high disease burden. Effervescent tablets, chewable forms, and orally disintegrating strips are becoming increasingly popular, especially among elderly and pediatric patients who may struggle with swallowing conventional tablets. Additionally, advancements in proton pump inhibitor (PPI) technology have led to the development of immediate-release variants, offering rapid symptom relief compared to traditional delayed-release options. There is also growing interest in prokinetic agents and new acid blockers, including potassium-competitive acid blockers (P-CABs), which offer an alternative to standard PPIs for patients with refractory symptoms. Moreover, research into the gut microbiome and its role in functional dyspepsia has opened new avenues for probiotics and microbiota-targeting therapies. Companies are also exploring personalized medicine approaches to treat chronic or recurrent cases of functional dyspepsia, based on patient genetics, gut flora, and specific symptom patterns. In parallel, herbal and alternative formulations derived from Ayurvedic and Traditional Chinese Medicine (TCM) are being clinically evaluated and commercialized, further diversifying treatment options. These innovations, while addressing clinical challenges, are also aimed at improving market competitiveness and capturing niche segments in an increasingly crowded therapeutic category.Are Shifting Healthcare Dynamics and Consumer Behavior Influencing Drug Utilization?

Changing healthcare ecosystems, evolving consumer expectations, and shifting regulatory environments are having a profound impact on how dyspepsia drugs are accessed, prescribed, and consumed. With growing internet penetration and digital health platforms, more consumers are turning to online pharmacies and e-consultations for digestive health concerns, increasing sales of both OTC and prescription drugs through e-commerce channels. Simultaneously, the trend toward self-medication and the wide availability of OTC dyspepsia drugs without a doctor’ s prescription have expanded market reach, particularly in developing economies where physician access may be limited. Patient education initiatives, coupled with digital content and influencer-led health awareness campaigns, have made consumers more proactive in managing symptoms, leading to increased demand for fast-acting and convenient drug formats. In developed markets, cost-sensitive consumers are shifting from branded drugs to generics, pressuring pharmaceutical companies to focus on pricing strategies and differentiation through added benefits like combination therapies or advanced delivery mechanisms. Meanwhile, reimbursement frameworks and healthcare insurance policies are influencing prescription trends in both public and private health systems, especially in regions like North America and Western Europe. Regulatory agencies are also increasingly scrutinizing long-term use of PPIs due to potential side effects such as nutrient malabsorption and kidney issues, which is prompting the development and marketing of safer alternatives. These shifts in consumer behavior and healthcare delivery are creating new distribution models and product positioning strategies, redefining how dyspepsia drugs are marketed and consumed across regions.What Are the Key Growth Drivers Propelling the Dyspepsia Drugs Market?

The growth in the dyspepsia drugs market is driven by several factors related to medical innovation, evolving consumer behavior, healthcare access, and demographic shifts. The rising global prevalence of digestive disorders due to poor dietary patterns, sedentary lifestyles, and stress has significantly increased the number of people seeking symptomatic relief, thereby expanding the core user base. Technological advancements in drug formulations - such as immediate-release PPIs, combination medications, and alternative delivery methods - have improved treatment outcomes and patient satisfaction. The expansion of e-pharmacy platforms and digital health services has made dyspepsia medications more accessible, especially in underserved rural or developing areas. Moreover, the aging global population is driving consistent demand, as seniors often suffer from gastrointestinal discomfort due to polypharmacy, decreased gastric motility, and underlying chronic illnesses. The increasing adoption of self-care practices and the widespread availability of OTC drugs have opened up a strong retail market for fast-relief and easy-to-administer products. Additionally, the growth of gastroenterology services, awareness campaigns by health organizations, and the push for early diagnosis of functional gastrointestinal disorders have created supportive infrastructure for higher prescription volumes. The market is also benefiting from emerging consumer segments seeking natural or herbal remedies, prompting pharma companies to diversify their offerings. Collectively, these factors are fueling sustained expansion in the global dyspepsia drugs market, with opportunities for innovation, differentiation, and regional market penetration across both developed and emerging economies.Report Scope

The report analyzes the Dyspepsia Drugs market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Indication (Functional Dyspepsia, Organic Dyspepsia); Drug (Proton Pump Inhibitor Dyspepsia Drugs, H-2-Receptor Antagonist Dyspepsia Drugs, Antacid Dyspepsia Drugs, Antibiotics Dyspepsia Drugs, Prokinetics Dyspepsia Drugs, Antidepressant Dyspepsia Drugs); Medication (Branded Dyspepsia Drugs, Generic Dyspepsia Drugs); Mode (Over-the-Counter Dyspepsia Drugs, Prescription Dyspepsia Drugs); Distribution Channel (Retail Pharmacies, Hospital Pharmacies, Online Pharmacies).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Functional Dyspepsia Drugs segment, which is expected to reach US$8.0 Billion by 2030 with a CAGR of a 4.2%. The Organic Dyspepsia Drugs segment is also set to grow at 2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.7 Billion in 2024, and China, forecasted to grow at an impressive 6.6% CAGR to reach $2.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Dyspepsia Drugs Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Dyspepsia Drugs Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Dyspepsia Drugs Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as A4 Apparel, Allegheny Apparel, Argus Apparel, Augusta Sportswear, Berunwear and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Dyspepsia Drugs market report include:

- Abbott Laboratories

- Allergan plc

- ANI Pharmaceuticals, Inc.

- AstraZeneca plc

- Bayer AG

- Boehringer Ingelheim GmbH

- Cadila Pharmaceuticals

- Dr. Reddy’s Laboratories Ltd.

- Eisai Co., Ltd.

- GlaxoSmithKline plc

- Haleon plc

- Johnson & Johnson Services, Inc.

- Lupin Limited

- Mankind Pharma

- Pfizer Inc.

- Procter & Gamble

- RedHill Biopharma Ltd.

- Salix Pharmaceuticals

- Sanofi

- Takeda Pharmaceutical Company Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories

- Allergan plc

- ANI Pharmaceuticals, Inc.

- AstraZeneca plc

- Bayer AG

- Boehringer Ingelheim GmbH

- Cadila Pharmaceuticals

- Dr. Reddy’s Laboratories Ltd.

- Eisai Co., Ltd.

- GlaxoSmithKline plc

- Haleon plc

- Johnson & Johnson Services, Inc.

- Lupin Limited

- Mankind Pharma

- Pfizer Inc.

- Procter & Gamble

- RedHill Biopharma Ltd.

- Salix Pharmaceuticals

- Sanofi

- Takeda Pharmaceutical Company Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 566 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

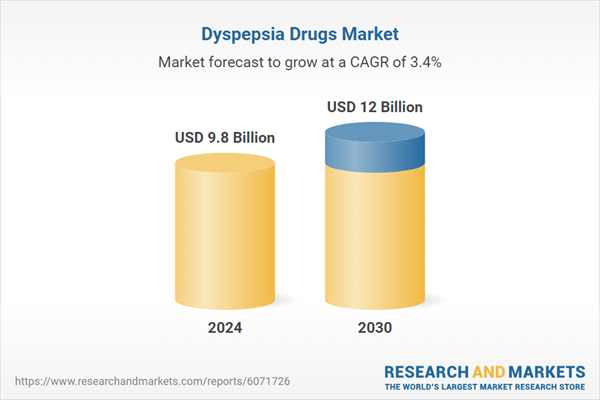

| Estimated Market Value ( USD | $ 9.8 Billion |

| Forecasted Market Value ( USD | $ 12 Billion |

| Compound Annual Growth Rate | 3.4% |

| Regions Covered | Global |