Global Live Biotherapeutic Products and Microbiome CDMO Market - Key Trends & Drivers Summarized

Why Is the Market for Live Biotherapeutic Products and Microbiome CDMO Expanding Rapidly?

The increasing understanding of the human microbiome's role in health and disease has fueled significant growth in live biotherapeutic products (LBPs) and microbiome contract development and manufacturing organizations (CDMOs). LBPs, which consist of living microorganisms offering therapeutic benefits, are gaining traction in treating gastrointestinal, metabolic, immunological, and neurological disorders. As microbiome research advances, pharmaceutical companies are heavily investing in LBP development, necessitating the support of specialized CDMOs to ensure regulatory compliance and scalable manufacturing. The shift toward precision medicine and the demand for personalized microbiome-based therapies are also driving the expansion of the sector. Additionally, regulatory agencies such as the FDA and EMA are providing clearer guidelines for LBPs, accelerating their commercialization. The growing prevalence of chronic diseases and the rise in antibiotic-resistant infections have further solidified the need for microbiome-based interventions. As awareness of microbiome-targeted treatments rises among consumers and healthcare providers, the LBP market is expected to witness exponential growth.What Innovations Are Driving Growth in Live Biotherapeutics and Microbiome CDMO Services?

Technological advancements are significantly enhancing the development and scalability of live biotherapeutic products. One of the key breakthroughs is the application of artificial intelligence (AI) and machine learning in microbiome analysis, enabling researchers to identify beneficial bacterial strains more efficiently. Next-generation sequencing (NGS) and metagenomics are providing deeper insights into microbial diversity, allowing for the design of targeted LBP formulations. Innovations in fermentation technology and bioprocessing are improving large-scale production, ensuring consistent quality and viability of live microbial therapeutics. Freeze-drying and encapsulation techniques are also improving stability and shelf-life, addressing challenges associated with microbial viability. Additionally, microbiome CDMOs are integrating automated manufacturing systems and real-time quality control analytics to optimize production processes. The use of synthetic biology to engineer probiotics with enhanced functionalities is further expanding the potential applications of LBPs. With continued research and innovation, live biotherapeutic products are becoming safer, more effective, and commercially viable at scale.How Are Consumer Trends and Industry Collaborations Shaping the Market?

The rising consumer demand for microbiome-based therapies and probiotic-driven health solutions is reshaping the live biotherapeutic products market. Consumers are increasingly prioritizing gut health and its connection to immunity, mental health, and metabolic balance, leading to heightened interest in microbiome-based interventions. Direct-to-consumer (DTC) microbiome solutions, such as personalized probiotic regimens and microbiome testing kits, are also gaining popularity, fueling market expansion. Industry collaborations between pharmaceutical companies, biotech firms, and CDMOs are accelerating research and development efforts, leading to faster commercialization of microbiome-based therapies. Regulatory agencies are streamlining approval processes for LBPs, facilitating quicker market entry and greater consumer access. Additionally, increased venture capital and private equity investments in microbiome research startups are providing funding for further innovations. As consumers continue to seek science-backed microbiome solutions, and industry stakeholders forge strategic partnerships, the live biotherapeutic products market is expected to experience sustained growth.What Are the Key Growth Drivers Fueling the Live Biotherapeutic Products and Microbiome CDMO Market?

The growth in the live biotherapeutic products and microbiome CDMO market is driven by multiple factors, including the rising prevalence of chronic diseases, increasing investments in microbiome research, and evolving regulatory frameworks. One of the primary drivers is the expanding role of LBPs in addressing conditions such as inflammatory bowel disease (IBD), obesity, and metabolic disorders. The growing body of clinical evidence supporting the efficacy of microbiome-based interventions is prompting pharmaceutical companies to accelerate product development. The involvement of microbiome CDMOs is crucial in ensuring scalable, high-quality production of LBPs, enabling their broader adoption. Additionally, advancements in synthetic biology and bioengineering are optimizing microbial strain selection, enhancing therapeutic efficacy. The emergence of microbiome-based precision medicine is also contributing to market growth, as researchers develop targeted therapies based on individual microbiota compositions. Increasing consumer awareness of gut health, coupled with government initiatives to promote probiotic-based treatments, is further supporting the expansion of the market. With ongoing innovation and investment, the live biotherapeutic products and microbiome CDMO industry is poised for significant growth, transforming modern healthcare and therapeutic approaches.Report Scope

The report analyzes the Live Biotherapeutic Products and Microbiome CDMO market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Application (C.difficle, Crohn's Disease, IBS, Diabetes, Others).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the C.difficle Application segment, which is expected to reach US$276.8 Million by 2030 with a CAGR of a 37.7%. The Crohn's Disease Application segment is also set to grow at 37.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $24.9 Million in 2024, and China, forecasted to grow at an impressive 35.1% CAGR to reach $93.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Live Biotherapeutic Products and Microbiome CDMO Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Live Biotherapeutic Products and Microbiome CDMO Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Live Biotherapeutic Products and Microbiome CDMO Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

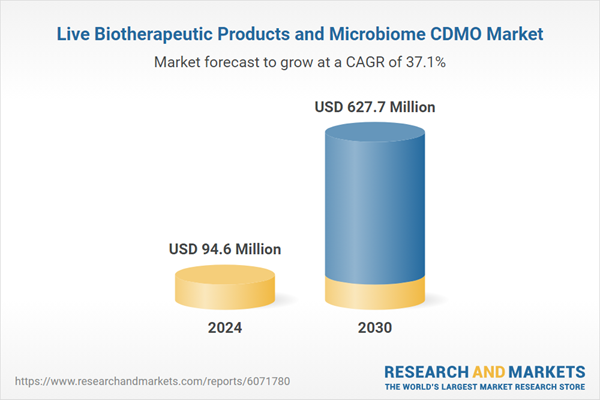

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 4D Pharma plc, Arrant Bio, Assembly Biosciences, Inc., Bacthera, Biose Industrie and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Live Biotherapeutic Products and Microbiome CDMO market report include:

- 4D Pharma plc

- Arrant Bio

- Assembly Biosciences, Inc.

- Bacthera

- Biose Industrie

- Cerbios-Pharma SA

- Freya Biosciences

- Genetic Analysis

- Genome & Company

- Inpac Probiotics

- Lallemand Health Solutions

- List Biological Laboratories, Inc.

- Lonza Group

- Microbiotica

- NIZO Food Research

- Quay Pharmaceuticals

- Rebiotix Inc. (A Ferring Company)

- Seres Therapeutics

- Siolta Therapeutics

- Wacker Biotech

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 4D Pharma plc

- Arrant Bio

- Assembly Biosciences, Inc.

- Bacthera

- Biose Industrie

- Cerbios-Pharma SA

- Freya Biosciences

- Genetic Analysis

- Genome & Company

- Inpac Probiotics

- Lallemand Health Solutions

- List Biological Laboratories, Inc.

- Lonza Group

- Microbiotica

- NIZO Food Research

- Quay Pharmaceuticals

- Rebiotix Inc. (A Ferring Company)

- Seres Therapeutics

- Siolta Therapeutics

- Wacker Biotech

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 108 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 94.6 Million |

| Forecasted Market Value ( USD | $ 627.7 Million |

| Compound Annual Growth Rate | 37.1% |

| Regions Covered | Global |