Global Exercise and Weight Loss Apps Market - Key Trends & Drivers Summarized

How Have Exercise and Weight Loss Apps Evolved?

The journey of exercise and weight loss apps from niche to mainstream mirrors the evolution of mobile technology. Originally, these apps were rudimentary, offering basic tools like pedometers and calorie counters. Over time, they have become far more sophisticated, utilizing the vast improvements in mobile processors, battery life, and display capabilities. This technological evolution has allowed developers to include more complex features such as 3D motion capture for feedback on workout form, heart rate monitoring, and even hydration tracking. These advancements have transformed smartphones into personal fitness coaches that are accessible to the average consumer, democratizing health and fitness guidance that was once available only to those who could afford personal trainers.The second wave of development in exercise and weight loss apps has been largely influenced by the integration with other digital platforms and wearable technologies. Apps now often come with support for smartwatches and fitness bands, pulling in data continuously to give users a comprehensive view of their health metrics throughout the day. For instance, sleep quality, which is crucial for weight management and overall health, can now be tracked and analyzed alongside physical activity and diet. This holistic health tracking offers a more complete picture and helps users understand the interdependencies between different aspects of their health. Such integrations also foster an ecosystem where data from various health and fitness sources can be consolidated, providing insights that are personalized and actionable.

What Makes These Apps a Necessity in Modern Day Fitness Regimens?

In a world where time is at a premium, exercise and weight loss apps offer a highly efficient solution to maintain fitness and manage diet. These apps eliminate the need for physical presence at health clubs or gyms and reduce dependency on scheduled sessions with dietitians or personal trainers. They empower users to perform workouts at their convenience and pace, using guided video tutorials and automated schedules that adapt to their fitness levels and goals. Additionally, these apps often incorporate dietary tracking and planning tools that help users stay on top of their nutrition. This blend of convenience, flexibility, and personalization is not just appealing but essential for individuals trying to balance health with busy careers and personal commitments.Moreover, these apps provide a level of engagement and social interaction that is crucial for motivation. Many include community features, allowing users to connect with friends or join groups with similar health goals. This community aspect can be incredibly motivating, as it taps into the human desire for social connection and competition. For instance, features that allow users to share achievements on social media or compete in virtual challenges add a fun and competitive edge to the often solitary activities of dieting and exercising. This social engagement is not only about competition but also about support, giving users a platform to share tips, celebrate successes, and encourage each other during setbacks, thereby fostering a supportive community centered around health and fitness.

What Drives the Growth in the Exercise and Weight Loss Apps Market?

Technological advancements and the increasing integration of health-focused technologies into everyday life are key drivers of growth in the exercise and weight loss app market. The widespread adoption of smartphones equipped with advanced sensors capable of tracking physical activity and other health metrics creates a fertile ground for app developers. These developers leverage cutting-edge technology such as AI and machine learning to create adaptive, intuitive applications. These apps not only track user data but also interpret it to offer personalized recommendations, pushing the boundaries of what mobile health (mHealth) platforms can achieve. Moreover, the increasing capabilities of these apps to sync with medical records and health systems allow for a more integrated health management approach, appealing to a broader user base, including those with specific health conditions.Another significant growth driver is the shifting demographics and lifestyle trends worldwide. As more individuals become proactive about their health and well-being, there is a natural rise in the demand for fitness and dietary management tools. This trend is amplified by the increasing awareness of the health risks associated with obesity and other lifestyle diseases, which has been particularly highlighted by the global health crises such as the COVID-19 pandemic. The market is also supported by governmental initiatives aimed at improving population health and reducing healthcare expenditures, which often promote the use of digital health tools. Additionally, insurance companies are increasingly partnering with app developers to encourage healthy living among their clients, often offering incentives like reduced premiums for active app users. These partnerships not only boost the usage of these apps but also enhance their credibility and perceived value, contributing to sustained market growth.

Global Exercise and Weight Loss Apps Market - Key Trends & Drivers Summarized

How Have Exercise and Weight Loss Apps Evolved?

The journey of exercise and weight loss apps from niche to mainstream mirrors the evolution of mobile technology. Originally, these apps were rudimentary, offering basic tools like pedometers and calorie counters. Over time, they have become far more sophisticated, utilizing the vast improvements in mobile processors, battery life, and display capabilities. This technological evolution has allowed developers to include more complex features such as 3D motion capture for feedback on workout form, heart rate monitoring, and even hydration tracking. These advancements have transformed smartphones into personal fitness coaches that are accessible to the average consumer, democratizing health and fitness guidance that was once available only to those who could afford personal trainers.The second wave of development in exercise and weight loss apps has been largely influenced by the integration with other digital platforms and wearable technologies. Apps now often come with support for smartwatches and fitness bands, pulling in data continuously to give users a comprehensive view of their health metrics throughout the day. For instance, sleep quality, which is crucial for weight management and overall health, can now be tracked and analyzed alongside physical activity and diet. This holistic health tracking offers a more complete picture and helps users understand the interdependencies between different aspects of their health. Such integrations also foster an ecosystem where data from various health and fitness sources can be consolidated, providing insights that are personalized and actionable.

What Makes These Apps a Necessity in Modern Day Fitness Regimens?

In a world where time is at a premium, exercise and weight loss apps offer a highly efficient solution to maintain fitness and manage diet. These apps eliminate the need for physical presence at health clubs or gyms and reduce dependency on scheduled sessions with dietitians or personal trainers. They empower users to perform workouts at their convenience and pace, using guided video tutorials and automated schedules that adapt to their fitness levels and goals. Additionally, these apps often incorporate dietary tracking and planning tools that help users stay on top of their nutrition. This blend of convenience, flexibility, and personalization is not just appealing but essential for individuals trying to balance health with busy careers and personal commitments.Moreover, these apps provide a level of engagement and social interaction that is crucial for motivation. Many include community features, allowing users to connect with friends or join groups with similar health goals. This community aspect can be incredibly motivating, as it taps into the human desire for social connection and competition. For instance, features that allow users to share achievements on social media or compete in virtual challenges add a fun and competitive edge to the often solitary activities of dieting and exercising. This social engagement is not only about competition but also about support, giving users a platform to share tips, celebrate successes, and encourage each other during setbacks, thereby fostering a supportive community centered around health and fitness.

What Drives the Growth in the Exercise and Weight Loss Apps Market?

Technological advancements and the increasing integration of health-focused technologies into everyday life are key drivers of growth in the exercise and weight loss app market. The widespread adoption of smartphones equipped with advanced sensors capable of tracking physical activity and other health metrics creates a fertile ground for app developers. These developers leverage cutting-edge technology such as AI and machine learning to create adaptive, intuitive applications. These apps not only track user data but also interpret it to offer personalized recommendations, pushing the boundaries of what mobile health (mHealth) platforms can achieve. Moreover, the increasing capabilities of these apps to sync with medical records and health systems allow for a more integrated health management approach, appealing to a broader user base, including those with specific health conditions.Another significant growth driver is the shifting demographics and lifestyle trends worldwide. As more individuals become proactive about their health and well-being, there is a natural rise in the demand for fitness and dietary management tools. This trend is amplified by the increasing awareness of the health risks associated with obesity and other lifestyle diseases, which has been particularly highlighted by the global health crises such as the COVID-19 pandemic. The market is also supported by governmental initiatives aimed at improving population health and reducing healthcare expenditures, which often promote the use of digital health tools. Additionally, insurance companies are increasingly partnering with app developers to encourage healthy living among their clients, often offering incentives like reduced premiums for active app users. These partnerships not only boost the usage of these apps but also enhance their credibility and perceived value, contributing to sustained market growth.

Report Scope

The report analyzes the Exercise and Weight Loss Apps market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Platform (iOS Platform, Android Platform, Other Platforms); Device (Smartphones, Tablets, Wearables).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the iOS Platform segment, which is expected to reach US$1.5 Billion by 2030 with a CAGR of a 16.6%. The Android Platform segment is also set to grow at 18.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $259.9 Million in 2024, and China, forecasted to grow at an impressive 22.5% CAGR to reach $540.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Exercise and Weight Loss Apps Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Exercise and Weight Loss Apps Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Exercise and Weight Loss Apps Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Advanced Micro Devices, Inc., Altair Engineering, Inc., Eviden SAS, Fujitsu Ltd., Hewlett Packard Enterprise Development LP and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Exercise and Weight Loss Apps market report include:

- Aaptiv Inc.

- ASICS Runkeeper

- Azumio

- Caliber

- Fitbod

- Google LLC

- HealthifyMe Wellness Private Limited

- Jefit

- Jevo Inc. d/b/a Physique 57

- Kic App Pty Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aaptiv Inc.

- ASICS Runkeeper

- Azumio

- Caliber

- Fitbod

- Google LLC

- HealthifyMe Wellness Private Limited

- Jefit

- Jevo Inc. d/b/a Physique 57

- Kic App Pty Ltd.

Table Information

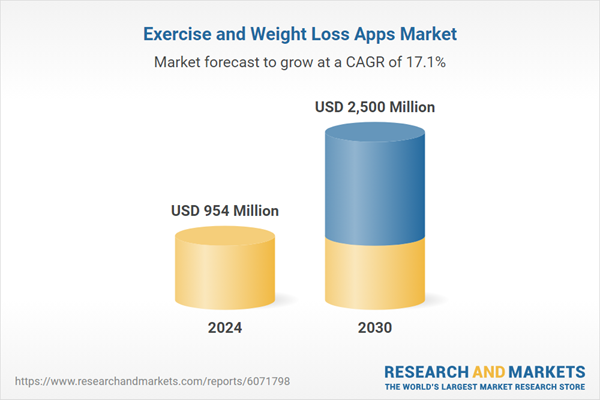

| Report Attribute | Details |

|---|---|

| No. of Pages | 279 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 954 Million |

| Forecasted Market Value ( USD | $ 2500 Million |

| Compound Annual Growth Rate | 17.1% |

| Regions Covered | Global |