Global Wound Closure Strips Market - Key Trends & Drivers Summarized

Why Are Wound Closure Strips Gaining Popularity? Understanding Their Role in Non-Invasive Wound Management

The rising preference for non-invasive wound closure solutions has led to a surge in demand for wound closure strips, which offer an effective alternative to sutures and staples in managing minor to moderate lacerations. Unlike traditional wound closure methods, which can cause significant tissue trauma and scarring, wound closure strips provide a painless and quick healing approach by approximating wound edges without the need for invasive procedures. These adhesive-based strips are particularly popular in outpatient settings, emergency rooms, and home healthcare due to their ease of application, minimal risk of infection, and patient comfort. The increasing number of minor surgical procedures, sports injuries, and household accidents has further driven the adoption of wound closure strips. In pediatric care, these strips are preferred over sutures as they eliminate the need for anesthesia and reduce the psychological distress associated with needle-based wound closures. Additionally, as healthcare providers emphasize cost-effective and efficient wound management techniques, wound closure strips have gained significant traction in both clinical and non-clinical settings.How Are Technological Advancements Enhancing Wound Closure Strip Effectiveness? Exploring Innovations

Technological advancements in wound closure strip materials and adhesives have significantly improved their durability, flexibility, and wound-healing efficiency. The development of hypoallergenic and waterproof adhesive formulations has expanded the usability of these strips, allowing them to be worn in various environmental conditions without the risk of premature detachment. Newer strips feature antimicrobial coatings, infused with silver ions or chlorhexidine, to reduce the risk of wound infections. Additionally, advanced microstructure designs have been incorporated into closure strips to enhance tensile strength and ensure better wound approximation. Some modern wound closure strips integrate bioengineered materials, such as hydrocolloid-based adhesives, which promote moisture balance and accelerate tissue regeneration. Another emerging trend is the development of dissolvable or biodegradable wound closure strips, which eliminate the need for removal and minimize discomfort for patients. These innovations have further cemented the role of wound closure strips as an effective alternative to conventional sutures, making them increasingly popular in a variety of medical applications.What Are the Market Challenges for Wound Closure Strips? Examining Potential Constraints

Despite their advantages, wound closure strips face several challenges that impact market growth, including limited applicability for deep or complex wounds, adhesive-related skin sensitivities, and competition from alternative wound closure techniques. While these strips are ideal for superficial lacerations and surgical incisions, they are not suitable for high-tension wounds or injuries with significant tissue loss, where sutures or staples are still necessary. Another issue is the variability in adhesive effectiveness, as some wound closure strips may lose adhesion prematurely, especially in humid or high-movement areas. Skin sensitivity concerns also pose a challenge, as certain adhesives can cause irritation or allergic reactions in some patients, limiting their widespread use. Additionally, healthcare professionals often prioritize more traditional wound closure methods due to familiarity and training, slowing the adoption rate of adhesive-based alternatives. Addressing these challenges will require continued product innovation, better clinician training, and improved patient education to increase confidence in wound closure strip efficacy.What Is Driving Growth in the Wound Closure Strips Market? Key Factors Fueling Expansion

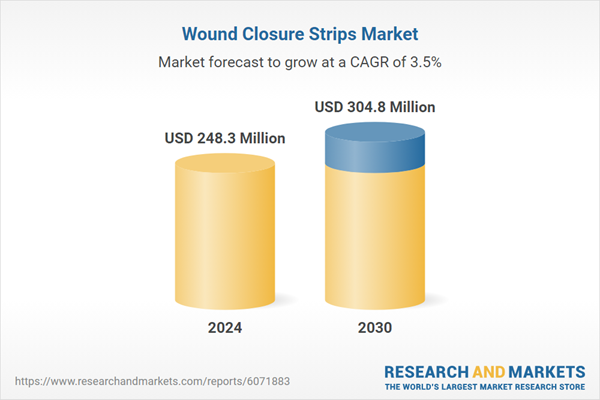

The growth in the wound closure strips market is driven by several factors, including the increasing emphasis on minimally invasive wound management, rising outpatient surgical procedures, and technological advancements in medical adhesives. The growing demand for cost-effective wound closure solutions in emergency care and ambulatory settings has significantly contributed to market expansion. Additionally, the shift toward home-based wound care and self-treatment has boosted the adoption of user-friendly wound closure products. The rising incidence of minor injuries, particularly among children and athletes, has further fueled market demand. Technological advancements, such as the integration of antimicrobial coatings and waterproof formulations, have enhanced product performance, making wound closure strips a preferred choice for both patients and healthcare providers. The expansion of e-commerce platforms and retail pharmacies has also improved accessibility to these products, allowing consumers to purchase them without a prescription. Furthermore, the increasing awareness of infection prevention in wound care and the need for faster recovery times have reinforced the market's upward trajectory. With continuous advancements in adhesive technology and broader applications in surgical and emergency care, the wound closure strips market is poised for sustained growth.Report Scope

The report analyzes the Wound Closure Strips market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Flexible, Reinforced); Product Sterility (Sterile, Non-Sterile); Indications (Surgical Wounds, Lacerations & Minor Cuts); End-Use (Hospitals, Specialty Clinics, Home Healthcare, Physician's Office, Nursing Homes, Others); Distribution Channel (Institutional, Retail).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Some of the 41 companies featured in this Wound Closure Strips market report include -

- Aero Healthcare

- Aspen Surgical Products, Inc.

- Cardinal Health, Inc.

- ConvaTec Ltd.

- DermaRite Industries LLC

- DeRoyal Industries, Inc.

- Dukal Corporation

- Dynarex Corporation

- Gentell, Inc.

- KitoTech Medical

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Flexible Closure Strips segment, which is expected to reach US$191.5 Million by 2030 with a CAGR of a 2.8%. The Reinforced Closure Strips segment is also set to grow at 4.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $67.6 Million in 2024, and China, forecasted to grow at an impressive 6.4% CAGR to reach $60.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Wound Closure Strips Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Wound Closure Strips Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Wound Closure Strips Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Angelini Pharma Inc., B. Braun SE, Cardinal Health, Inc., ConvaTec Ltd., DermaRite Industries LLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Select Competitors (Total 41 Featured):

- Aero Healthcare

- Aspen Surgical Products, Inc.

- Cardinal Health, Inc.

- ConvaTec Ltd.

- DermaRite Industries LLC

- DeRoyal Industries, Inc.

- Dukal Corporation

- Dynarex Corporation

- Gentell, Inc.

- KitoTech Medical

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aero Healthcare

- Aspen Surgical Products, Inc.

- Cardinal Health, Inc.

- ConvaTec Ltd.

- DermaRite Industries LLC

- DeRoyal Industries, Inc.

- Dukal Corporation

- Dynarex Corporation

- Gentell, Inc.

- KitoTech Medical

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 563 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 248.3 Million |

| Forecasted Market Value ( USD | $ 304.8 Million |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Global |