Global WTTx Market - Key Trends & Drivers Summarized

Why Is WTTx Becoming a Game Changer? Exploring Its Role in Broadband Expansion

Wireless-to-the-x (WTTx) technology has emerged as a transformative solution in the broadband sector, providing high-speed internet connectivity to underserved and remote areas without the need for extensive fiber infrastructure. As internet accessibility becomes increasingly critical for businesses, education, healthcare, and smart city applications, WTTx is gaining traction as a cost-effective and scalable alternative to traditional wired broadband. The rapid growth in mobile data consumption and the expansion of 5G networks have further propelled the adoption of WTTx, allowing telecom providers to deliver high-speed, low-latency internet services efficiently. Governments and regulatory bodies are also promoting WTTx solutions to bridge the digital divide, ensuring that rural and suburban areas have reliable internet access. With the growing demand for fixed wireless access (FWA) solutions, WTTx is revolutionizing the way broadband services are deployed, making high-speed connectivity more inclusive and widely available.How Are Technological Advancements Enhancing WTTx Deployment? Unveiling Innovations

The rapid evolution of wireless technologies has significantly improved the performance and reliability of WTTx networks. The introduction of 5G-based WTTx solutions has enabled faster data speeds, lower latency, and improved spectrum efficiency, making wireless broadband a viable alternative to fiber-optic connectivity. Advanced antenna designs, such as massive MIMO (Multiple Input, Multiple Output) and beamforming, have enhanced signal coverage and network stability, reducing service disruptions and performance fluctuations. Additionally, the integration of AI-powered network optimization tools has allowed service providers to improve bandwidth management, ensuring seamless connectivity for users in high-demand areas. Cloud-based WTTx solutions and software-defined networking (SDN) have further streamlined network deployment and maintenance, reducing operational costs for telecom companies. As these innovations continue to evolve, WTTx is becoming an increasingly viable option for delivering high-quality broadband services across diverse geographic landscapes.What Challenges Are Limiting WTTx Market Expansion? Identifying Key Barriers

Despite its potential, the WTTx market faces several challenges, including spectrum availability, regulatory constraints, and competition from fiber-optic broadband solutions. The limited availability of high-frequency spectrum bands, which are crucial for delivering high-speed wireless broadband, has posed a challenge for service providers looking to expand their WTTx networks. Regulatory approvals and spectrum allocation policies vary across regions, leading to inconsistencies in market adoption. Additionally, fiber-optic broadband remains the preferred choice for ultra-high-speed internet applications, creating competition for WTTx solutions in urban areas where fiber infrastructure is readily available. Another challenge is network congestion in densely populated regions, where multiple users sharing the same wireless spectrum can lead to bandwidth limitations. Addressing these challenges requires coordinated efforts between telecom providers, regulators, and technology developers to optimize WTTx deployment and spectrum utilization.What Is Driving Growth in the WTTx Market? Exploring Market Expansion Drivers

The growth in the WTTx market is driven by several factors, including the global push for digital inclusion, advancements in 5G technology, and the increasing adoption of smart home and IoT applications. Governments worldwide are investing in broadband expansion initiatives to ensure universal internet access, particularly in rural and remote regions where fiber deployment is not feasible. The rollout of 5G networks has further strengthened WTTx capabilities, enabling faster speeds and improved reliability. Additionally, the rising demand for cloud computing, video streaming, and connected devices has fueled the need for robust wireless broadband solutions. Telecom providers are increasingly leveraging WTTx to offer competitive fixed wireless services, catering to consumers and businesses seeking high-speed internet without the delays associated with fiber installation. As smart cities and digital transformation initiatives gain momentum, the adoption of WTTx is expected to accelerate, making it a key component of next-generation connectivity solutions.Report Scope

The report analyzes the WTTx market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Component (WTTx Platforms & Solutions, WTTx Hardware, WTTx Services); Operating Frequency (1.8 GHz - SUB 6 GHz Operating Frequency, 6 GHz - 24 GHz Operating Frequency, Above 24 GHz Operating Frequency).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Some of the 32 companies featured in this WTTx market report include -

- Airspan Networks Holdings Inc.

- Anritsu Corporation

- AT&T Inc.

- AVSystem

- BLiNQ Networks

- Cisco Systems, Inc.

- Cohere Technologies

- Cohere Technologies Inc.

- CommScope Holding Company, Inc.

- Digi International Inc.

- EDX Wireless

- Eltel Group

- Ericsson

- Fibocom Wireless Inc.

- Gemtek Technology Co., Ltd.

- Huawei Technologies Co., Ltd.

- Inseego Corp.

- Jaton Technology Ltd.

- Keysight Technologies Inc.

- Lumine Group

- Nokia Corporation

- Qualcomm Technologies, Inc.

- Remcom Inc.

- Samsung Electronics Co., Ltd.

- Tarana Wireless, Inc.

- Technicolor SA

- Telefonaktiebolaget LM Ericsson

- Telrad Networks

- UScellular

- Verizon Communications Inc.

Key Insights:

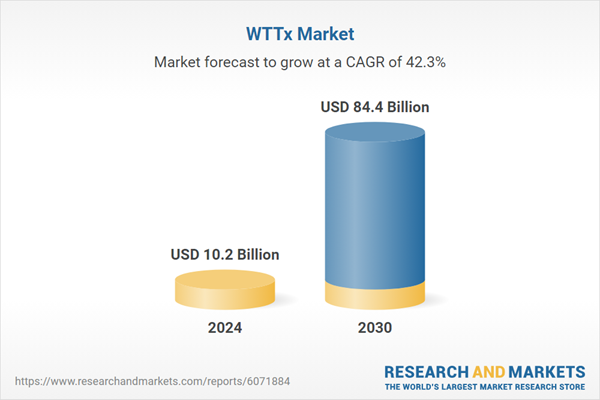

- Market Growth: Understand the significant growth trajectory of the WTTx Platforms & Solutions segment, which is expected to reach US$36.7 Billion by 2030 with a CAGR of a 37.5%. The WTTx Hardware segment is also set to grow at 47.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.8 Billion in 2024, and China, forecasted to grow at an impressive 50.8% CAGR to reach $20.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global WTTx Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global WTTx Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global WTTx Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aero Healthcare, Aspen Surgical Products, Inc., Cardinal Health, Inc., ConvaTec Ltd., DermaRite Industries LLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Select Competitors (Total 32 Featured):

- Airspan Networks Holdings Inc.

- Anritsu Corporation

- AT&T Inc.

- AVSystem

- BLiNQ Networks

- Cisco Systems, Inc.

- Cohere Technologies

- Cohere Technologies Inc.

- CommScope Holding Company, Inc.

- Digi International Inc.

- EDX Wireless

- Eltel Group

- Ericsson

- Fibocom Wireless Inc.

- Gemtek Technology Co., Ltd.

- Huawei Technologies Co., Ltd.

- Inseego Corp.

- Jaton Technology Ltd.

- Keysight Technologies Inc.

- Lumine Group

- Nokia Corporation

- Qualcomm Technologies, Inc.

- Remcom Inc.

- Samsung Electronics Co., Ltd.

- Tarana Wireless, Inc.

- Technicolor SA

- Telefonaktiebolaget LM Ericsson

- Telrad Networks

- UScellular

- Verizon Communications Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Airspan Networks Holdings Inc.

- Anritsu Corporation

- AT&T Inc.

- AVSystem

- BLiNQ Networks

- Cisco Systems, Inc.

- Cohere Technologies

- Cohere Technologies Inc.

- CommScope Holding Company, Inc.

- Digi International Inc.

- EDX Wireless

- Eltel Group

- Ericsson

- Fibocom Wireless Inc.

- Gemtek Technology Co., Ltd.

- Huawei Technologies Co., Ltd.

- Inseego Corp.

- Jaton Technology Ltd.

- Keysight Technologies Inc.

- Lumine Group

- Nokia Corporation

- Qualcomm Technologies, Inc.

- Remcom Inc.

- Samsung Electronics Co., Ltd.

- Tarana Wireless, Inc.

- Technicolor SA

- Telefonaktiebolaget LM Ericsson

- Telrad Networks

- UScellular

- Verizon Communications Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 10.2 Billion |

| Forecasted Market Value ( USD | $ 84.4 Billion |

| Compound Annual Growth Rate | 42.3% |

| Regions Covered | Global |