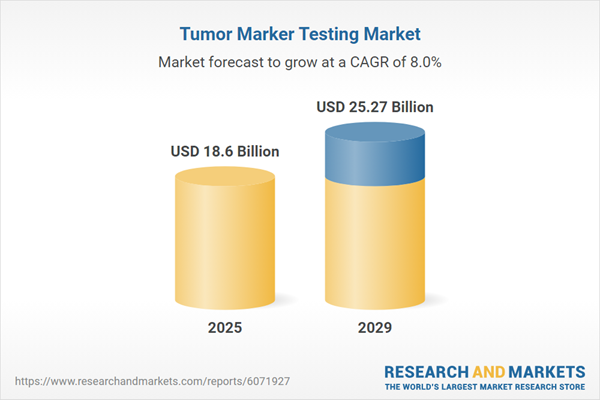

The tumor marker testing market size has grown strongly in recent years. It will grow from $17.18 billion in 2024 to $18.6 billion in 2025 at a compound annual growth rate (CAGR) of 8.3%. The growth in the historic period can be attributed to increasing cancer prevalence, rising focus on research and development, rising public awareness of cancer screenings, improved healthcare infrastructure, and an aging population.

The tumor marker testing market size is expected to see strong growth in the next few years. It will grow to $25.27 billion in 2029 at a compound annual growth rate (CAGR) of 8%. The growth in the forecast period can be attributed to growing awareness of early cancer detection, increasing funding for cancer research, expansion of personalized medicine, increased healthcare expenditure, and improved insurance coverage. Major trends in the forecast period include technological advancements, product innovation, advancement in diagnostic technologies, innovative testing solutions, and increasing strategic collaborations.

The growth of the tumor marker testing market is expected to be driven by the rising prevalence of cancer. Cancer is a disease marked by the uncontrolled growth of abnormal cells that can invade nearby tissues and spread throughout the body via the blood and lymphatic systems. The increase in cancer rates is attributed to factors such as an aging population, greater environmental exposures, lifestyle changes, and advancements in detection and diagnosis. Tumor marker testing is used to diagnose cancer, monitor treatment responses, and detect recurrences by measuring specific substances produced by cancer cells. For example, a report from the American Cancer Society in January 2023 noted that there were 1,958,310 new cancer cases and 609,820 cancer deaths in the United States. Additionally, the National Library of Medicine projected in May 2021 that the global cancer burden would reach 28.4 million cases by 2040, representing a 47% increase from 2020, with a substantial number of deaths. This increasing prevalence of cancer is driving the growth of the tumor marker testing market.

Companies in the tumor marker testing market are focusing on developing advanced tests, such as molecular testing solutions, to stay competitive. Molecular testing solutions are sophisticated diagnostic methods that analyze genetic material (DNA or RNA) to detect mutations, pathogens, or specific biomarkers at a molecular level. For instance, in April 2024, RGCC International GmbH, a Swiss company specializing in personalized cancer treatment, introduced Onco-D-clare, an innovative cancer detection test. This test enables early cancer detection before symptoms appear by combining molecular biology with artificial neural networks. Onco-D-clare isolates peripheral blood mononuclear cells from blood samples and performs a comprehensive gene expression analysis across more than 90 genes.

In June 2023, Quest Diagnostics, a US-based clinical laboratory, acquired Haystack Oncology for $300 million. This acquisition is intended to improve cancer diagnostics by integrating advanced minimal residual disease (MRD) testing technology. Furthermore, it not only enhances Quest's diagnostic capabilities but also seeks to offer more personalized and effective cancer care solutions through innovative liquid biopsy technology. Haystack Oncology is a biotechnology company based in the United States.

Major companies operating in the tumor marker testing market are Thermo Fisher Scientific Inc., Abbott Laboratories, F. Hoffmann-La Roche AG, Danaher Corporation, Siemens Healthineers AG, Becton Dickinson and Company (BD), Quest Diagnostics Inc., Agilent Technologies Inc, Hologic Inc., Illumina Inc., bioMérieux SA, Bio-Rad Laboratories Inc., Qiagen N.V., DiaSorin S.p.A., Myriad Genetics, Ortho Clinical Diagnostics PLC, Veracyte Inc., Biodesix Inc., Biocept Inc., Proteomedix AG, OncoCyte Corporation, Biocartis NV.

North America was the largest region in the tumor marker testing market in 2024. The regions covered in the tumor marker testing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the tumor marker testing market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Tumor marker testing involves detecting specific substances, often proteins, that are produced by cancer cells or by the body in response to cancer. These tests are used for diagnosing cancer, monitoring treatment progress, and checking for recurrence. Typically, the tests are conducted on blood, urine, or tissue samples.

Key products in tumor marker testing include biochemical markers, oncogenes, growth factors, hormones, colony-stimulating factors, lymphokines, and immunohistochemical stains, among others. Biochemical markers are measurable substances in the body, such as proteins or enzymes, that indicate biological or pathological processes and are used for diagnosing or tracking diseases. Tumor marker testing is conducted using methods such as screening, imaging, theranostics, and sigmoidoscopy. It is utilized in various settings including hospitals, commercial or private laboratories, physician offices or group practices, cancer clinics, and ambulatory care centers.

The tumor marker testing market research report is one of a series of new reports that provides tumor marker testing market statistics, including the tumor marker testing industry's global market size, regional shares, competitors with a tumor marker testing market share, detailed tumor marker testing market segments, market trends and opportunities, and any further data you may need to thrive in the tumor marker testing industry. This tumor marker testing market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The tumor marker testing market consists of revenues earned by entities by providing services such as genetic testing, prostate-specific antigen (PSA) tests, and dehydrogenase (LDH) tests. The market value includes the value of related goods sold by the service provider or included within the service offering. The tumor marker testing market also includes sales of test kits, instrumentation, consumables, and reagents. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Tumor Marker Testing Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on tumor marker testing market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for tumor marker testing? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The tumor marker testing market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Product: Biochemical Markers; Oncogenes; Growth Factors; Hormones; Colony Stimulating Factors; Lymphokines; Immunohistochemical Stains; Other Products2) by Methods: Screening; Imaging; Theranostics; Sigmoidoscopy; Other Methods

3) by Application: Hospitals; Commercial or Private Laboratories; Physician Offices or Group Practices; Cancer Clinics; Ambulatory Care Centers

Subsegments:

1) by Biochemical Markers: Alpha-fetoprotein (AFP); Prostate-Specific Antigen (PSA); Carcinoembryonic Antigen (CEA); Cancer Antigen 125 (CA 125); Cancer Antigen 19-9 (CA 19-9); Human Chorionic Gonadotropin (hCG)2) by Oncogenes: HER2/neu; KRAS; BRAF; EGFR (Epidermal Growth Factor Receptor); c-MYC; p53

3) by Growth Factors: Vascular Endothelial Growth Factor (VEGF); Platelet-Derived Growth Factor (PDGF); Transforming Growth Factor-beta (TGF-β); Fibroblast Growth Factor (FGF); Insulin-like Growth Factor (IGF)

4) by Hormones: Estrogen Receptors (ER); Progesterone Receptors (PR); Thyroglobulin; Calcitonin; Adrenocorticotropic Hormone (ACTH); Gastrin

5) by Colony Stimulating Factors: Granulocyte Colony-Stimulating Factor (G-CSF); Granulocyte-Macrophage Colony-Stimulating Factor (GM-CSF); Macrophage Colony-Stimulating Factor (M-CSF)

6) by Lymphokines: Interleukin-2 (IL-2); Interferon-gamma (IFN-γ); Tumor Necrosis Factor-alpha (TNF-α); Interleukin-6 (IL-6)

Key Companies Mentioned: Thermo Fisher Scientific Inc.; Abbott Laboratories; F. Hoffmann-La Roche AG; Danaher Corporation; Siemens Healthineers AG

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Tumor Marker Testing market report include:- Thermo Fisher Scientific Inc.

- Abbott Laboratories

- F. Hoffmann-La Roche AG

- Danaher Corporation

- Siemens Healthineers AG

- Becton Dickinson and Company (BD)

- Quest Diagnostics Inc.

- Agilent Technologies Inc

- Hologic Inc.

- Illumina Inc.

- bioMérieux SA

- Bio-Rad Laboratories Inc.

- Qiagen N.V.

- DiaSorin S.p.A.

- Myriad Genetics

- Ortho Clinical Diagnostics PLC

- Veracyte Inc.

- Biodesix Inc.

- Biocept Inc.

- Proteomedix AG

- OncoCyte Corporation

- Biocartis NV

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 18.6 Billion |

| Forecasted Market Value ( USD | $ 25.27 Billion |

| Compound Annual Growth Rate | 8.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |