Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Legalization has expanded consumer access via both online and physical retail platforms, supported by Health Canada’s stringent oversight on product quality and safety. Demand continues to rise, particularly for recreational cannabis, as consumers shift toward regulated, high-quality products. The market has seen consolidation through strategic mergers and acquisitions, which have boosted production capabilities and optimized supply chains. Trends such as the rising popularity of edibles, beverages, and wellness-oriented cannabis products are reshaping product portfolios, while sustainability and digital integration continue to influence business operations and consumer engagement.

Key Market Drivers

Rising Medical Cannabis Adoption

The rising use of medical cannabis is a key driver for the Canada Legal Cannabis Market. Public awareness around its therapeutic benefits - especially for chronic pain, insomnia, anxiety, and neurological conditions - has led to increased adoption. According to a 2021 patient survey, daily medical cannabis usage rose from 83.2% pre-pandemic to 90.3% during the pandemic, underscoring growing dependence among users.The Cannabis Act has provided a clear legal and regulatory structure, enhancing consumer confidence and encouraging broader acceptance. Medical cannabis is now more accessible through licensed producers and prescribing healthcare providers, with an expanding range of formats such as tinctures, oils, and capsules. Surveys also highlight higher usage among Indigenous populations compared to non-Indigenous groups, signaling varied adoption across demographics. Insurance support and innovations tailored to specific health needs are expected to further accelerate growth in the medical cannabis segment, reinforcing its contribution to the overall market expansion.

Key Market Challenges

Complex and Inconsistent Provincial Regulations

The fragmented regulatory landscape across provinces presents a major challenge for cannabis businesses in Canada. While the federal Cannabis Act provides a national framework, provinces are responsible for implementation, resulting in varying rules for retail, product availability, and distribution. For instance, some provinces limit the number of stores or product types like edibles, while others operate through public or private retail systems.These inconsistencies complicate logistics and supply chain planning for multi-region operators and hinder market expansion efforts. Additionally, regulatory fragmentation inflates compliance costs, discourages new entrants, and creates uncertainty for investors. Variability in access and product availability can also reduce consumer engagement and loyalty, affecting demand in under-served regions. Businesses must remain highly adaptable to manage shifting provincial policies, which can strain resources and limit the ability to scale efficiently across the country.

Key Market Trends

Expansion of Cannabis 2.0 and 3.0 Products

The rapid evolution of Cannabis 2.0 and the emergence of Cannabis 3.0 products are reshaping consumer preferences and driving market growth. Cannabis 2.0, introduced in 2019, brought edibles, beverages, vapes, and topicals to market, offering alternatives to traditional smoking. These formats appeal to health-conscious consumers seeking discreet, low-dose, or controlled experiences. Cannabis-infused beverages, in particular, have gained popularity for their convenience and social appeal.The next wave, Cannabis 3.0, includes advanced delivery systems, personalized formulations, and wellness-focused applications such as cannabis-infused skincare and nutraceuticals. These products often leverage precise dosing and enhanced bioavailability technologies like nanoemulsion, appealing to both new and experienced users. The expanding variety caters to diverse needs - from recreation and wellness to medical applications - broadening the consumer base. As product innovation continues, the Canadian cannabis market is evolving into a sophisticated ecosystem with wide-ranging, differentiated offerings that promote sustained industry growth.

Key Market Players

- Canopy Growth Corporation

- Charlotte's Web, Inc.

- Aurora Cannabis Inc.

- Tilray Brands

- The Cronos Group

- Jazz Pharmaceuticals, Inc.

- Organigram Holding, Inc.

- Maricann, Inc.

- Isodiol International, Inc

- Sundial Growers

Report Scope:

In this report, the Canada Legal Cannabis Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below.Canada Legal Cannabis Market, By Source:

- Marijuana

- Hemp

Canada Legal Cannabis Market, By Cultivation:

- Indoor Cultivation

- Greenhouse Cultivation

- Outdoor Cultivation

Canada Legal Cannabis Market, By Derivatives:

- CBD

- THC

- Others

Canada Legal Cannabis Market, By End Use:

- Medical Use

- Recreational Use

- Industrial Use

Canada Legal Cannabis Market, By Region:

- Ontario

- Quebec

- Alberta

- British Columbia

- Saskatchewan & Manitoba

- Rest of Canada

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Canada Legal Cannabis Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Canopy Growth Corporation

- Charlotte's Web, Inc.

- Aurora Cannabis Inc.

- Tilray Brands

- The Cronos Group

- Jazz Pharmaceuticals, Inc.

- Organigram Holding, Inc.

- Maricann, Inc.

- Isodiol International, Inc

- Sundial Growers

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 83 |

| Published | April 2025 |

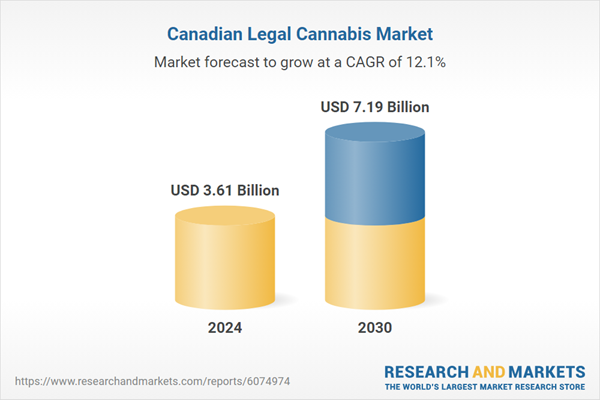

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.61 Billion |

| Forecasted Market Value ( USD | $ 7.19 Billion |

| Compound Annual Growth Rate | 12.1% |

| Regions Covered | Canada |

| No. of Companies Mentioned | 10 |