Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The resurgence of shale operations, including in the Permian Basin and oil sands regions, is driving the construction of new tank infrastructure. Technological advancements in corrosion-resistant materials and smart monitoring systems are also enhancing operational safety and compliance with environmental standards. Furthermore, increased attention to energy security, strategic reserves, and price volatility has prompted investments in both government and private storage capacity. As North America continues to modernize its energy infrastructure, storage tanks will remain a vital element in ensuring operational continuity, inventory management, and supply chain resilience.

Key Market Drivers

Growth in Crude Oil Production in the U.S. and Canada

The surge in crude oil production across North America is a primary driver of the storage tank market. Advancements in hydraulic fracturing and horizontal drilling have significantly boosted output in key shale regions, notably the Permian Basin, Bakken, and Eagle Ford in the U.S., and oil sands in Canada. This production growth necessitates additional storage infrastructure to manage higher volumes, buffer supply, and support transportation to refineries or export terminals. Producers and midstream companies are investing in tank farms and expanding capacity, especially in areas where pipeline infrastructure is limited. Above-ground storage tanks are increasingly preferred due to their ease of inspection and reduced environmental risks. According to the U.S. Energy Information Administration, domestic crude oil production reached approximately 13.3 million barrels per day in December 2023 - one of the highest levels recorded - reinforcing the urgency for expanded storage infrastructure.Key Market Challenges

Aging Infrastructure and Risk of Structural Failure

A critical challenge facing the North American oil and gas storage tank market is the aging infrastructure across many facilities. Numerous tanks built decades ago now face issues related to corrosion, material fatigue, and structural degradation. These older systems often lack modern monitoring technologies, making early detection of leaks or failures difficult. Additionally, environmental conditions such as humidity and temperature fluctuations further deteriorate legacy equipment. Inadequate inspection frequency and limited maintenance budgets compound the issue, especially in remote or older installations. This aging infrastructure poses operational risks, threatens environmental safety, and requires significant capital for modernization and compliance with evolving regulatory standards.Key Market Trends

Adoption of Advanced Digital Monitoring and Automation Systems

The integration of digital technologies is a growing trend in the storage tank industry. Operators are adopting IoT-enabled sensors, cloud-based monitoring platforms, and automated safety systems to enhance real-time visibility and operational efficiency. These tools support leak detection, inventory tracking, and predictive maintenance, minimizing unplanned downtime and improving regulatory compliance. The use of digital twins and augmented reality is also gaining traction for maintenance planning and virtual inspections. Automation is optimizing tank filling and emptying processes, reducing cycle times, and increasing throughput. As regulatory and environmental pressures mount, digital transformation is emerging as a key strategy for ensuring safe, efficient, and sustainable tank operations.Key Market Players

- General Industries, Inc.

- McDermott International, Ltd.

- CST Industries, Inc.

- Hassco Industries Incorporated

- McWane Inc.

- PCL Constructors Inc.

- Imperial Industries Inc.

- Fox Tank Company

Report Scope:

In this report, the North America Oil & Gas Storage Tank Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below.North America Oil & Gas Storage Tank Market, By Product:

- Crude Oil

- Liquefied Natural Gas (LNG)

- Diesel

- Gasoline

- Kerosene

- Liquefied Petroleum Gas (LPG)

- Others

North America Oil & Gas Storage Tank Market, By Material:

- Steel

- Carbon Steel

- Fiberglass-reinforced Plastic

North America Oil & Gas Storage Tank Market, By Country:

- United States

- Canada

- Mexico

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the North America Oil & Gas Storage Tank Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- General Industries, Inc.

- McDermott International, Ltd.

- CST Industries, Inc.

- Hassco Industries Incorporated

- McWane Inc.

- PCL Constructors Inc.

- Imperial Industries Inc.

- Fox Tank Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | April 2025 |

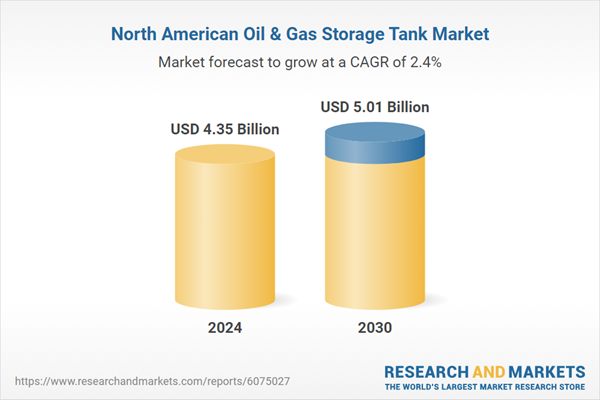

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.35 Billion |

| Forecasted Market Value ( USD | $ 5.01 Billion |

| Compound Annual Growth Rate | 2.3% |

| Regions Covered | North America |

| No. of Companies Mentioned | 8 |