Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite this robust demand, the industry encounters significant hurdles due to increasingly stringent environmental and safety regulations. Manufacturers must navigate complex compliance landscapes regarding Volatile Organic Compounds and synthetic allergens, necessitating expensive reformulations and transparent ingredient labeling. This regulatory pressure compels companies to balance product efficacy with environmentally conscious chemical standards, which can impede rapid product development and slow market expansion in jurisdictions with strict requirements.

Market Drivers

A growing consumer preference for aromatherapy and wellness-oriented fragrances is fundamentally transforming the market, as individuals increasingly treat home scent as a tool for psychological well-being rather than merely for odor elimination. This trend, often called "scent-scaping," fuels demand for premium candles, essential oils, and diffusers intended to alleviate stress, improve sleep, or boost energy, with brands launching complex, perfume-grade profiles mimicking luxury spas or nature. The economic impact is evident in retail performance; for example, Bath & Body Works Inc. reported net sales of $1.61 billion in its 'Third Quarter 2024 Results', driven by strong customer response to innovation in its core home fragrance portfolio.Continuous product innovation in long-lasting and automated dispensing formats acts as a second critical catalyst, addressing the modern need for convenience and consistent olfactory experiences. Manufacturers are aggressively upgrading portfolios from basic aerosols to sophisticated, battery-operated, and smart-enabled devices with adjustable settings, encouraging premiumization and recurring refill purchases. This strategic focus on advanced delivery systems propels growth for major players; Reckitt’s 'Q3 2024 Trading Update' noted that its Hygiene business unit, housing the Air Wick brand, generated net revenue of £1.52 billion with volume growth explicitly linked to innovation, while Procter & Gamble reported high single-digit organic sales growth for its Home Care segment in the 2024 fiscal year.

Market Challenges

The significant challenge hindering the Global Household Air Care Product Market is the escalating complexity of environmental and safety compliance, particularly concerning Volatile Organic Compounds (VOCs) and synthetic allergens. This regulatory fragmentation forces manufacturers to dedicate substantial capital toward reformulating existing product lines to meet divergent regional standards instead of investing in innovation. The necessity to customize formulations and packaging for specific jurisdictions creates supply chain inefficiencies and delays the commercialization of new air care solutions, directly stalling revenue potential in key markets.This intensified scrutiny is highlighted by recent legislative trends that underscore the growing compliance burden. According to the Household & Commercial Products Association, in 2024, nine individual states introduced rigorous legislation specifically targeting chemical management and product reporting standards. This surge in localized regulatory activity obliges companies to navigate a patchwork of requirements, increasing operational costs and diverting resources away from market expansion efforts. Consequently, the high barrier of adhering to these evolving transparency and safety mandates restricts the industry's ability to swiftly adapt to consumer trends and limits overall market growth.

Market Trends

The shift toward sustainable, refillable, and plastic-free packaging solutions is fundamentally altering production standards as manufacturers actively decouple growth from virgin plastic usage. Companies are increasingly replacing single-use aerosol canisters and plastic vessels with high-quality reusable systems and concentrated refills to meet the circular economy demands of eco-conscious consumers. This transition is financially accretive as well as reputational, as efficient refill models reduce material costs and secure long-term brand loyalty; according to Reckitt’s 'Sustainability Report 2024' released in March 2025, the company’s net revenue from more sustainable products expanded to reach 34.9% of its total portfolio, underscoring the commercial viability of eco-centric inventory.Concurrently, the adoption of clean-label transparency and natural ingredient formulations is driving significant volume growth, distinct from the functional wellness trend. Consumers are rigorously scrutinizing product labels for synthetic additives, prompting brands to reformulate air care lines with upcycled botanicals, biodegradable molecules, and plant-derived essential oils that offer olfactory authenticity without chemical complexity. This preference for "better-for-you" composition is revitalizing the mass market; according to Symrise’s '2024 Financial Results' from January 2025, the Consumer Fragrance business unit delivered double-digit percentage organic sales growth, driven largely by robust performance in the home care and body care categories.

Key Players Profiled in the Household Air Care Product Market

- Reckitt Benckiser Group plc

- Pour Home Products Private Limited

- Sneh Chemical Industries

- Parveen Industries Private Limited

- Aroma360 Holdings LLC

- N. Ranga Rao & Sons Pvt. Ltd.

- Newell Brands Inc.

- Diptyque SAS

- Rad Brands Pvt. Ltd.

- Welburn Candles Private Limited

Report Scope

In this report, the Global Household Air Care Product Market has been segmented into the following categories:Household Air Care Product Market, by Product Type:

- Candles

- Home Fragrances

- Air Freshener

- Others

Household Air Care Product Market, by Distribution Channel:

- Supermarket & Hypermarket

- Convenience Stores

- Specialty Stores

- Online

- Others

Household Air Care Product Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Household Air Care Product Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Household Air Care Product market report include:- Reckitt Benckiser Group PLC.

- Pour Home Products Private Limited

- Sneh Chemical Industries

- Parveen Industries Private Limited

- Aroma360 Holdings LLC

- N. Ranga Rao & Sons Pvt. Ltd

- Newell Brands Inc.

- Diptyque SAS

- Rad Brands Pvt. Ltd

- Welburn Candles Private Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | January 2026 |

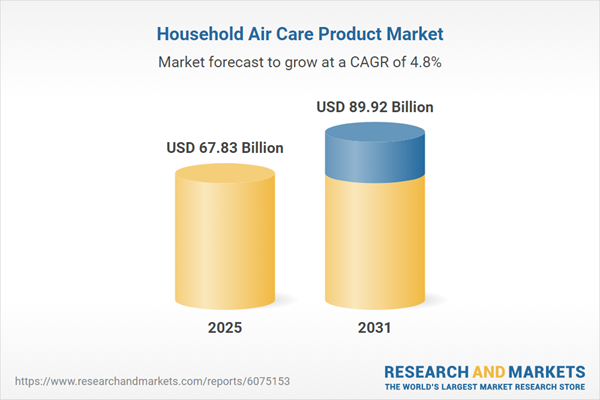

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 67.83 Billion |

| Forecasted Market Value ( USD | $ 89.92 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |