Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Rising Vehicle Electrification

China’s rapid transition toward electric vehicles is a major driver for the EPS market. EPS systems are more suitable for electric and hybrid vehicles because they eliminate the need for an engine-driven pump, thereby improving efficiency and reducing emissions. With EV penetration in China reaching 22% and the country accounting for over half of global battery and EV output, the demand for EPS continues to rise. Automakers are focusing on EPS systems that are lightweight, compact, and adaptable to various vehicle platforms. The integration of EPS with electronic control units supports energy-efficient steering and enhances vehicle performance, making it indispensable in the electrification trend sweeping across China’s automotive sector.Key Market Challenges

High Development and Implementation Costs

The implementation of EPS systems entails significant costs due to the complexity of integrating electronic components, sensors, and precision actuators. Automakers must invest heavily in R&D and system testing to ensure performance and reliability, particularly under varying road conditions. Transitioning from hydraulic to EPS requires extensive redesign of existing vehicle frameworks, which increases engineering and production costs. This poses a challenge for manufacturers aiming to introduce EPS into lower-priced or budget vehicle categories, where cost-efficiency is critical. As a result, the scalability of EPS solutions remains limited in certain market segments, affecting widespread adoption.Key Market Trends

Advancements in AI-Based Steering Control

The adoption of artificial intelligence in EPS systems is a transformative trend in China’s automotive landscape. AI-powered steering systems are capable of real-time learning and adaptive control, analyzing data from multiple sensors to fine-tune steering responsiveness. These systems enhance driver assistance functions and support semi-autonomous driving capabilities by predicting vehicle behavior and adjusting accordingly. The integration of AI also enables predictive maintenance, helping detect faults before they become critical. As China advances toward intelligent and autonomous transportation, AI-enhanced EPS systems are expected to become a key differentiator for OEMs seeking to deliver smarter and safer driving experiences.Key Market Players

- ATS Automation Tooling Systems Inc.

- Denso Corporation

- GKN Automotive Limited

- Hitachi Astemo Automotive Systems (China) Ltd.

- Hyundai Mobis Co., Ltd.

- JTEKT (China) Investment Co., Ltd.

- Mitsubishi Electric Corporation

- Nexteer Automotive Corporation

- NSK Ltd

- Robert Bosch GmbH

Report Scope:

In this report, the China Automotive EPS Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below.China Automotive EPS Market, By Component Type:

- Steering Rack/Column

- Sensor

- Steering Motor

- Other

China Automotive EPS Market, By Vehicle Type:

- Passenger Cars

- Commercial Vehicles

China Automotive EPS Market, By Type:

- Column Type

- Pinion Type

- Dual Pinion Type

China Automotive EPS Market, By Region:

- Northeast

- East

- South Central

- Southwest

- North

- Northwest

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the China Automotive EPS Market.Available Customizations:

With the given market data, the publisher offers customizations according to the company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- ATS Automation Tooling Systems Inc.

- Denso Corporation

- GKN Automotive Limited

- Hitachi Astemo Automotive Systems (China) Ltd.

- Hyundai Mobis Co., Ltd.

- JTEKT (China) Investment Co., Ltd.

- Mitsubishi Electric Corporation

- Nexteer Automotive Corporation

- NSK Ltd

- Robert Bosch GmbH

Table Information

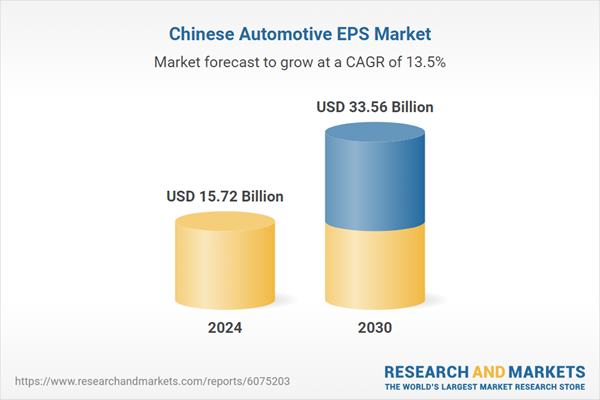

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | April 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 15.72 Billion |

| Forecasted Market Value ( USD | $ 33.56 Billion |

| Compound Annual Growth Rate | 13.4% |

| Regions Covered | China |

| No. of Companies Mentioned | 10 |